Everyone knows you need solid revenue and profits to build a sustainable business.

But there are lots of different factors influencing those areas.

To truly understand your revenue and profits, you need to first understand billable rates and your average billable rate (ABR).

This way, you know how efficiently you’re generating revenue and profits. And can adjust your pricing or resource allocations to boost your margins.

Here are the basics:

What is a billable rate?

The billable rate (sometimes called “bill rate”) is how much a client pays for an hour of work. The billable rate is based on billable hours. That is, when you invoice the client for 100 hours of work, how much do you charge for those hours?

Billable rates can vary by client, the type of work, and the role or team member performing the work.

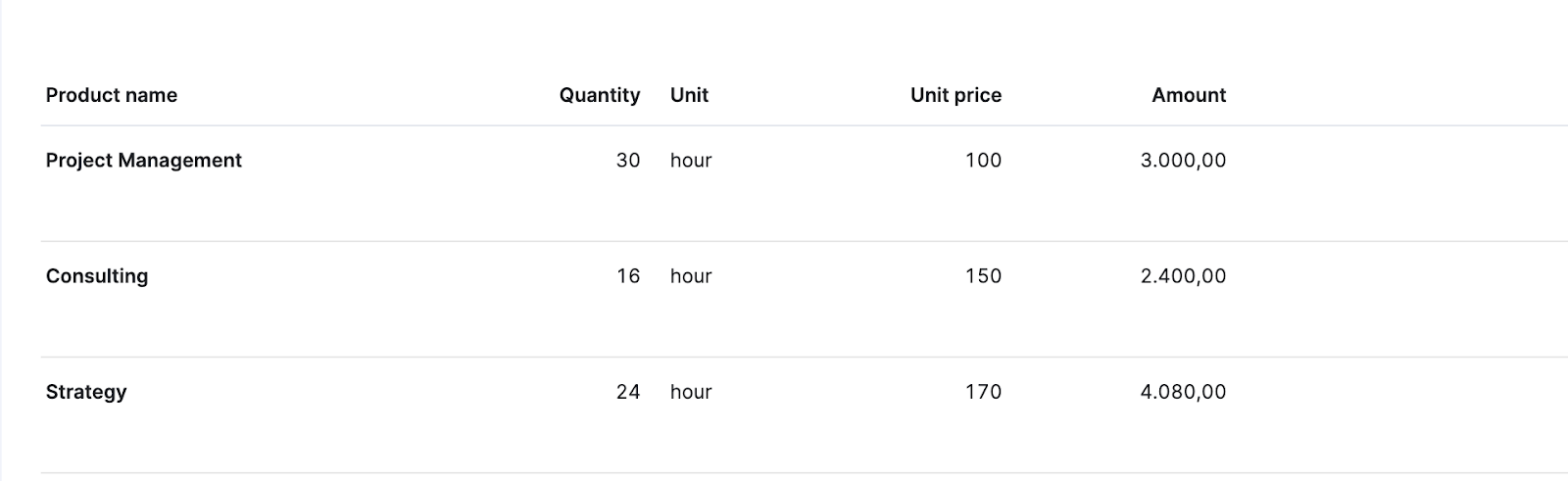

For example, on the invoice below, this agency charged their client three different billable rates:

- Project management work: $100/hour

- Consulting work:$150/hour

- Strategy work: $170/hour

We’ll discuss how to set these rates later. For now, just keep in mind that your billable rates can vary.

4 key types of rates

There are a lot of terms and metrics related to billable rates. And knowing the difference between them allows you to accurately calculate profitability.

Focus on these four:

- Employee hourly rate: How much a team member earns per hour

- Actual Cost Per Hour (ACPH): How much it costs to employ someone for an hour of work

- Billable rate: How much a client pays for an hour of work

- Average billable rate (ABR): The average hourly rate earned across all time worked in a given period (also known as Effective Hourly Rate (EHR))

All of these numbers should be different.

Let’s look at a design agency’s team. Junior designers make $40/hour. And senior designers make $70/hour. These are the employee hourly rates.

However, the ACPH for those employees will be higher. The actual cost of employing those two for an hour of work includes more than just their salary. You also need to factor in things like benefits, overhead, and paid time off.

So, in this case, the ACPH might be $75/hour for junior designers. And $125/hour for senior designers.

To cover those overhead costs and still make a profit in professional services, your billable rate has to be higher than your ACPH.

Here, then, you might charge your newest web design client $130/hour for work done by junior designers and $200/hour for senior designers. These are the billable rates.

Finally, the ABR factors in all the billable and non-billable time invested in a project across roles, showing how much money you’re bringing in hourly on average. It’s a key indicator of how efficiently you’re generating revenue.

Say your team did 50 hours of work: 30 billable hours by junior designers, 10 billable hours by senior designers, and 10 non-billable hours.

Using their billable rates, this adds up to $5,900 in revenue:

- 30 hours by junior designers at $130/hour = $3,900

- 10 hours by senior designers at $200/hour = $2,000

Then, you’d divide that total by the total hours worked to get your ABR:

($5,900) / 50 total hours of work = $118/hour (ABR)

Why it’s important to track billable rates and your average billable rate (ABR)

Tracking both billable rates and your ABR tells you how efficiently you’re generating revenue.

Monitoring billable rates helps you set more effective pricing strategies to get the most return for your team’s investment.

Understanding your billable rates also helps you manage:

- Profitability: You need to set (and maintain) high-enough billable rates to cover business costs, generate profit, and support business sustainability.

- Competitive pricing: Strategic billable rates help you keep prices affordable in your market while still allowing you to hit your profit margin targets

- Project budgeting: Knowing your billable rates makes it easier to estimate realistic project costs. Even with flat-fee pricing, you can use billable rates and estimated time to figure out how much you’ll need to spend.

Then, tracking your ABR signals when you need to improve profit margins—whether that’s by adjusting pricing, staffing, or your clients.

Because it accounts for all the time employees spend on the project, it’s a more accurate depiction of how much money you’re truly bringing in each hour.

Which, by proxy, makes your costs, revenue, and profits calculations more inclusive and accurate.

ABR is especially helpful if you’re using flat-fee pricing. Even when you’re not using an hourly model, your ABR needs to be able to effectively cover your ACPH while still leaving you adequate profit margins.

For example, if you’re billing a $30,000 project and spend 150 hours on it, your ABR is $200.

Knowing this and comparing it to your target ABR and ACPH can help you strengthen:

- Your pricing strategy: Seeing your true ABR tells you when you need to adjust billable rates to meet your profit targets

- Your staffing strategy: Understanding your ABR helps you choose the most cost-effective mix of team members to complete a project

- Your data analysis: Looking at your ABR helps you evaluate profitability by team, roles, projects, and clients. So, you can identify areas for improvement, focus on higher-value projects and clients, or adjust staffing to improve profitability.

How to calculate billable rates

Setting strategic billable rates is a big help for boosting profits. The key is to make sure they cover your ACPH, account for non-billable time, and align with your profitability targets.

Using this approach might lead to higher billable rates than other methods (like guess-timating). But it supports long-term profitability and sustainability.

Here’s how to calculate a billable rate that makes sense for your business:

1. Determine your Average Cost Per Hour (ACPH)

As we previously mentioned, your ACPH is the total amount you have to pay for your team for every hour worked.

Start by adding up all the annual costs for your team. This includes:

- Annual salaries

- Benefits (health insurance, retirement contributions, etc.)

- Overhead (rent, utilities, software subscriptions, etc.)

- Any regular freelance or consultant costs

So, an employee’s annual salary maybe $60,000. But the total cost of employing them for a year maybe $80,000—that’s the number you want to use here.

Then, calculate the total number of annual hours your team and regular freelancers or consultants are available to work in a year.

Be sure to exclude time for:

- Holidays

- Vacations

- Sick leave

- Non-billable work (e.g., internal meetings, training, etc.)

Let’s say your team has five members with the following costs:

| Team member | Annual salary | Other costs | Total annual costs |

|---|---|---|---|

| Project Manager | $65,000 | $10,000 | $75,000 |

| Junior Designer | $55,000 | $10,000 | $65,000 |

| Senior Designer | $75,000 | $10,000 | $85,000 |

| Copywriter | $55,000 | $10,000 | $65,000 |

| Strategist | $95,000 | $12,000 | $107,000 |

So, in this example, your total annual cost for your entire team is $397,000.

And if each of your team members has 35 hours available for billable work and receives an average of three weeks of annual PTO, their annual capacity would be 1,715 hours.

Which brings your total annual capacity to 8,575 hours.

Now, use the following formula to calculate your ACPH:

ACPH = Total Annual Costs / Total Annual Capacity

In this example, it would be:

$397,000 / 8,575 = $46/hour.

2. Set your target delivery margin

Your delivery margin is how much profit remains after accounting for the costs associated with delivering a service.

For example, if your delivery cost is $100 per hour and you charge your client $150 per hour, your delivery margin would be $50/hour (or 35%).

We recommend aiming for a 70% delivery margin. Generally, this margin will allow you to:

- Cover your costs (your ACPH)

- Generate enough profit to keep the business running and sustainable

- Absorb fluctuations in project workloads as well as unexpected project expenses or non-billable hours

Set your target margins higher if you want to generate a higher profit, if you have a lot of scope fluctuations in projects, or if you want more room to cover expenses.

Top Tip

Check out our guide to agency margins to learn more about maximizing your profit.

3. Calculate your hourly billable rate

Now, use the following formula to determine your optimal hourly billable rate:

ACPH / (1 – delivery margin target) = Hourly billable rate

Following our previous example, our sample agency has an ACPH of $46. And let’s say they’re aiming for a target delivery margin of 70%.

Their hourly billable rate would be:

$46 / (1 – 0.70) = $153/hour.

And they could choose to go up to $155/hour for a round number for clients.

How to calculate and monitor your ABR

Monitor your ABR regularly to analyze how much revenue you’re actually bringing in hourly. This helps you identify if your current billable rates are covering costs while still leaving you with a healthy profit margin.

Weekly analysis is best for high-volume teams. For smaller teams working on longer-term projects, monthly analysis may be sufficient.

Either way, you want to calculate your ABR with enough time to make adjustments that strengthen your margins before your projects wrap up.

Beyond shorter-term reviews, quarterly and annual reviews give a big-picture look at profitability. And help with long-term planning, revenue forecasts, and making business decisions about which projects to take on.

But first, here’s how to calculate your ABR:

1. Track billable revenue

To calculate your ABR, you need to understand the total billable revenue you’re bringing in.

Tally up all the income you’ve invoiced for billable work in your chosen timeframe. This could come directly from invoices. Or you can ask your finance team to pull it from their accounting software.

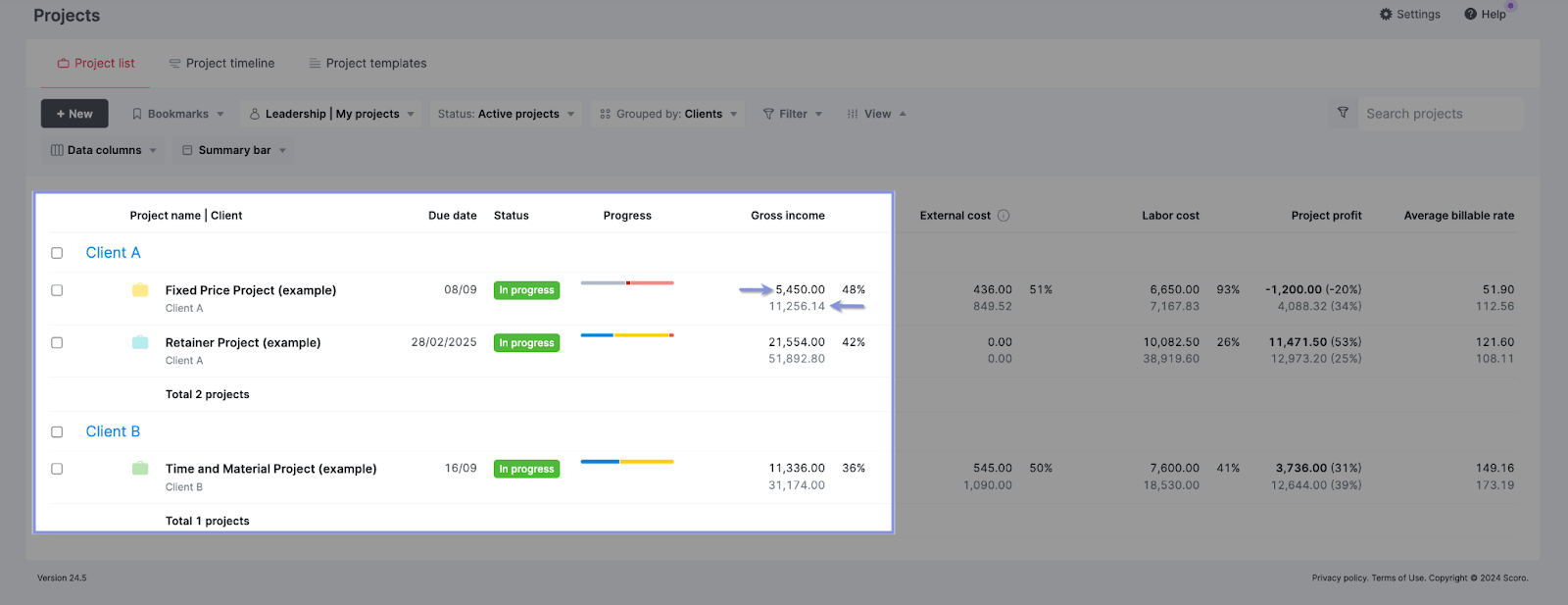

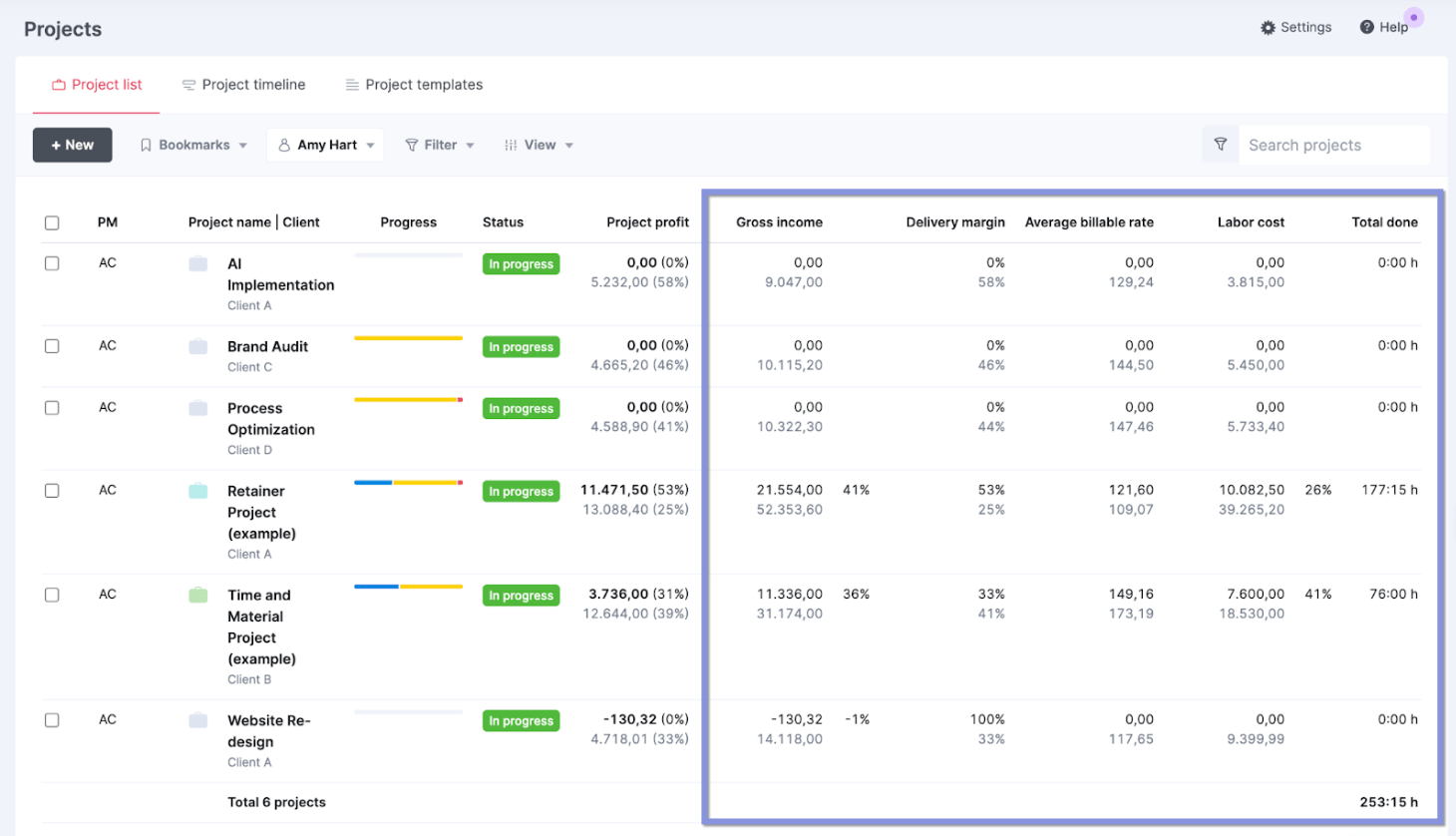

Or, in Scoro, you can quickly find it in the “Project list” view.

Head there and click “Data columns” → “Gross income.”

Now, you can see your actual (black text) and estimated (gray text) billable revenue for each project. Then, add up your actuals to get your total billable revenue.

2. Track total hours worked on projects

Next, you’ll need to determine the total billable and non-billable hours spent on each project. And for that, you need a time tracking system in place.

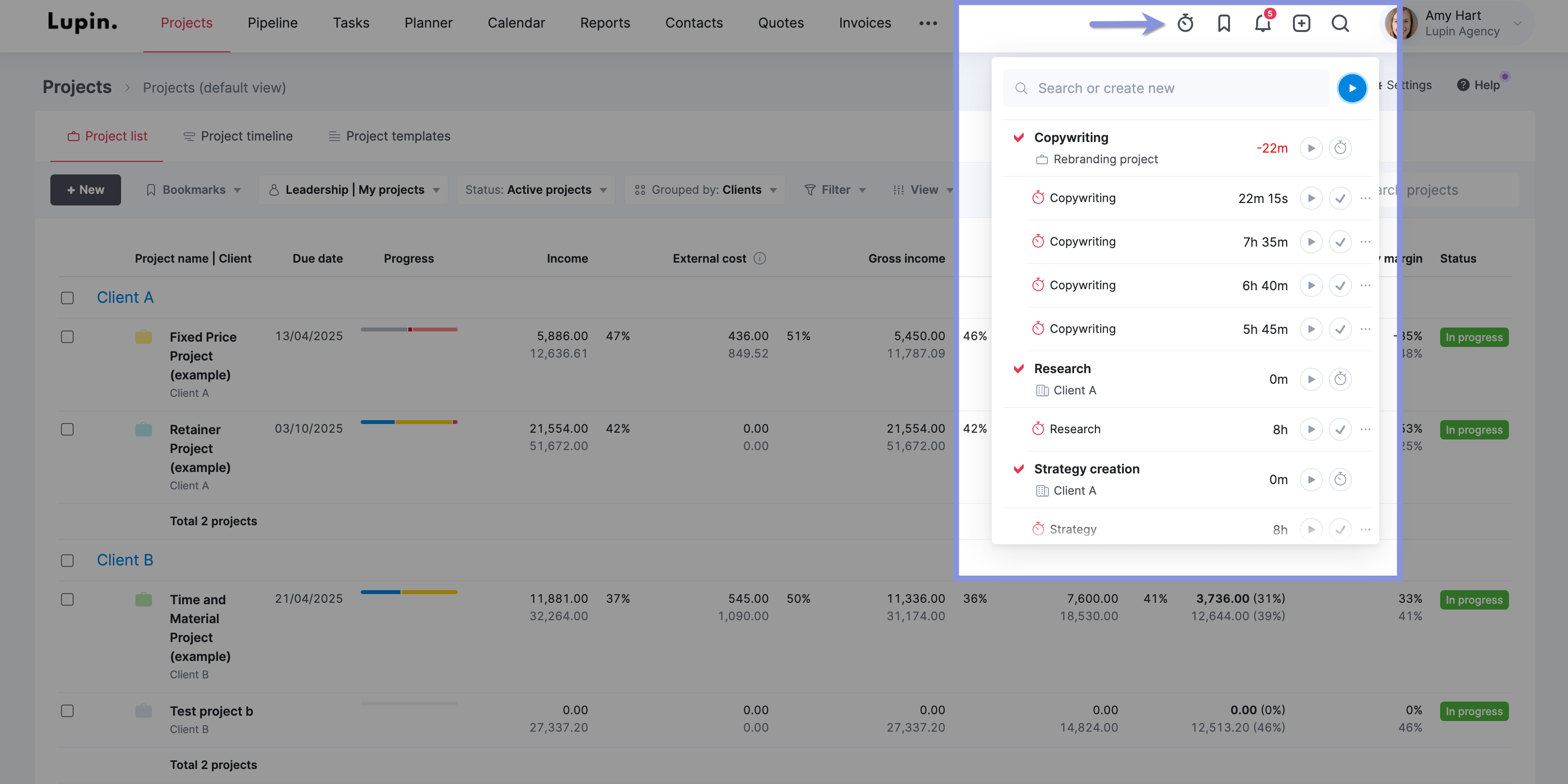

Scoro’s built-in time tracker removes the hassle of manually tracking time in a spreadsheet or timesheet.

For example, you can start tracking time using the timer from any page in Scoro. Click the stopwatch in the navigation bar.

Then, select the task you’re working on and click the “play” button to start it.

As your team tracks time, Scoro will automatically label the project, client, and tracked time as billable or non-billable based on the chosen task type.

Top Tip

We recommend establishing what is billable and non-billable in your business. Then, create “Activity types” in Scoro for detailed reporting on your team’s time allocation.

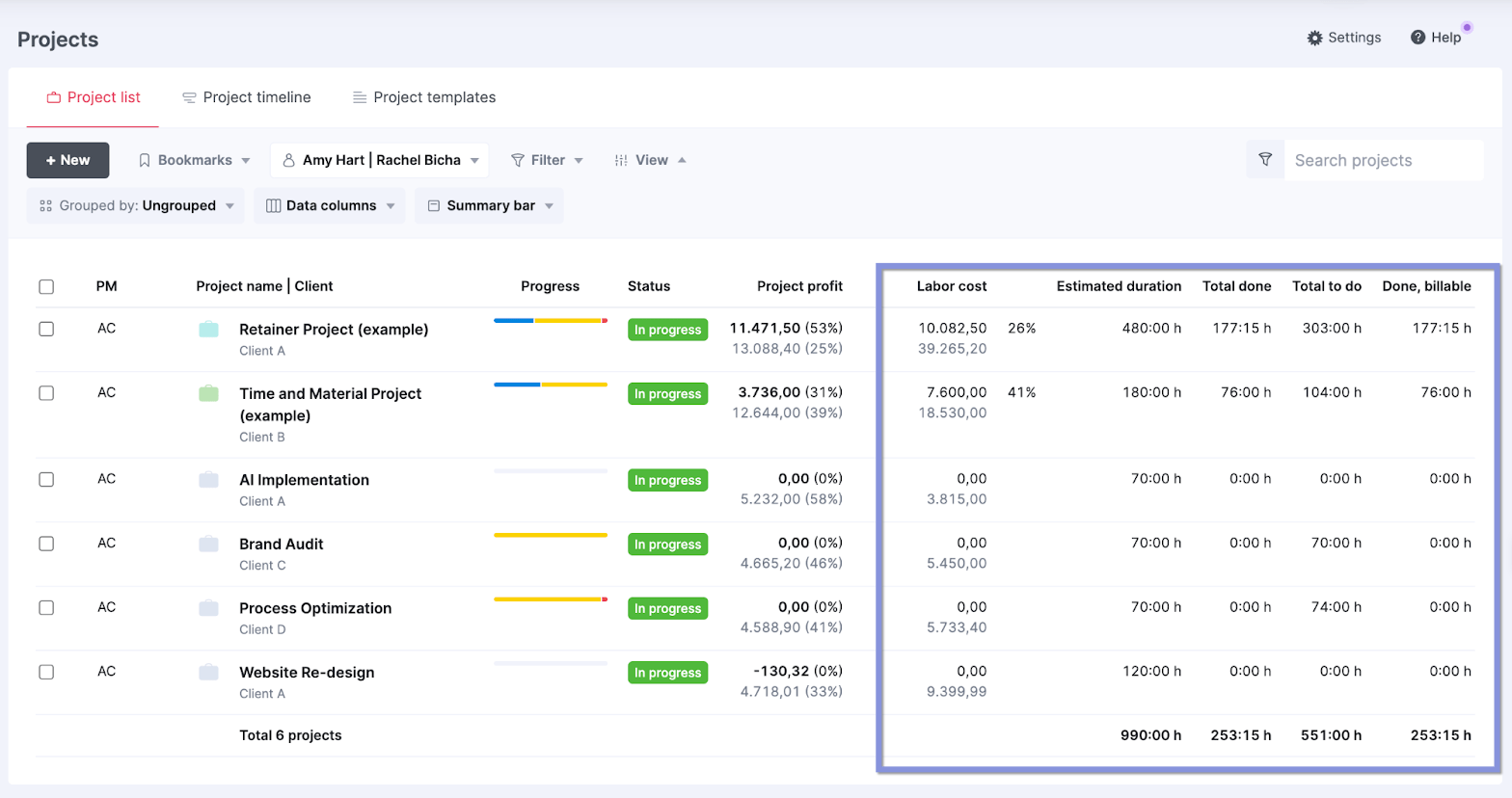

Find all this info in the “Project list” view.

Go to “Project list” → “View.” Click “Data columns.” In addition to the pre-set boxes, check the “Labor cost,” “Estimated duration,” “Total done,” and “Done, billable” ones, too.

Now, besides seeing each project’s logged time, you can also see the respective cost of that time:

- Estimated duration: Shows the estimated hours for the entire project

- Total done: Shows the total hours tracked to the project

- Done, billable: Shows the amount of tracked billable time for the project

- Labor cost: Shows your company’s total cost of labor based on tracked hours for each project

Add up the number of hours in the “Total done” column to set yourself up to calculate your ABR.

3. Divide your total billable revenue by the total hours worked

Using your numbers from the previous two steps, calculate your ABR with this formula:

Total Billable Revenue / Total Hours Worked = ABR

Let’s say you’re running a monthly analysis of all client projects to find your ABR for July.

Looking at invoices, you find that your team generated $63,400 in revenue during July. And based on your time-tracking software, you see that your team spent 512 hours on client work.

So, in this case, the formula would be:

$63,400 (revenue) / 512 (hours worked) = $124 ABR

Meaning that, across all team members, projects, and clients, you billed an average of $124 per hour.

If you want to skip that math, though, just use Scoro’s “Project list view” to see your per-project ABR. Because it automatically factors in both billable and non-billable time entries, Scoro’s ABR calculation tends to be more precise than manual tracking or basic software.

Click “View” → “Data columns.” Then, check “Average billable rate.”

To see the numbers determining that ABR, check “Gross income” and “Total done,” too. We also recommend checking “Delivery margin” to see how your actual margins measure up to your targets. And “Labor cost” to see actual labor costs compared to your ACPH.

Now, you’ll see your automatic ABR calculation in the “Average billable rate” column. Scoro calculates this based on “Gross income” (invoiced revenue) and tracked time (shown in the “Total done” column).

4. Analyze your ABR’s effectiveness with Scoro’s “Project list” view

Look beyond the surface of your ABR to understand the “whys” behind it.

By digging deeper, you can start to figure out how to adjust billable rates, productivity, and team utilization to better support your project profitability.

Compare your actual ABR to your target on a weekly or monthly basis. If it’s not measuring up, dig into your project-level tracked time and finances to understand what’s eating into it.

Ask yourself:

- Is your team completing a lot of non-billable time for each project? If so, review your non-billable activities to see if any should actually be considered billable, like emails or extra Zoom calls.

- Are your labor costs unnecessarily expensive? If so, adjust your staffing or your team’s workloads to speed up deliveries and reduce your APCH for the project.

- Do you frequently experience scope creep or budget overruns? If so, review our project budgeting and project estimates guides to set more accurate quotes. Or raise your pricing to create a higher delivery margin for unexpected costs and scope changes.

Find the answers to these questions (and more) using Scoro’s “Project list” view.

From “Project list,” use “View” → “Data columns” again. And select “Gross income,” “Labor cost,” “Project profit,” “Delivery margin,” and “Average billable rate.”

Beyond determining your ABR for each project, this view will help you answer important questions like:

- How much did we really end up making on each project? (Look at “Gross income”)

- How much did this project cost us to deliver based on time spent? (Look at “Labor cost”)

- What was the resulting profit and delivery margin? (Look at “Project profit” and “Delivery margin”)

Click on any project title to see expanded data—tracked time, revenue, expenses, task durations, resources used, and more—on that project.

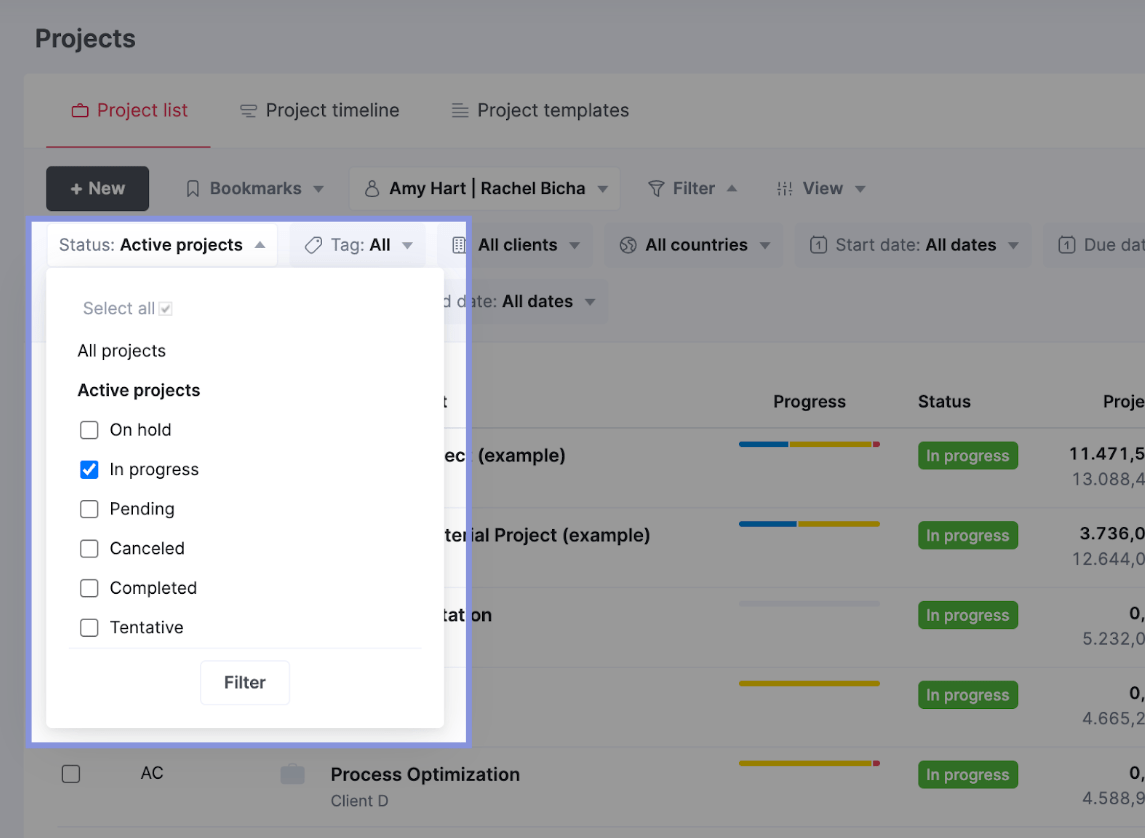

You can also use the “Filter” options to further analyze your ABR and profitability.

For example:

To monitor the ABR and profitability of current projects in real time, click “Filter” → “Status” → “In progress.”

Here, you can quickly identify any current projects that need adjustments to stay on track with your target delivery margin and ABR goals.

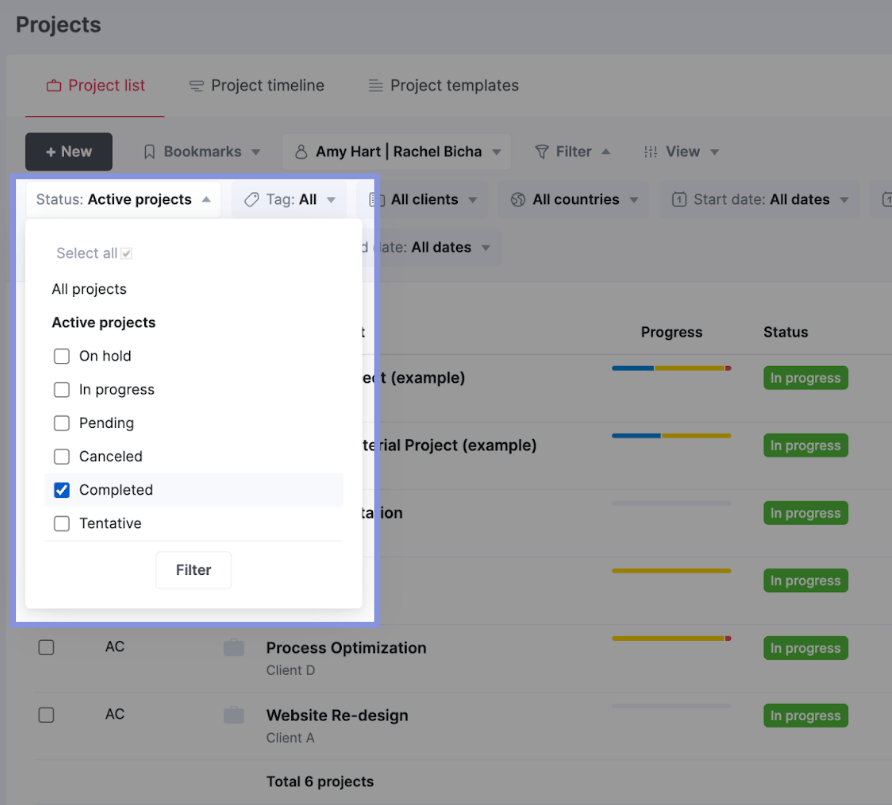

To analyze completed projects, click “Filter” → “Status” → “Completed.”

Here, you can see trends in your ABR over time, pinpoint the most profitable types of projects, and identify where you can improve.

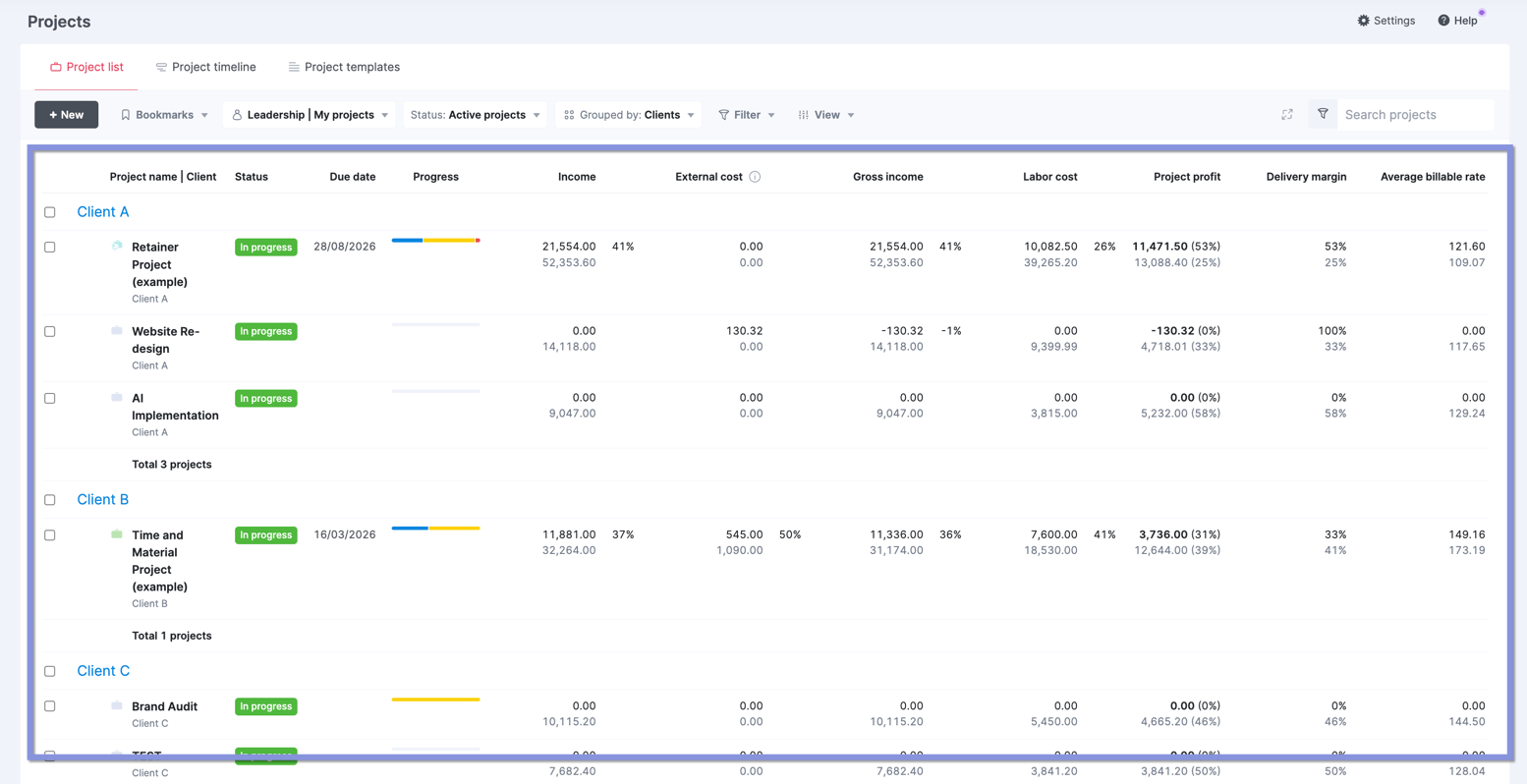

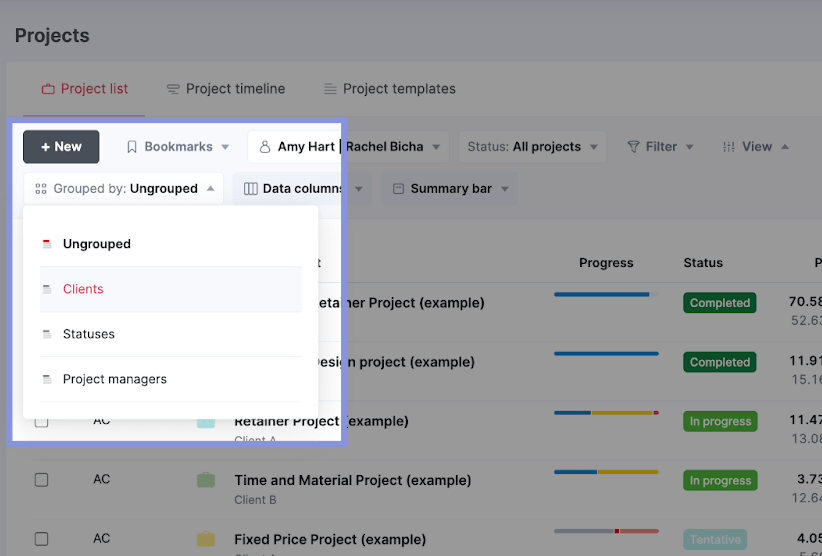

To analyze the value of your clients, click “View” → “Grouped by” → “Clients.”

Prioritize those clients with consistently high ABRs. And focus on working more with similar clients in the future.

Calculate and track ABR easily with Scoro

Understanding how much revenue you’re actually making for each hour of employee work is crucial for building a sustainable business.

But as we said at the beginning, many factors beyond billable rates influence profit and revenue.

Scoro makes it easy to analyze them all.

Just take it from Cosmonauts & Kings. The political comms agency used Scoro’s “detailed reporting and tracking capabilities” to boost their billable utilization and profit margins.

Sign up for a free trial of Scoro today to see how it can work for your own team.