If you can’t match projects with the right pricing model, you’ll end up leaving money on the table.

Look over these five agency pricing models and find out which ones can best support your unique services and profit targets:

1. Hourly pricing

Hourly pricing is a time-based model where you bill clients a set rate for the hours your team works. Many agencies use this model because it’s the simplest option.

You figure out hourly rates based on your labor costs, overhead, and profit margin targets. This way, you make sure what you charge for each hour covers the cost of your expenses while still making a profit.

Say your agency charges $150 per hour for website development. If your team logs 50 billable hours for a client project, you’d invoice the client for $7,500 ($150 x 50).

Pros and cons of hourly pricing

One of the biggest pros of an hourly pricing model is its simplicity. The more hours your team logs, the more revenue your agency earns.

But this model also has downsides. The faster your team works, the less you can bill.

So this might inadvertently incentivize your team to work more slowly. And it can cause clients to scrutinize or challenge your invoices.

Plus, there are limits to the number of hours your team can work (e.g., 35 billable hours per week for a full-time employee). If you want to bring in more revenue when your team is already at max capacity, you have to expand available hours by outsourcing or hiring.

How to charge with hourly pricing

There are two ways to approach hourly pricing: blended and tiered.

Blended hourly pricing factors in the rates for all employees on a project and combines them into a single rate.

Start by determining billable rates for each employee. Take the amount they earn per hour (i.e., their employee hourly rate) and factor in overhead costs like benefits and paid time off. This is their actual cost per hour.

Take their actual cost per hour and add your desired profit margin.

Say your employee’s actual cost per hour is $100 and you want to add a 60% profit margin. Use the calculation $100 x 1.6 = $150. This is their billable rate.

A web development agency might use the following breakdown for a typical project:

- Jay, a front-end developer with an hourly rate of $150, is assignedlogs 40% of hours

- Phil, a back-end developer with an hourly rate of $125, is assignedlogs 35% of hours

- Mary, a quality assurance engineer with an hourly rate of $100, is assignedlogs 10% of hours

- Allison, a strategist with an hourly rate of $200, is assignedlogs 15% of hours

From there, you can get a standard hourly fee by calculating a blended rate: (($150 x .4) + ($125 x .35) + ($100 x .1) + ($200 x .15)) = $143.75

Blended pricing works well when you want to simplify your quoting process with a single rate.

However, this method isn’t ideal for all agencies, since it averages out hourly rates across roles.

With tiered pricing, you assign rates for each role and seniority level.

For example, you might set an hourly rate of $200 for senior front-end developers and $150 for junior front-end developers.

This method gives a more accurate picture of how much revenue you’ll earn for the work, making it a good choice for most agencies.

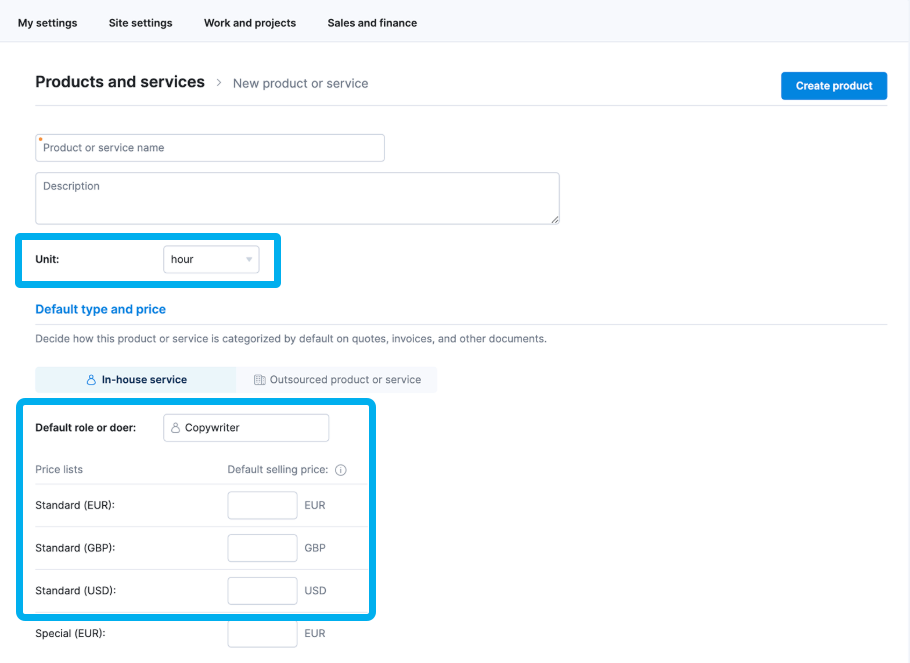

No matter which hourly pricing model you use, you can set billable rates for each employee in an agency management system like Scoro.

Go to “Settings” > “Sales and Finance” > “Products and services” and click to create a new service. Select “Hour” from the “Unit” drop-down menu.

Then, choose a relevant role from the “Default role or doer” menu and type in their hourly rate.

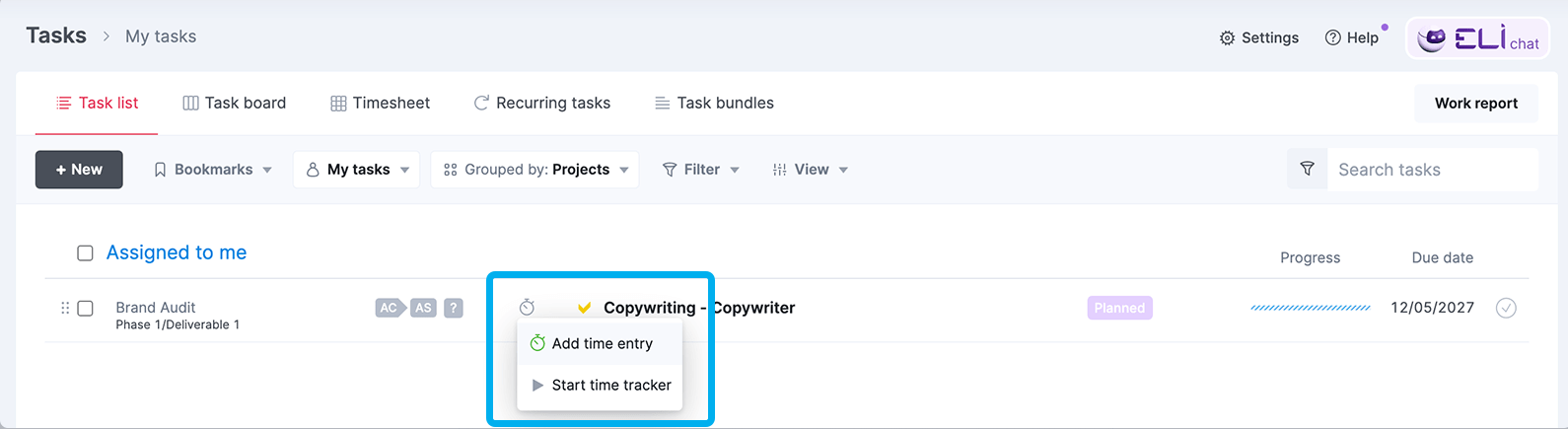

Once you’ve set up billable rates, each employee can track their time in Scoro.

In the “Tasks” view, team members can hover over the clock icon for the project they’re working on. They can select “Start time tracker” for real-time tracking or “Add time entry” to create a retroactive log.

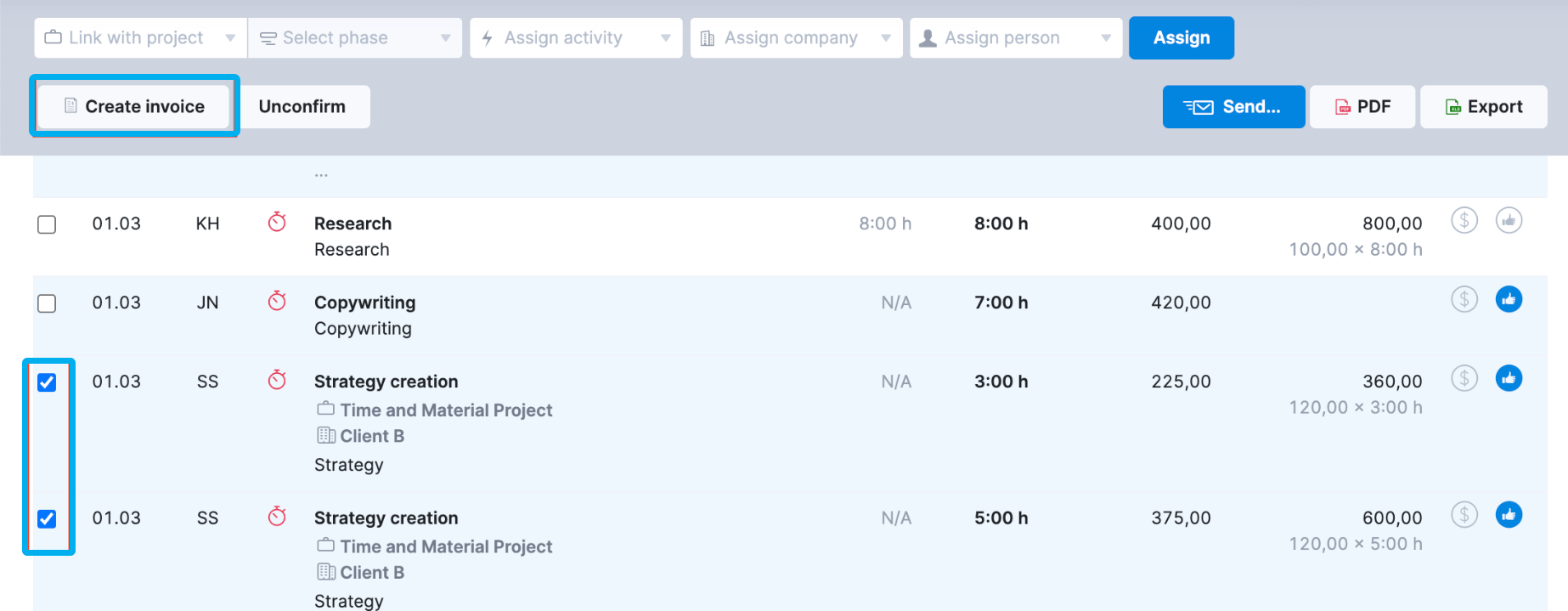

Then, you can easily create invoices that include those logged hours using Scoro’s “Detailed work” report.

Just check the box next to all the time entries you want to bill for. Then, click the “Create invoice” button and send it to your client.

2. Fixed-fee pricing

Also known as a project-based pricing model, fixed-fee pricing uses a flat rate for each type of project.

Many agencies use this model because it requires the agency and client to agree on the total cost and project scope in advance.

For example, your agency might charge a fixed fee of $25,000 for a full website design. And for an SEO strategy, you might charge $10,000.

Pros and cons of fixed-fee pricing

Compared to an hourly rate, a fixed-fee model offers more predictability for both your company and clients.

Why?

Because you know how much your agency will earn for each project before you even start it.

And since you aren’t charging by the hour, you don’t have to increase the project price if a roadblock happens. Which keeps clients happier.

Fixed-fee pricing can also improve project profitability. Because the time your team takes doesn’t affect your revenue, they can get jobs done faster. This leaves more open billable hours on their schedules to take on other projects—and earn more.

But flat rates can backfire if you underestimate the resources you need for the project. If you regularly end up needing more time or people, it cuts into your profit margin.

Scope creep can also be an issue with fixed-fee pricing. If you don’t define the scope clearly, clients might ask for additional deliverables or extra revisions without expecting to pay more.

How to charge by fixed-fee pricing

Work with the client to clearly define the project scope. Identify the resources, deliverables, and milestones for the project.

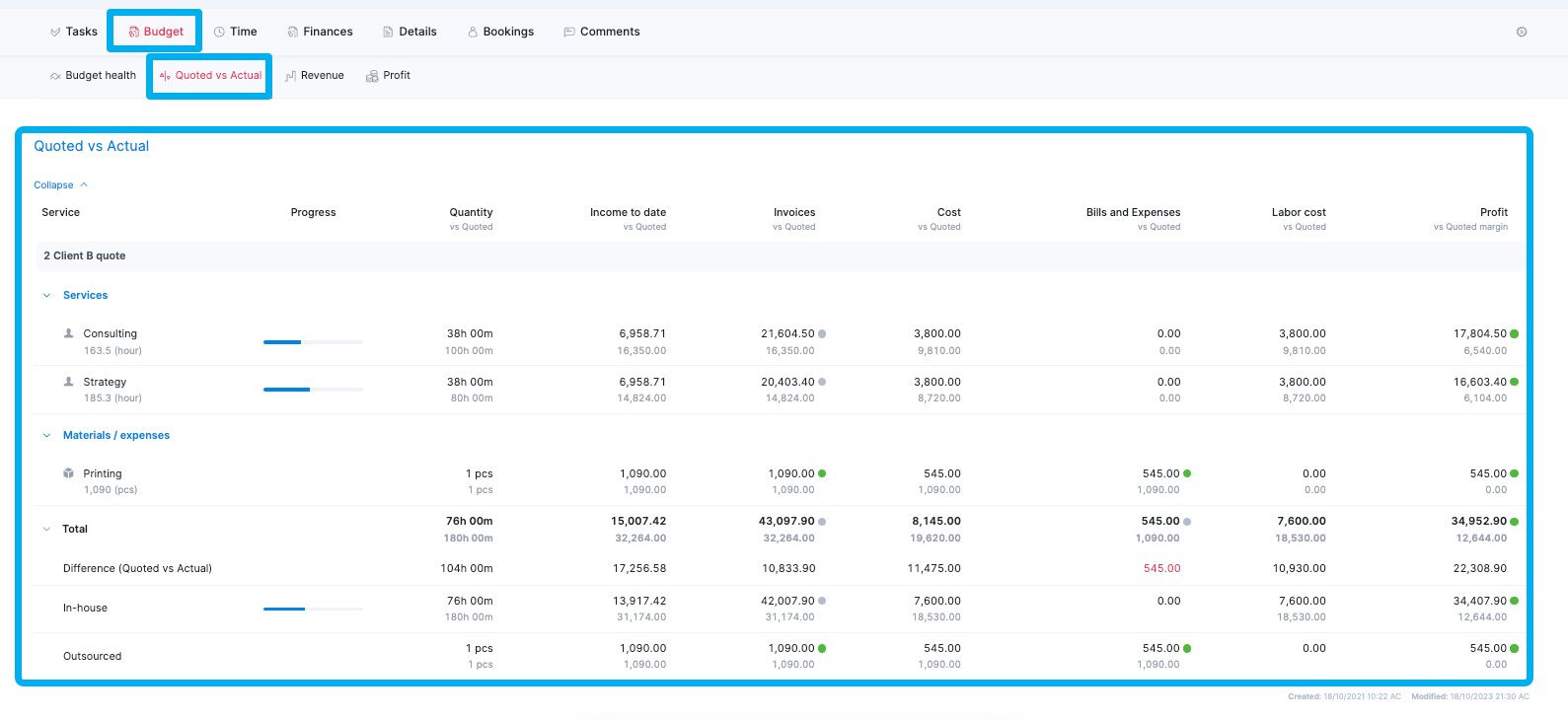

Then, head to Scoro’s “Quoted vs Actual” table. Use the data from past similar projects (especially under “Quantity” and “Labor Costs”) as the basis of your project cost estimate.

The chart will also help you to determine a reasonable cost buffer (e.g., an extra 15%) that accounts for things like additional client calls or extra rounds of revisions. And you can set more realistic project management KPIs.

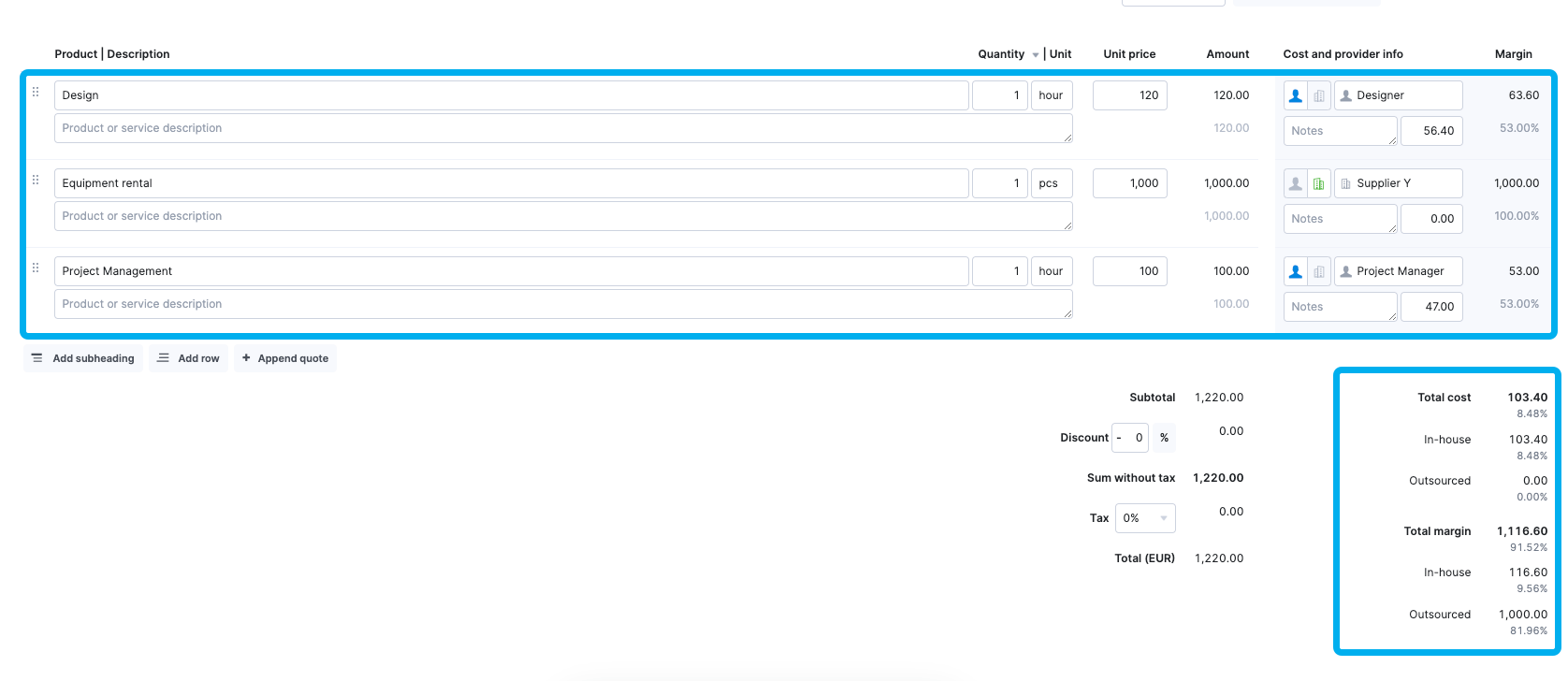

Once you have your high-level numbers, head to Scoro’s “Quote” builder to build your proposal.

As you enter in different phases, hours, and roles, it’ll automatically tally up the final cost for you. Make sure to include the 15% buffer in your hourly calculations.

3. Retainer pricing

Retainer pricing uses a recurring fee for ongoing services, often on a monthly basis. A retainer typically includes a set number of hours or deliverables.

Agencies often use retainers because of their dependability—this pricing model provides consistent monthly income.

Say your agency offers monthly social media management retainers. Your basic tier might include three social media posts per week plus monthly reports for $2,500 per month. And your top tier might include daily posts across three social channels plus monthly reports for $10,000 per month.

Pros and cons of retainer pricing

The biggest perk of a retainer pricing model is the steady revenue it provides. So it supports a predictable cash flow.

And a retainer model is often easier for clients to budget for since the cost is the same every month.

Since retainers are designed around ongoing work, they also tend to lead to long-term client-agency relationships. So your company can feel less pressure to continually bring on new customers. And clients benefit from working with an agency team that deeply understands their business.

But if your workload varies significantly, a retainer might compromise your agency’s profitability during busier months and leave clients questioning the value you provide during slower months.

How to charge by retainer pricing

Start by clearly defining your agency’s services. Like the social media management packages with different levels of support.

Use your team’s billable rates as a basis for a monthly retainer fee.

Then, create a service-level agreement to make sure clients understand exactly what is and isn’t included. Include limits for the retainer package, including the maximum number of hours or deliverables your team will provide.

Show your results by providing detailed monthly reports (e.g., from your advertising or web analytics platform). Explain what you’ve accomplished and demonstrate the value your team provided. Like tying results to revenue.

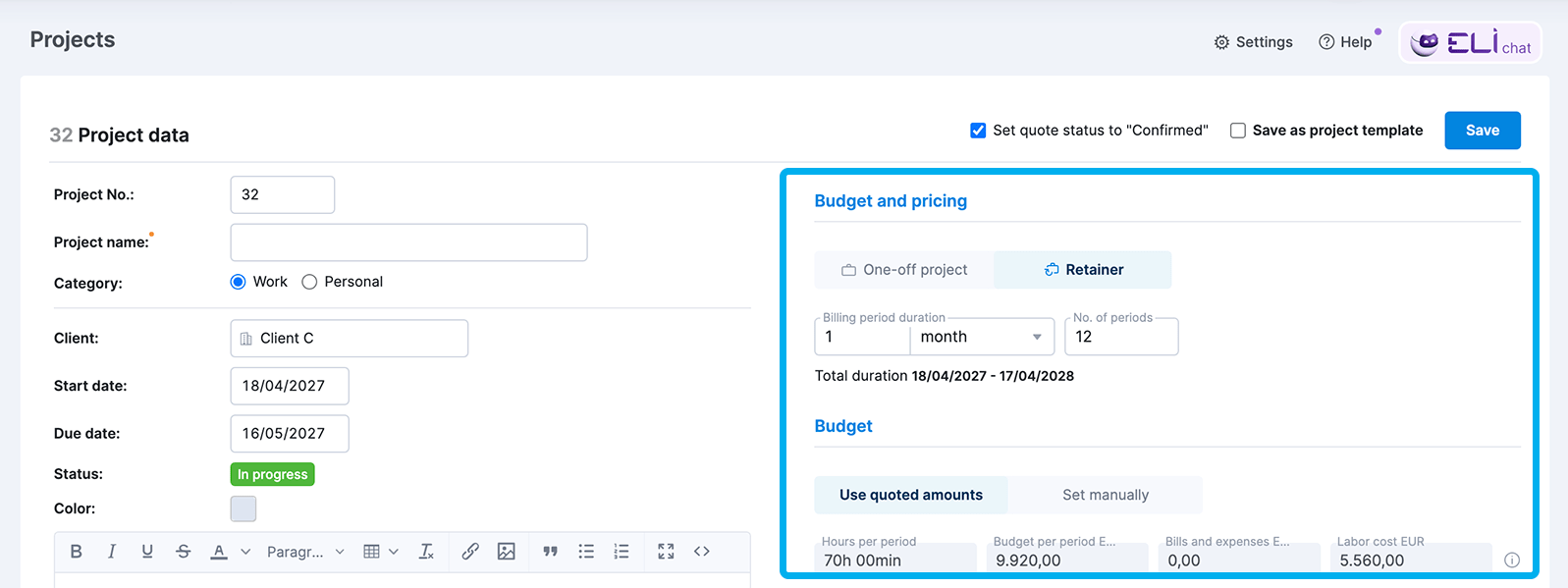

You can manage retainer agreements in Scoro’s “Project” view. When you create a new project, select “Retainer” under “Budget and pricing.” Then, enter the billing period duration and the number of periods.

If you create the project from a quote, Scoro will automatically include your initial budget.

Otherwise, fill in the hours and budget per billing period under “Budget.” This way, you can track time and costs throughout the project to make sure you’re within your projections.

4. Value-based pricing

Value-based pricing depends on the outcome your agency provides. It links the cost of the work to the value or impact you create for the client.

Many agencies consider a value-based pricing model to be the ultimate goal. The better your agency becomes at delivering results (e.g., revenue, sign-ups) for the client, the more you can charge for your work.

Say your SEO agency is scoping a project for a potential ecommerce client. Your SEO strategy is projected to drive an additional $100,000 in revenue for the client. So you decide to charge 10% ($10,000) for the project.

Pros and cons of value-based pricing

The main benefit of value-based pricing is that it focuses on the outcome the client cares about. This can help you position your agency as a strategic partner and justify your rates—especially if you’re charging more than competitors.

A value-based approach is one of the best pricing models for maximizing profitability. As your team improves and generates better results, you can charge more for their time.

However, this approach can be difficult to sell without proven results for previous clients. If prospects doubt the ROI you’ll bring them, they’ll probably question your pricing structure. Or simply go with another agency.

How to charge by value-based pricing

A successful value-based pricing model starts with an in-depth discovery phase. Talk with the client to understand what they want to achieve. Like traffic, leads, or revenue.

Based on your insights from the discovery phase, decide which results to measure (e.g., revenue) and how to track them (e.g., an analytics tool). Then, estimate the total value your work will generate.

Refer to similar projects you’ve done in the past to get this number. Or use client data to inform your estimate. If you anticipate generating 100 leads that the client values at $1,000 each, your total value would be $100,000.

Then, use your value estimate to establish pricing. For example, you might charge 10% of the $100,000 in revenue you anticipate generating, resulting in a fee of $10,000.

5. Performance-based pricing

Performance-based pricing is when your agency’s compensation is linked to the results you achieve. Essentially, you earn a commission when you achieve certain outcomes.

This pricing model is ideal for incentivizing performance, which benefits both the agency and the client. It works best for projects that have measurable outcomes.

While it has some similarities to value-based pricing, performance-based pricing typically sets different rates for specific results.

Agencies that use a performance-based model often charge a base rate. Then, they establish tiers with fees that increase alongside performance.

Suppose your digital marketing agency offers lead-generation services. You might charge a standard rate of $10,000. Then, you might charge $100 per qualified lead up to 500 leads, $150 per qualified lead up to 1,000 leads, and so on.

Pros and cons of performance-based pricing

The biggest pro of a performance-based pricing model is the potential increase in profitability. The more results you generate, the more revenue you earn.

Although clients pay more for extra results, they can see a direct connection between what they pay and what they receive. This can increase their trust in your business, leading to stronger (and longer) partnerships.

But performance-based pricing doesn’t always work as intended. If your team isn’t able to achieve predicted outcomes, your agency margin will be lower than anticipated.

How to charge by performance-based pricing

Performance-based pricing depends on clearly defined goals. Start by quantifying what your team will achieve for the client (e.g., leads or traffic).

Establish a baseline, or the minimum you’ll deliver. Then, agree on tiers and compensation when you exceed the baseline.

Add this information to a performance agreement to make sure everyone is on the same page.

What’s your agency pricing strategy?

Choosing the right pricing model is key for optimizing your rates and transforming your agency metrics.

By using a strategic method that suits your agency, you can estimate costs more accurately and boost revenue. Which helps your business scale faster.

Scoro makes it easy to measure agency performance and profitability. From custom dasboards to 50+ reports, Scoro gives you complete control of your projects, finances, and resources.

See how Scoro can simplify pricing and invoicing with a free 14-day trial.