Cash flow is the net amount of money that moves in and out of your agency during a given time period.

This includes:

- Income (i.e., revenue from clients)

- Expenses (e.g., employee salaries, vendor payments, and software subscriptions)

A positive cash flow means your agency earns more than it spends, while a negative cash flow indicates higher expenses than income.

Managing cash flow effectively is crucial for smooth operations. With a positive cash flow, you can cover payroll, pay contractors on time, and set aside funds for unexpected delays, late client payments, or contract cancellations. It also allows you to invest in marketing, hiring, and software upgrades to support growth.

On the other hand, insufficient cash flow can lead to late salary and vendor payments, downsizing, or postponing key investments—ultimately stalling long-term growth.

Understanding cash flow in agencies

Before you can address cash flow challenges, you need to know how your agency makes and spends money. And how certain earning and spending patterns impact your cash flow.

How agencies make money

Digital agencies typically generate revenue from one or more of these service models:

- Project-based work (based on billable hours or flat rates) like web design, branding, or marketing campaigns

- Retainers for ongoing services like SEO, social media management, or web maintenance

- Fees and commissions for certain results (e.g., a specific number of leads or conversions)

- Consulting engagements

All of these models can drive income. But some are more irregular than others.

For instance, project-based work tends to revolve around one-off invoices and one-time customers, which can lead to ebbs and flows in revenue. But retainers provide consistent monthly income and ongoing relationships, which contribute to steady cash flow.

Where agencies spend money

For most agency owners, the biggest expenses come from:

- Employee salaries and payroll

- Freelancer and contractor fees

- Software subscriptions for project management, design, and analytics tools

- Equipment rentals and purchases

- Office space and overhead costs

Employee salaries and office space tend to stay the same from month to month. But many of the other expenses can fluctuate wildly over time.

For example, you might invest in new laptops for your team in a single month. Or you might have hefty freelancer invoices to pay after a big client project wraps.

Common agency cash flow pitfalls

Even the most successful agencies can face cash flow issues. Watch out for these common pitfalls:

- Overpromising services: Setting unrealistic client expectations can lead to unpaid extra work, reducing profitability and disrupting project timelines.

- Relying on a few big clients: Depending heavily on one or two clients can create revenue gaps when contracts end, potentially leading to layoffs or paused initiatives.

- Overspending: Leasing excessive office space, hiring too quickly, or overinvesting in tools can inflate fixed costs, making it harder to stay profitable during slow months.

- Failing to save for emergencies: Without a financial cushion, your agency may struggle to cover expenses, risk taking on debt, or even face shutdown during extended slow periods.

- Allowing scope creep: Uncompensated extra work drains resources, delays projects, and shrinks profit margins. Ensure additional tasks come with additional pay.

- Accepting long payment terms: Agreeing to 60- or 90-day terms creates cash flow gaps, increasing the risk of shortages. Shorter payment cycles help maintain stability.

The creative agency Design de Plume improved its finances and increased project profits with Scoro.

Before Scoro, they had trouble tracking budgets and managing scope creep, which led to lost revenue.

After switching to Scoro’s real-time reporting and automated invoicing, they gained better visibility, stopped over-servicing, and boosted project profitability by over 20%.

Want to see how they did it? Check out the full case study here.

Core strategies to improve agency cash flow

With careful planning, you can strengthen your revenue streams and build up cash reserves.

Use these strategies to improve cash flow management for agencies:

1. Forecast your revenue

Revenue forecasting is a method of predicting your agency’s future income. You can do this on a monthly, quarterly, or annual basis.

This process is essential for making sure you don’t spend more than you earn. It helps you understand if you’ve got enough business lined up to avoid a cash flow crisis during slow periods.

Forecast cash flow by:

- Reviewing retainers: Add up all the recurring revenue your agency will earn from ongoing monthly retainers

- Checking upcoming work: Use Scoro’s Pipeline to monitor in-progress deals and anticipate revenue. Base your projections on previous quotes for similar completed projects.

- Listing fixed costs: Create a list of all your expected costs, including salaries, software, and office space

Remember to factor in seasonal fluctuations. Use project profitability data from past work to identify slow and busy periods.

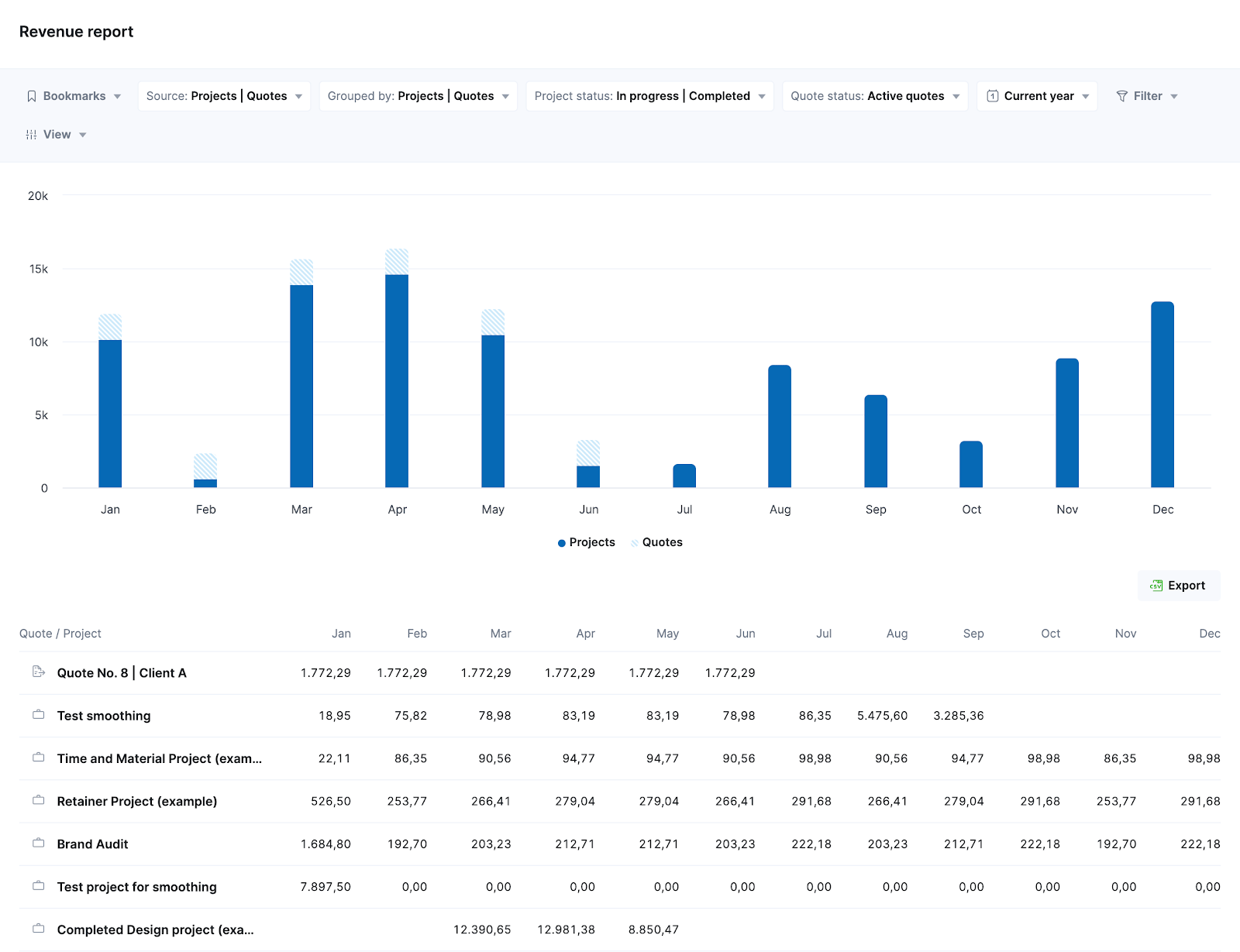

With Scoro, you can automatically forecast revenue. Check the “Revenue” report to see how much money your agency should bring in over the course of the next month, quarter, or year.

It shows financial data from the projects and quotes you’ve created in Scoro. Projects (solid dark blue) reflect confirmed work, and quotes (striped, light blue) reflect tentative work.

The report uses the revenue recognition principle to monitor this key agency metric. It tracks revenue as your agency earns it (i.e., when you deliver services to the client) instead of when you send invoices.

This way, you get a more accurate picture of how much work your team is doing each month—and how much you’re really bringing in.

If you spot periods with low forecasted revenue, work with your sales team to get more projects in the pipeline through targeted outreach, marketing campaigns, or brand partnerships.

Top Tip

For a deeper dive into this process and how to manage it with Scoro, watch our webinar on automating revenue forecasting.

2. Phase payments for projects

Phasing payments for projects involves breaking down large projects into smaller parts. Each milestone or deliverable is tied to a payment, which equals a percentage of the total.

With this approach, you bring in revenue throughout the project—you don’t have to wait for a lump sum at the end.

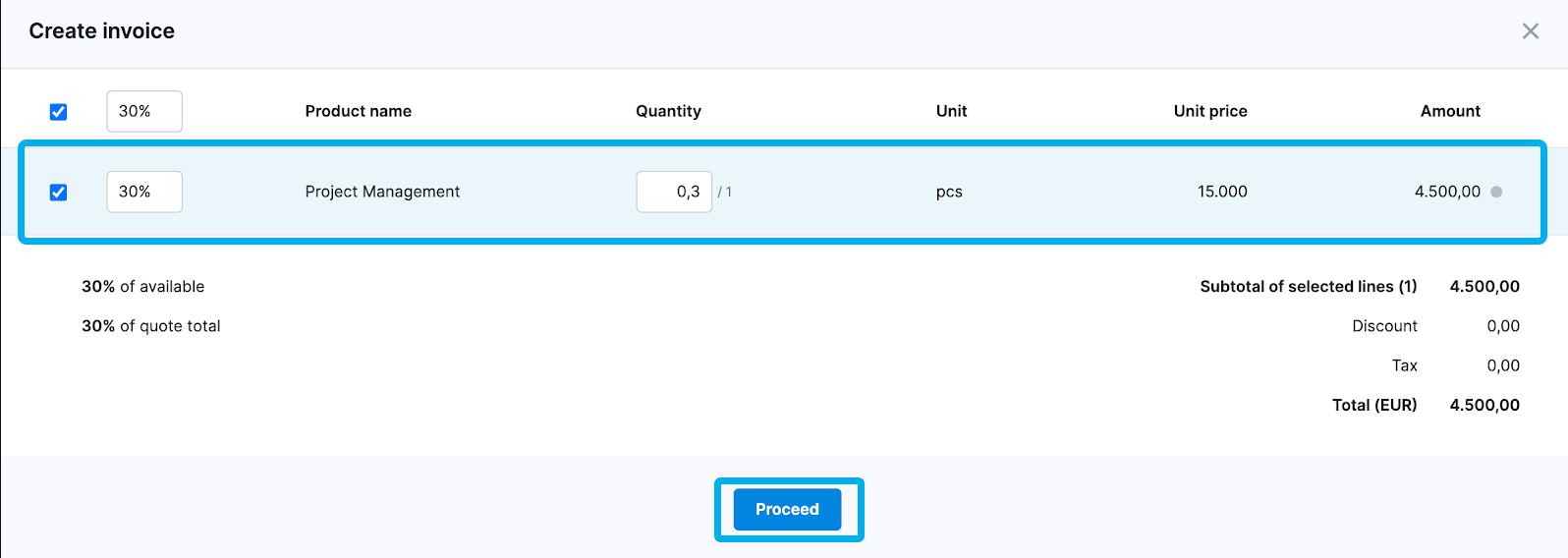

First, establish your milestones and the corresponding payments. For example, you might charge 30% as a deposit before the project begins. Then, you might charge 30% at the halfway point and 40% when you complete the project.

Or you might charge 25% up front, 25% when your team completes the deliverable draft, and 50% when they deliver the final product (e.g., the website design or ad campaign).

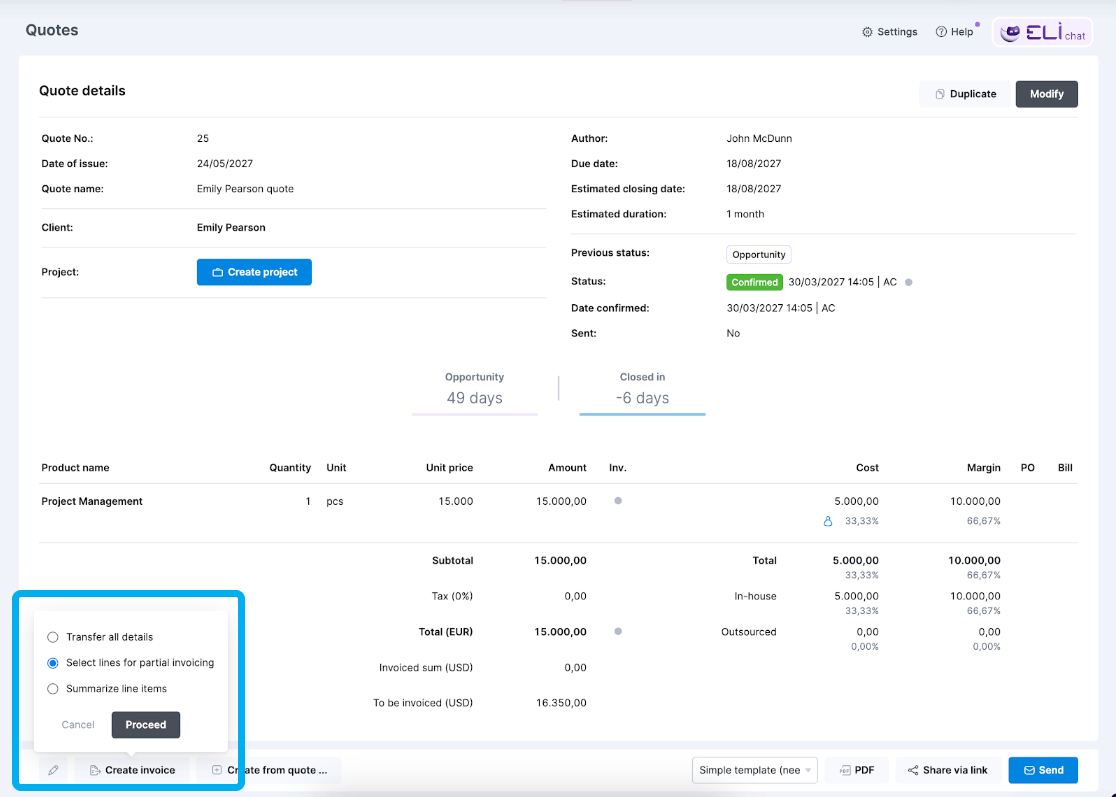

Scoro makes it easy to set up phased payments in your invoices.

Access “Partial invoicing” by opening a client quote. Click the “Create invoice” button and choose “Select times for partial invoicing” from the pop-up menu. Hit “Proceed.”

Then, check the boxes next to each service you want to invoice. Set the percentage of each service. Click “Proceed” to save and send the invoice.

Once you send partial invoices, you can see the percentage invoiced in the “Quotes” view.

3. Diversify your client base

Instead of depending on a few big clients to pay the bills, take on a larger number of smaller clients to diversify your client base.

This approach reduces the risk of losing a substantial portion of your monthly revenue if a major client leaves.

It also stabilizes your agency’s revenue streams and makes cash inflow more predictable. With a varied client base, you can lose one or more without instantly creating a cash flow crisis.

Ramp up your outreach and invest in marketing for your agency. Partner with your sales team to do more prospecting. Target new clients that fit your ideal customer profile (ICP) to expand your roster and build a more reliable foundation.

As you sign new clients, aim for a 70:30 ratio of retainer to project-based clients. This way, you’ll have a steady monthly cash inflow from retainer clients. Which you can supplement with one-off project-based work.

Top Tip

Struggling to win high-value clients?

Check out our podcast episode “How to pitch to WIN” with Freia Muehlenbein.

Freia shares practical advice on:

- Developing a strong qualification process to truly understand your client’s needs

- The concept of a war room and how it helps in crafting effective strategies

- Why prioritizing financials and ROI is more important than focusing on tactics

4. Automate invoicing and collections

Automate invoicing and reminders to reduce manual work, avoid payment delays, and maintain a steady cash flow.

Scoro makes this easy.

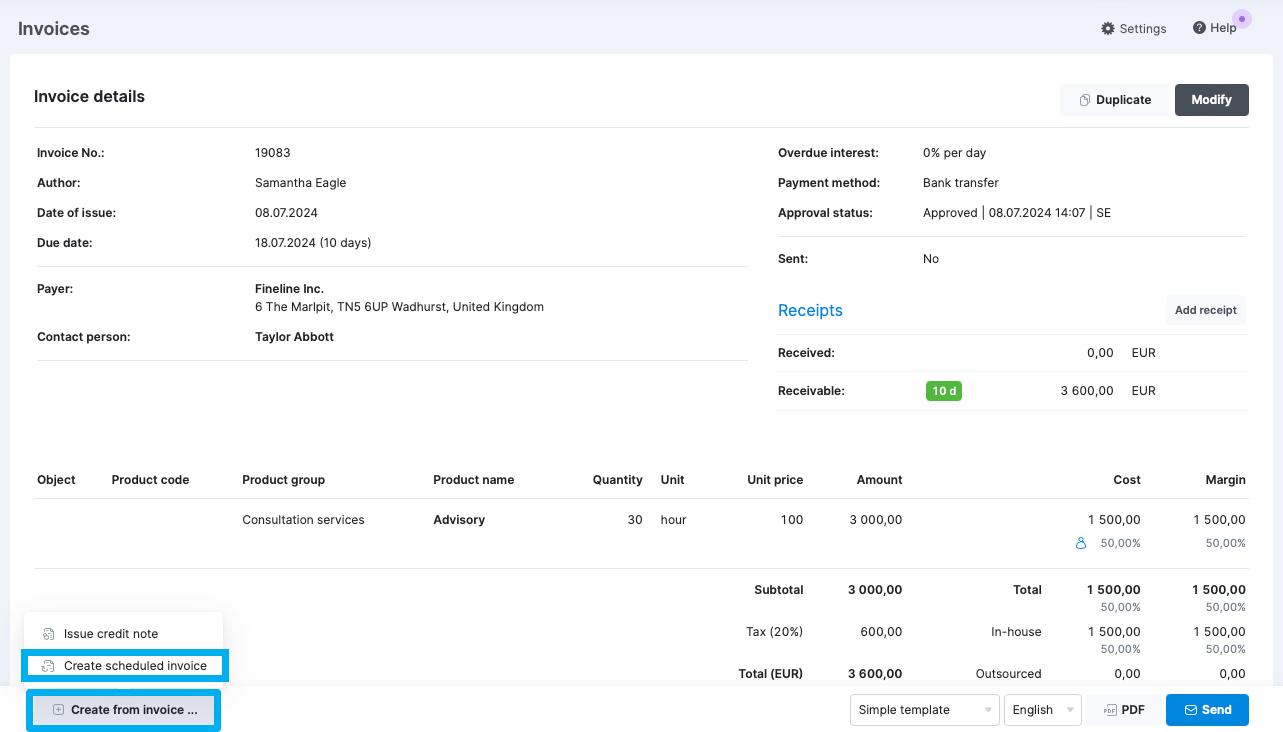

First, open a client invoice from the “Invoices” view. Click the “Create from invoice…” button and select “Create scheduled invoice” from the pop-up menu.

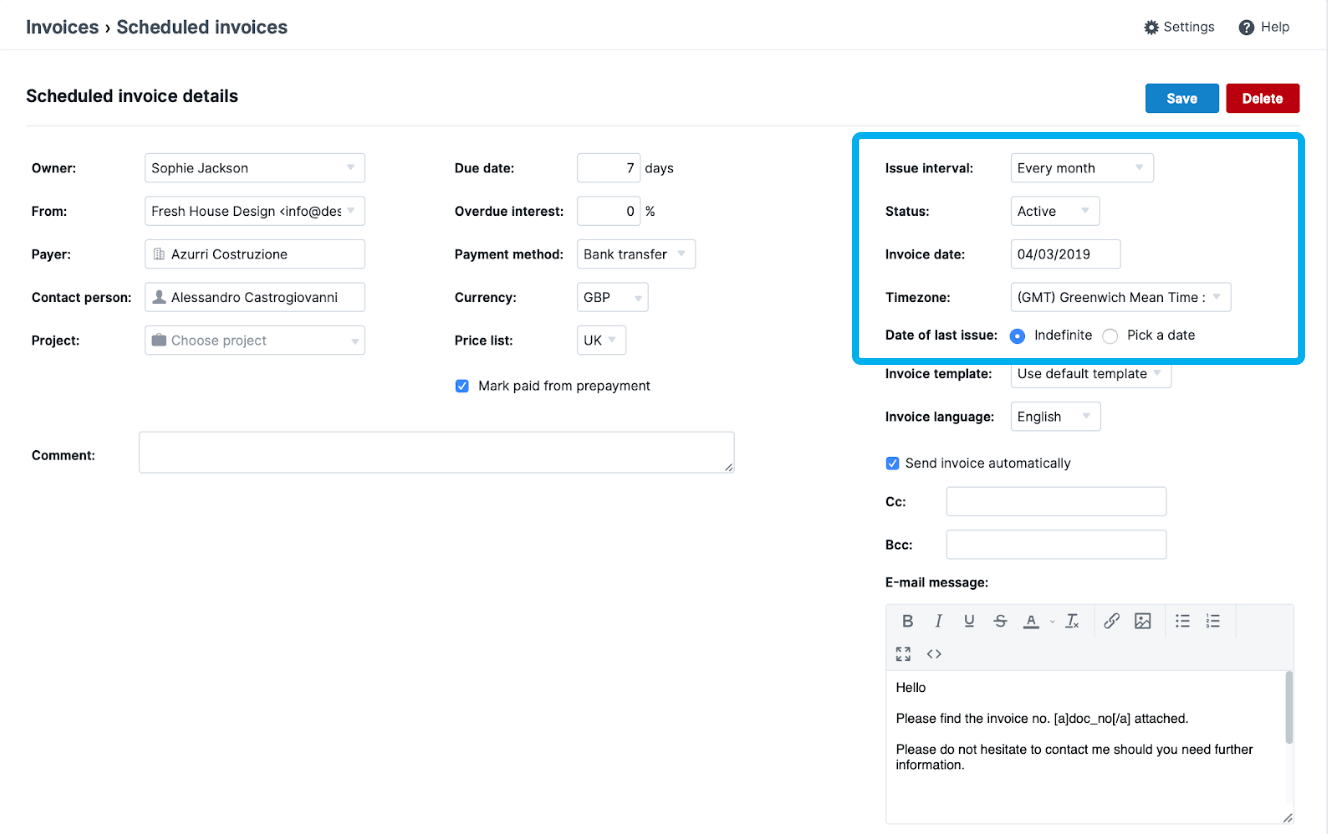

Then, choose the interval (e.g., monthly). Select “Indefinite” next to “Date of last issue” if you want to continue sending invoices indefinitely (i.e., for a monthly retainer). Otherwise, select “Pick a date” and set a date.

Then, check “Send invoice automatically.“

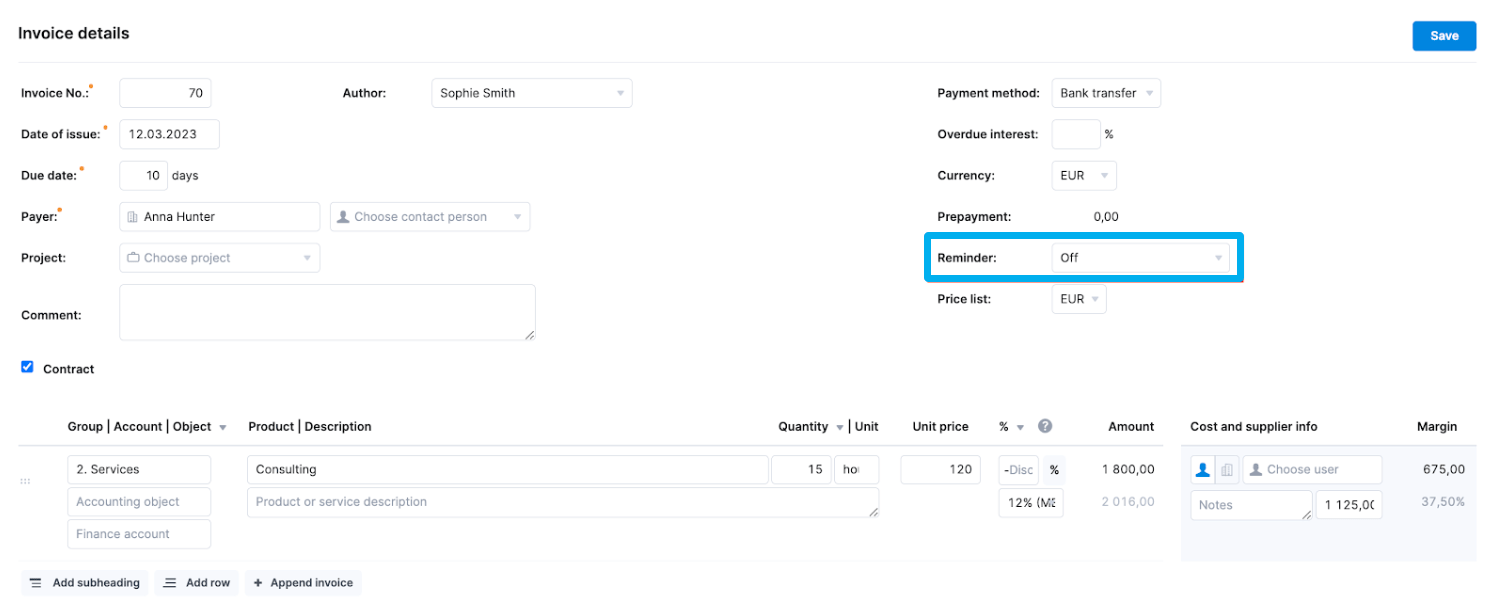

Scoro also gives you two options to automate invoice reminders. When you create a new invoice, select “On” from the “Reminder” menu.

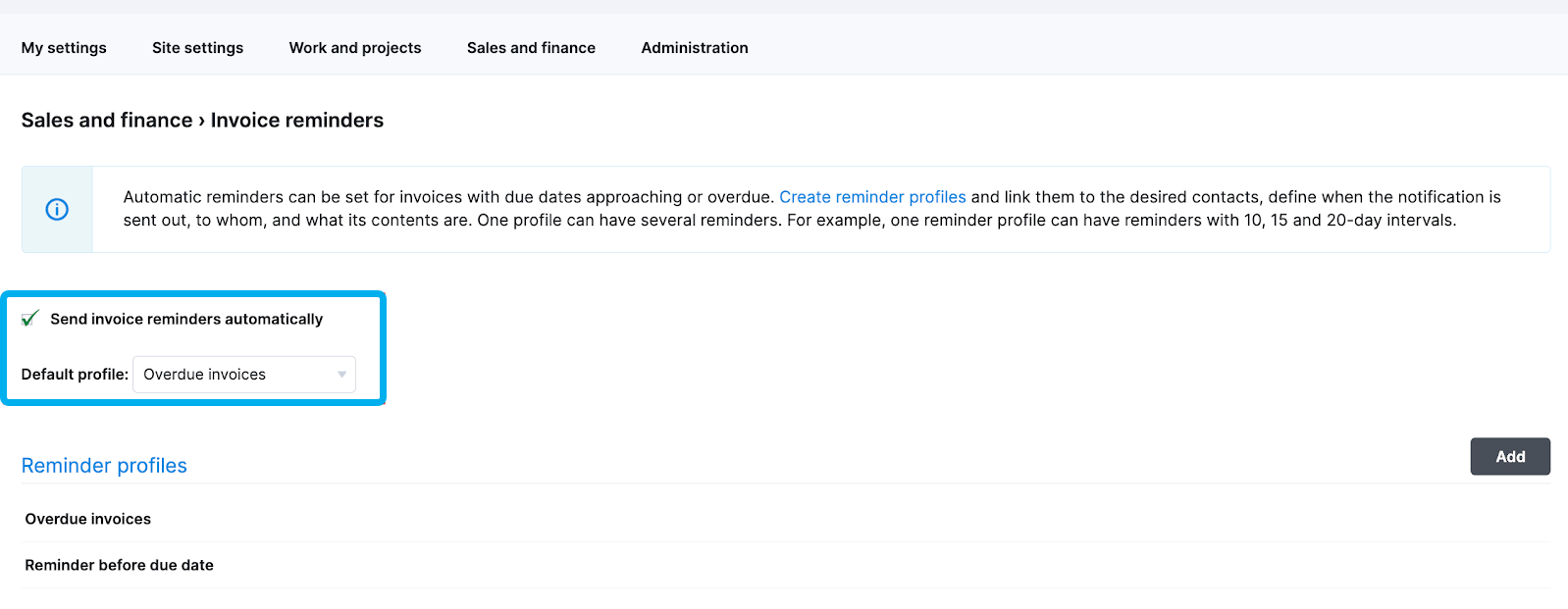

Or go to “Sales and finance” > “Invoice reminders” to activate automatic reminders for overdue invoices.

And make it easy for clients to pay you. Offer electronic methods like credit card payments or ACH transfers.

Top Tip: Streamline the invoicing process further by integrating Scoro with QuickBooks, Xero, or Stripe.

5. Build recurring revenue

Instead of focusing on one-off projects, prioritize services that clients need on a recurring basis. For example, you might offer social media management, website maintenance, or design retainers.

Retainers create recurring revenue, which produces predictable income for your agency. This simplifies revenue forecasting and financial planning.

Develop packages with ongoing services. For example, offering social media ad account management on a monthly basis.

And instead of offering a single pricing option, create different tiers. Your basic tier might include ad account management for a single platform with a low ad spend. The standard and premium tiers might include multiple ad accounts and a higher ad spend.

After completing one-off projects for clients, do your best to upsell them on your retainer packages. By creating ongoing relationships, you get to know client accounts more deeply, helping your team work more efficiently and deliver better results.

Top Tip

Consider basing the operating expenses you can afford only on your retainer income. This way, you won’t overestimate your cash inflow and run into potential financial issues.

6. Control operational expenses

Review your agency’s operational expenses at least once a quarter.

This way, you can cut unnecessary expenses and spend more efficiently. Reviewing expenses also helps you stay on top of your fixed costs and make sure you have enough money coming in to cover them.

Chart expenses like payroll, contractor fees, rent for office space, and software subscriptions. Then, consider making changes like:

- Canceling software subscriptions you don’t consistently use or reducing the number of seats you pay for

- Renegotiating vendor contracts to flat-fee projects to better align with your needs and reduce costs

- Shifting your agency to remote or hybrid work to cut down on office costs

Keep your agency’s cash flow strong with Scoro

Managing cash flow is key to keeping your agency running smoothly and growing sustainably. Late payments, inconsistent revenue, and high expenses can create financial stress, but with the right tools and strategies, you can stay in control.

Scoro helps agencies streamline cash flow management by automating invoicing, tracking revenue, and optimizing expenses—all in one place.