It’s easy to get behind on managing project finances amid all your other day-to-day responsibilities, especially if you have a lot of projects going at the same time.

But if you don’t understand financial management, you’ll likely experience overservicing, delivery delays, and less profitable projects.

Why?

Without a proactive financial management approach, project budgets, time logs, and margins soon become inaccurate.

Maintain healthier profits and simplify project financial management with our guide.

What is project financial management?

Project financial management is the process of estimating, budgeting, tracking, and controlling a project’s costs.

The goal is to keep project costs within your planned budget—or even lower, if possible. This way, you can hit your profit margin targets and keep clients happy.

Why project financial management is important

Project financial management is essential for project success. As the Project Management Institute notes, 35% of project failures are related to budget problems.

It’s also key to maintaining healthy profit margins. Without effective cost management, it’s nearly impossible to accurately track where money goes and stays on budget, leading to dropping profits.

With good project cost control, you can avoid overspending. Tracking costs also gives you a wealth of solid historical cost and resource data, which helps you price future projects more accurately.

Effective financial management also helps:

- Improve client relationships: A clear budget and cost-tracking plan make it much easier to manage finances and give regular updates to your clients. Being able to show how you’re using their money wisely helps build trust and keep clients returning.

- Avoid end-of-project surprises: If you’re not tracking costs closely, it’s easy to get to the end of the project and realize you exceeded your budget. A project financial management plan helps you avoid unexpected costs and difficult client conversations at the end of the project.

- Make informed decisions: By tracking actual project costs, such as labor, materials, and time, you can make better decisions about which future projects to take on, how to staff them, and what to charge.

- Grow the business: Higher project profit margins ultimately give higher-ups more money to invest in the business, hire top talent, and scale project onboarding. And when you manage costs well, you objectively demonstrate the value you bring to your organization.

How to create a project financial management plan

Creating a project financial management plan before the project kicks off helps you accurately estimate and manage costs, avoid going over budget, and maintain your profit margins.

Top Tip

Have you assessed your team’s capacity to handle new work? Scoro’s utilization reports reveal if your team is overloaded and at risk of blowing your budget.

1. Build your project cost estimate

An accurate cost estimate is the foundation of your budget. And it sets clear expectations on how much each phase or deliverable of the project should cost.

Follow these steps to build a precise estimate:

| Step | Description |

|---|---|

| 1. Break down the project scope into deliverables or phases. | Take the main goal of the project (e.g., “redesign website” and break it down into separate parts (e.g., “write copy for five landing pages” and “update logo”). This makes it easier to negotiate a fair, transparent contract and build client trust. |

| 2. Estimate the duration of each deliverable or phase. | List how long each of these deliverables or tasks should take. |

| 3. Calculate the cost of each task and deliverable. | Multiply the estimated time each task will take by the labor cost of each task based on the role that will likely complete it. |

| 4. Add external costs. | Include pass-through costs (supplier bills and project expenses) related to the project. |

| 5. Calculate the total project cost estimate. | Add internal and external costs to get the total project cost estimate. |

| 6. Get your quote approved internally. | Share the quote with any internal stakeholders for review and approval. |

| 7. Share the estimate with your prospect or client. | Share the estimate with your client for review and approval. |

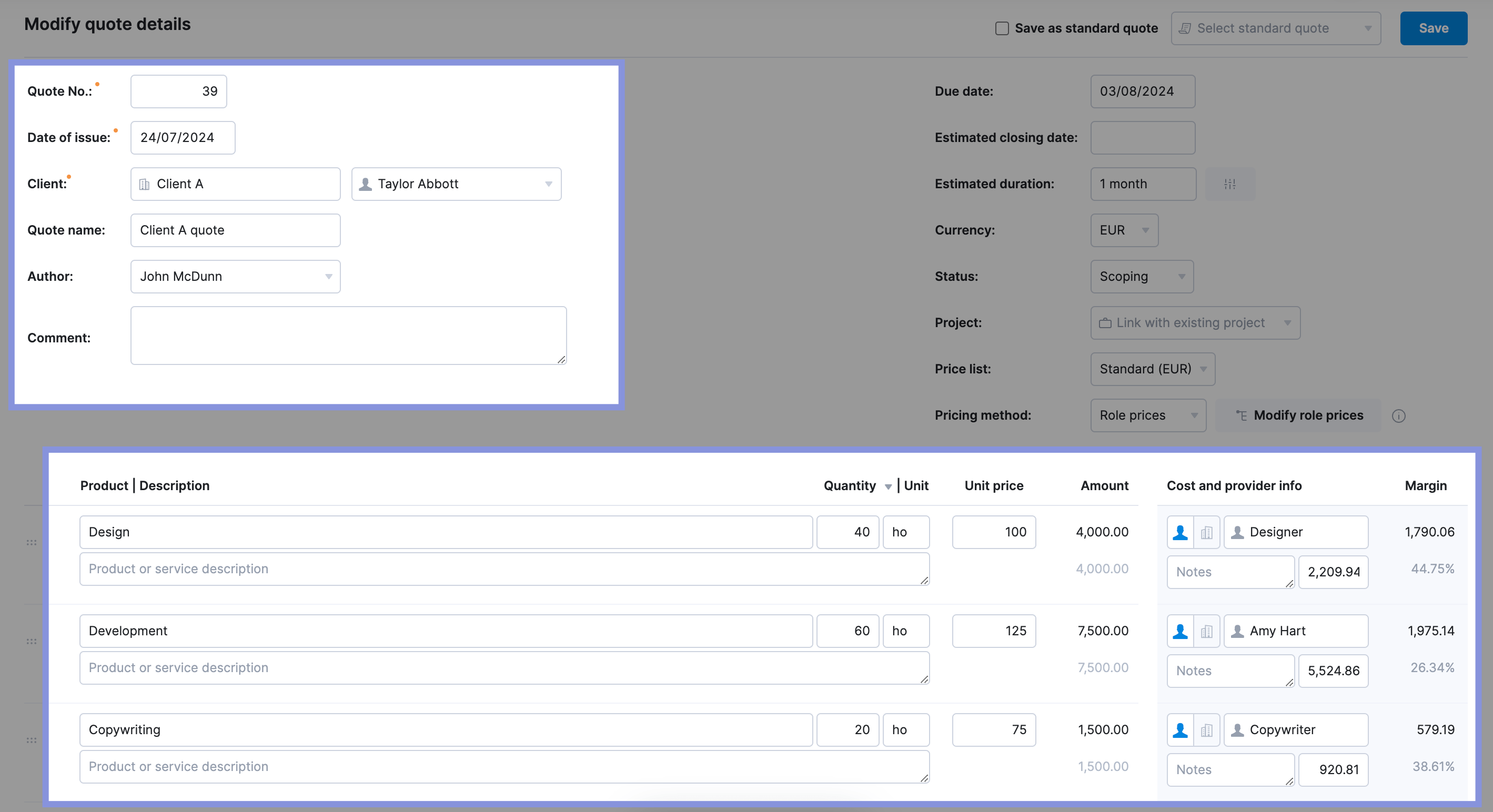

Use Scoro’s quote builder to streamline this process and keep all your project data in one place.

First, fill out the quote details and add each deliverable or phase to your quote.

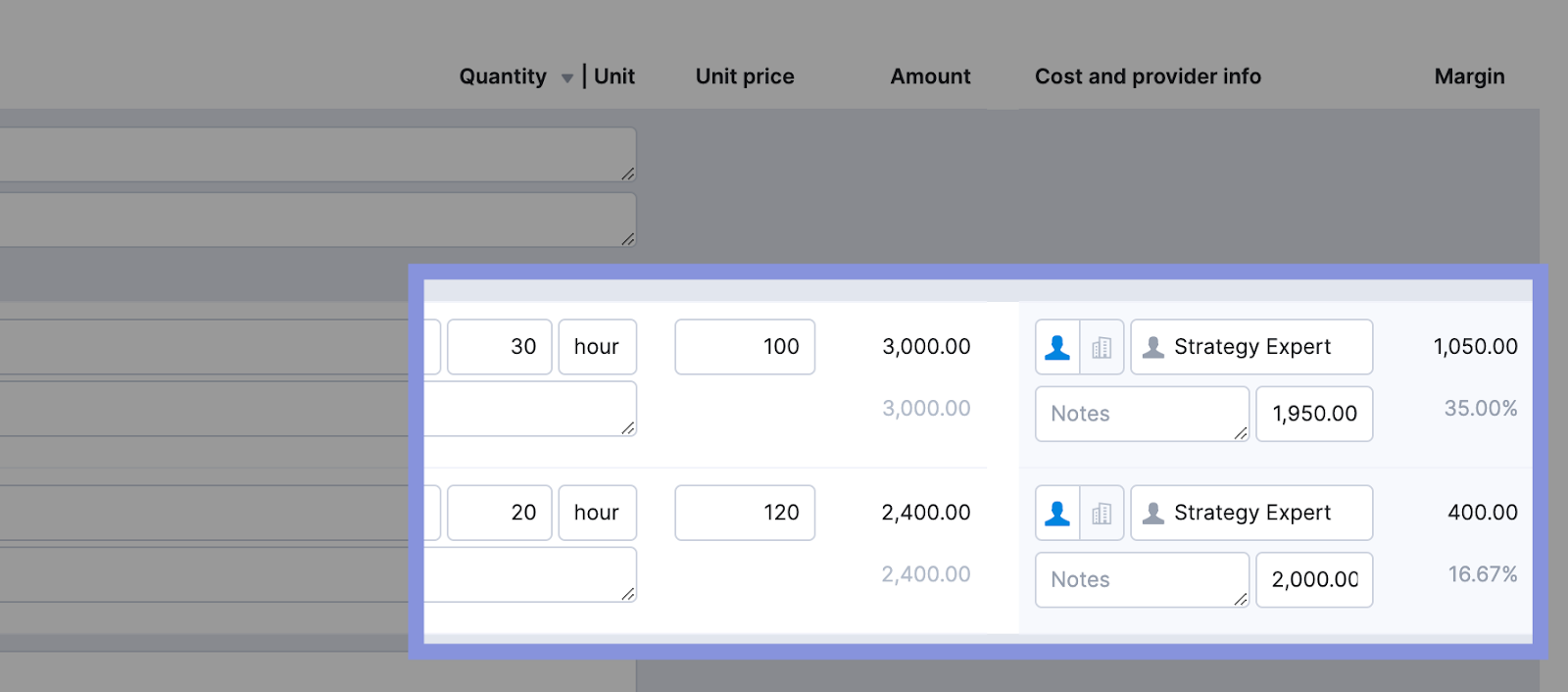

Then, click on “Quantity” to set the number of hours. And “Unit price” to set the labor cost.

Next, add the role for each task, and Scoro will automatically calculate the total cost and your resulting margin.

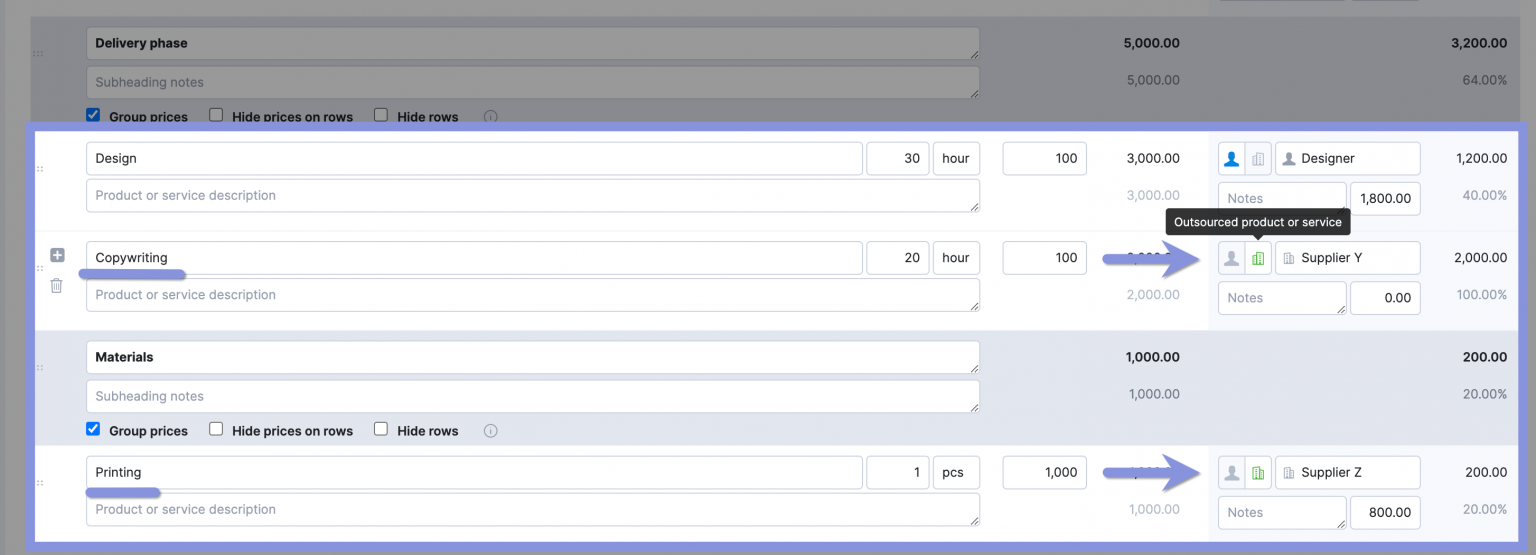

Next, add in your external costs.

For example, if you’re working on a design project, you might budget for an external writer for “Copywriting” and allocate funds for “Printing” costs.

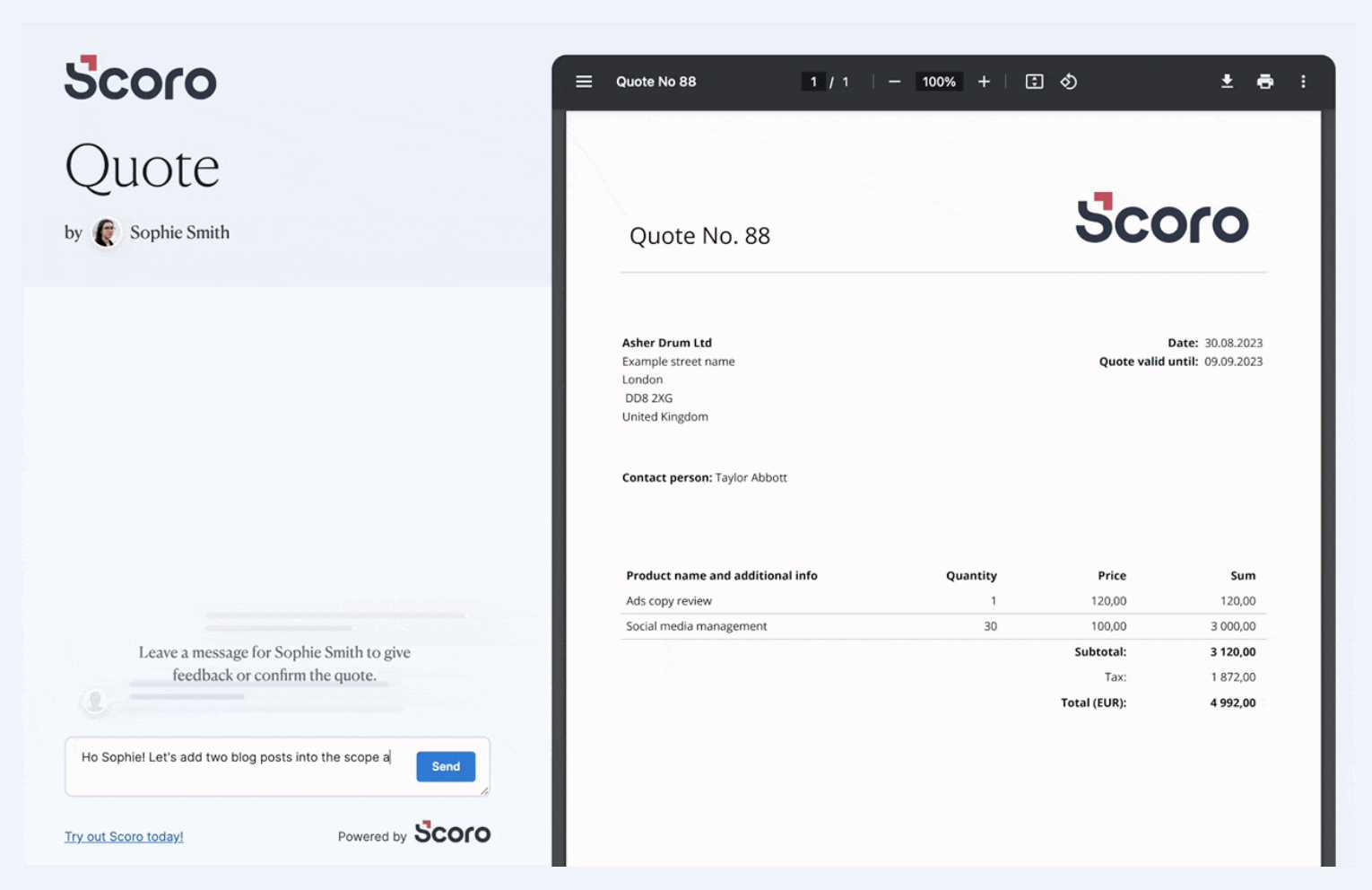

Once your quote is ready, save it and then click “Send” to share it with your client.

Then, you’ll have access to a chatbox to message clients and get feedback on the quote in real-time.

Further reading

Check out our guide “Project Cost Estimation: A Guide to Quoting Profitable Projects” to learn more about creating accuate cost estimates for your next project.

2. Choose which team members will work on the project

Once you’ve chosen the general roles to fulfill each deliverable in your cost estimate, it’s time to assign specific people to that work (also known as resource planning).

Consider each team member’s availability, labor rates, and skills to create a realistic plan that aligns with your cost estimate.

Evaluate team members’ capacity to find people who can handle the workload based on their current schedule.

If you give too much work to a team member (even if they have the right skill set), you risk delays and lower-quality deliverables.

And avoid assigning work to someone whose labor rates are over budget for the given project phase or deliverable.

For example, if your budget for 10 hours of copywriting is $1,000, assigning it to a Junior Copywriter with a labor rate of $55 / hr. instead of your Head of Content ($125 / hr.) would make sense.

This way, you still have the relevant skill set available, but don’t risk burning through your budget and margins.

On the other hand, sometimes the cheapest resource is not the best choice.

If you have five landing pages to design, you might have these team members to choose from:

- Head Designer, $125 / hr.

- UX Designer, $110 / hr.

- Junior Designer, $60 / hr.

The Junior Designer costs less hourly. But if you know the Head Designer can create the web pages twice as fast with fewer revisions, it could be a better (and more profitable) use of skills for this project.

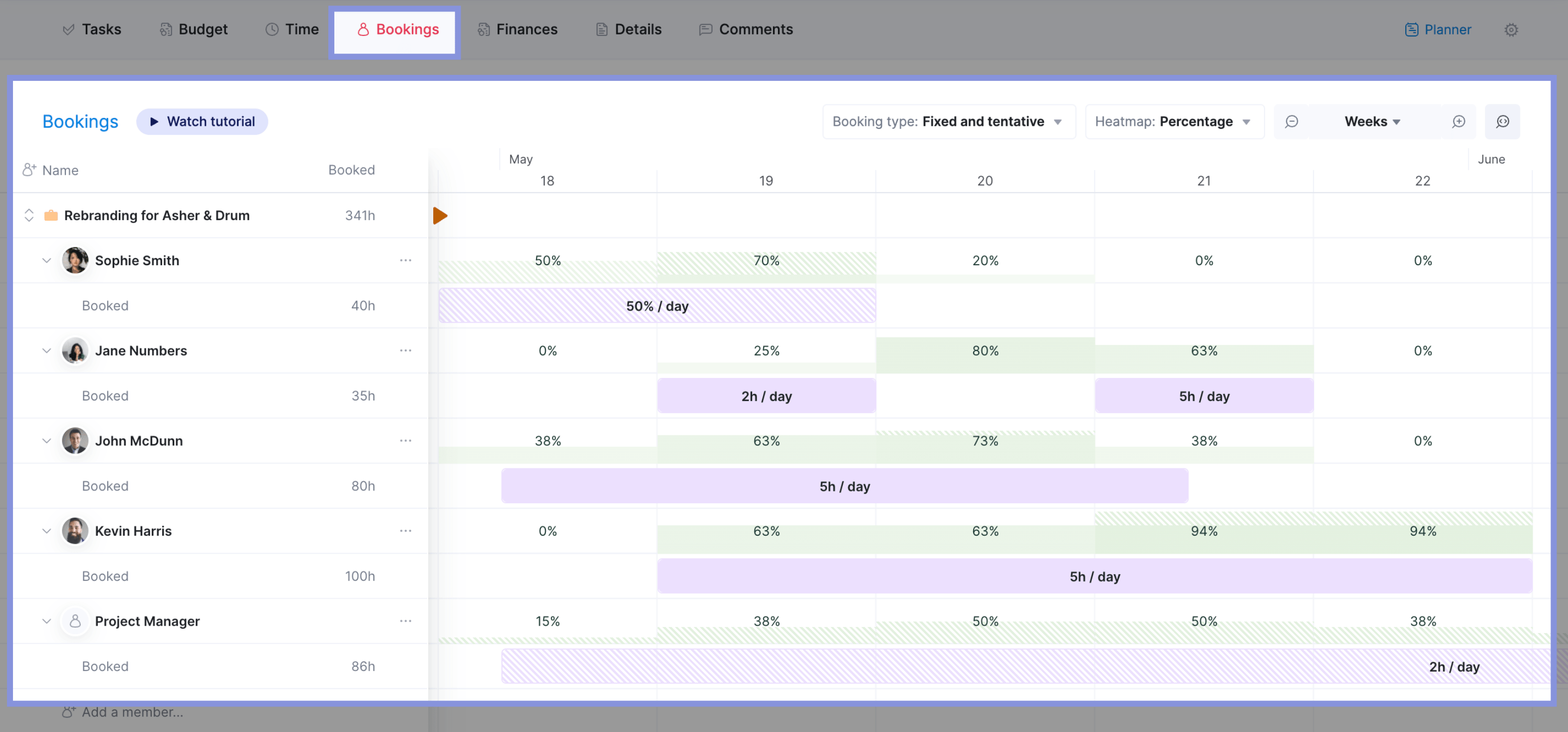

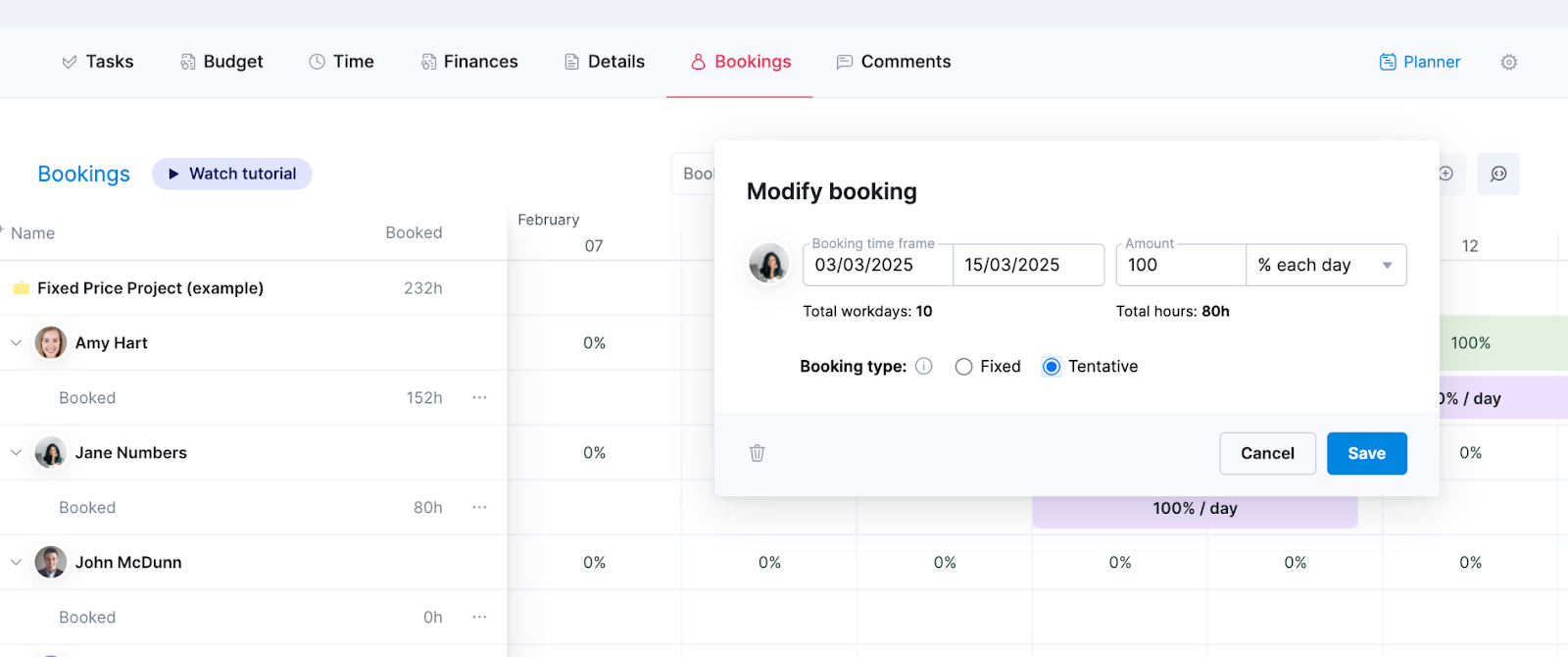

Use Scoro’s “Bookings” tab to reserve time on team member’s calendars as you make your staffing decisions.

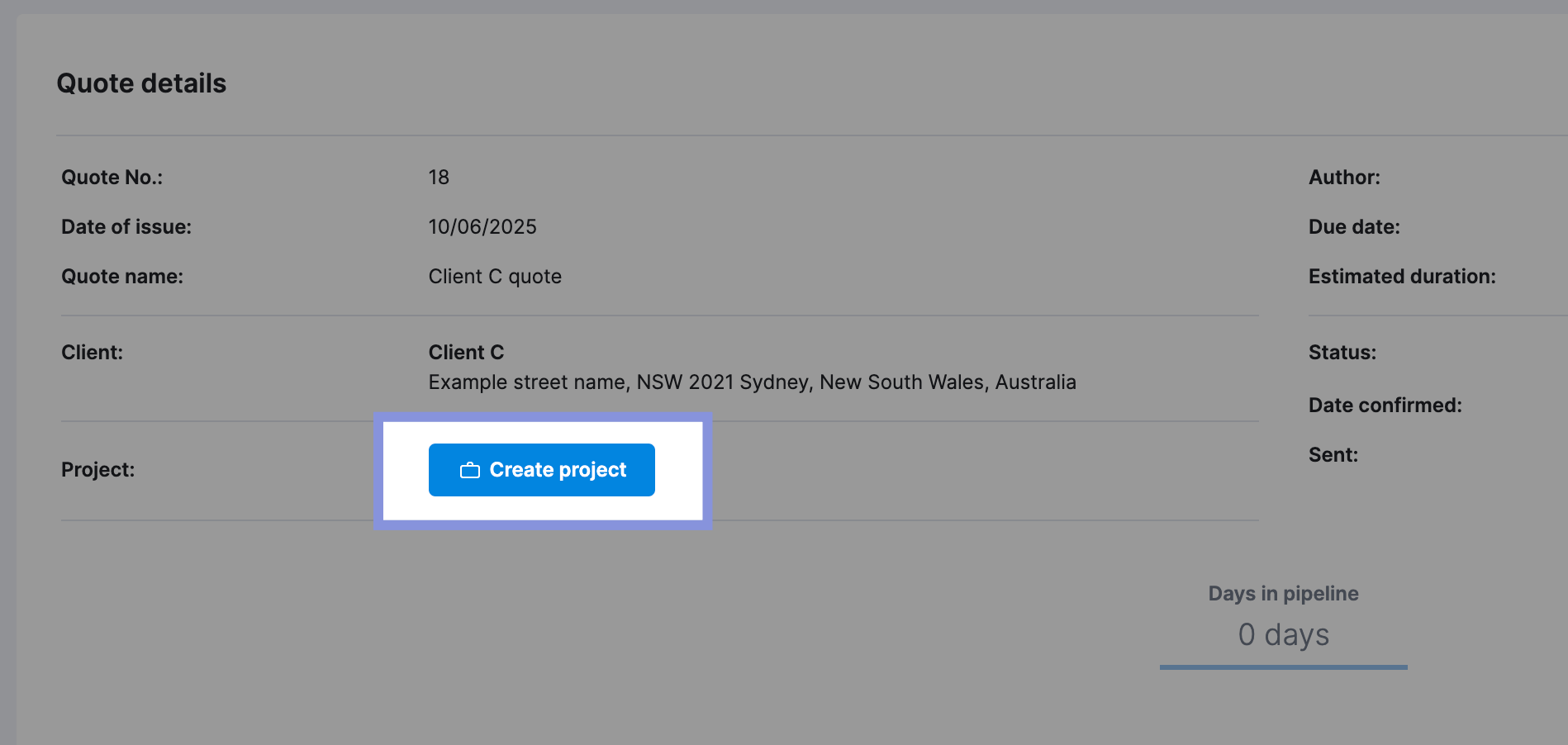

First, turn your quote into a project by clicking “Create project.“

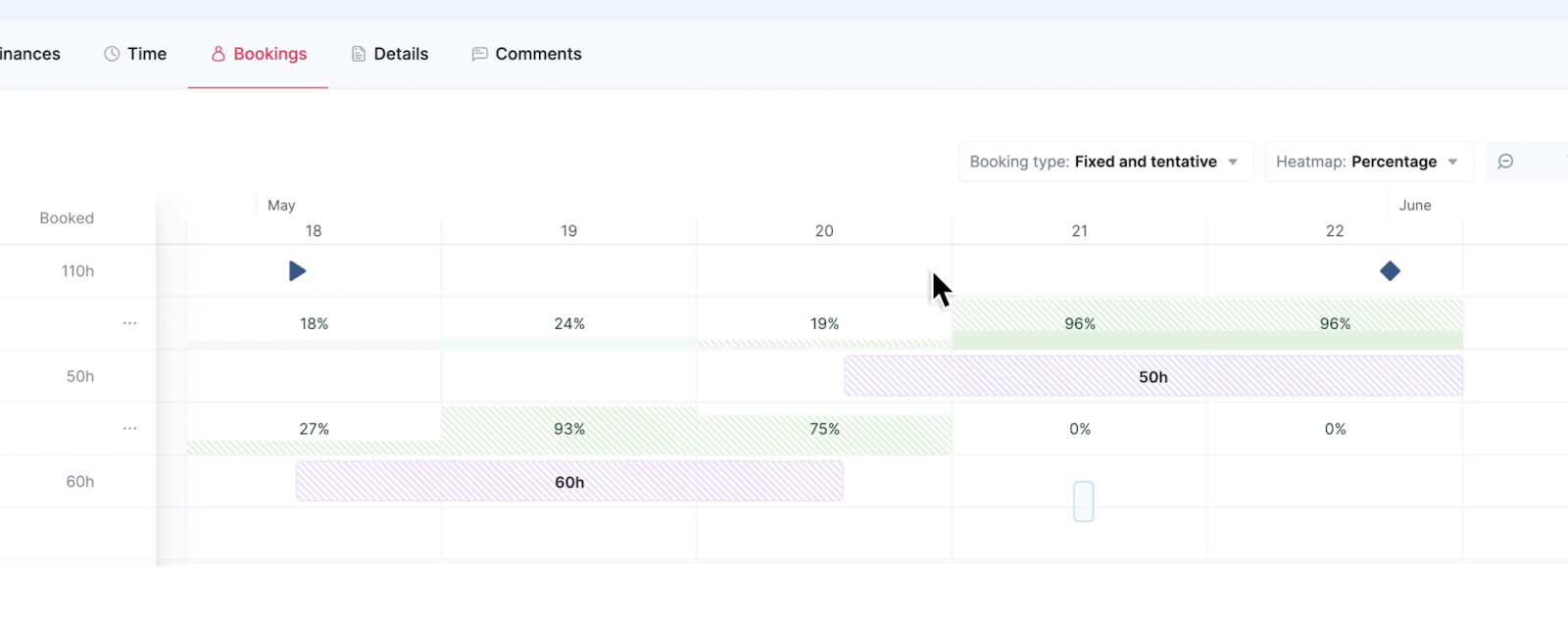

Go to the “Bookings” tab within your project view. Here, you’ll see each project phase represented as a purple bar indicating the estimated number of hours required.

The quoted hours are automatically converted into tentative bookings.

- Green bars represent the overall utilization percentage for each team member or role across all projects.

- Purple bars represent specific bookings for this project. They either show a percentage of time per day or hours per day.

- Solid-colored bars indicate fixed bookings, while striped bars represent tentative bookings

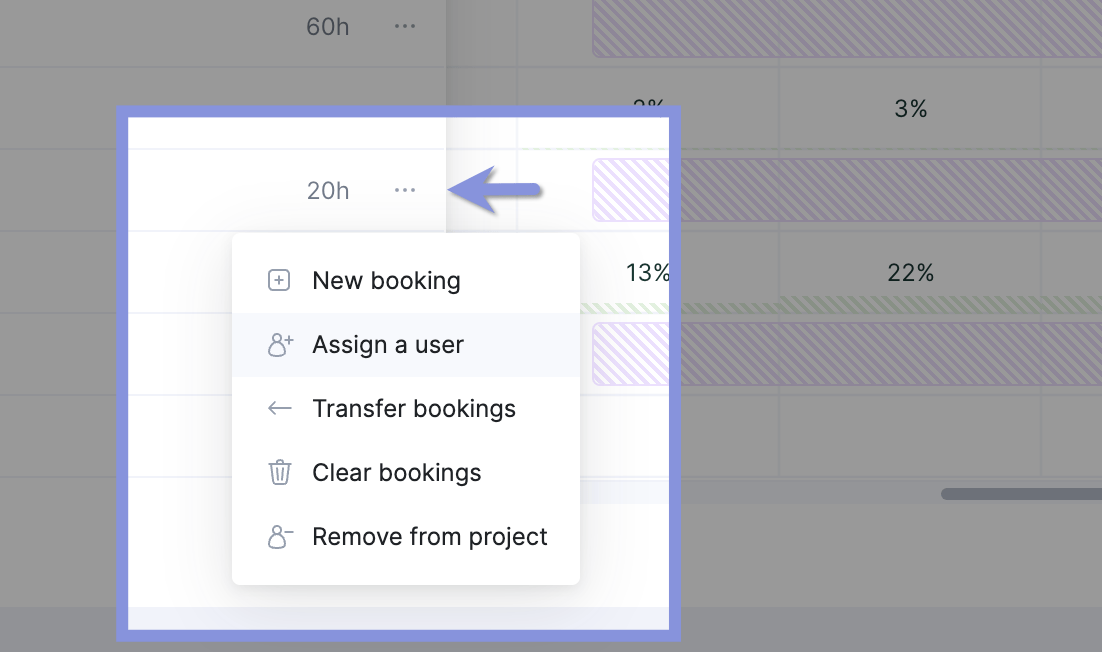

Click the three dots next to a role placeholder booking and select “Assign user.” Choose a team member from the list with the appropriate role and skillset.

Scoro will automatically transfer the placeholder booking to the chosen user, visually updating the heatmap to reflect their updated workload.

This allows you to quickly assess their availability and make any necessary adjustments to the project timeline or resource allocation to prevent delays.

If you need to adjust the timeline of the work, just drag and drop the purple hours bar and see the capacity adjust automatically.

From here, you can add additional team members to the work, or transfer it to someone else to build your team. This ensures you have the right team members available to take on the work.

Click on the bar to adjust the booking from “Tentative” (shaded colored bars) to “Fixed” (filled color bars) to reserve time on that employee’s calendar.

Further reading

Read our guide to resource planning to learn more about assigning the right people to your projects.

3. Set your budget

With your estimate approved and your team in place, it’s time to create your project budget.

This is different from your project estimate. Your estimate is a high-level calculation of costs and resources that helps you and the client determine whether the project is a go.

The project budget is a detailed plan for how the money allocated to the project will be spent.

A budget aims to help you control spending and track your profits. It shows you if and when you’re at risk of excessive spending and why. Think of it as your financial game plan.

In general, there are three main types of budgets:

- Fixed fee: Based on offering the client a flat rate for an agreed-upon scope of work (e.g., $50,000 to redesign the company website). This is best for projects where the scope is definite and you have a team who can efficiently manage the work.

- Time and materials: This is based on hourly rate invoices (e.g., $15,000 for the first 100 hours of work) and the cost of any expenses. It is best for projects with scopes that are more likely to change down the line.

- Retainer: This involves the client paying a recurring fee (often monthly) in exchange for a set amount of work or services. It is best for ongoing work with a predictable workload.

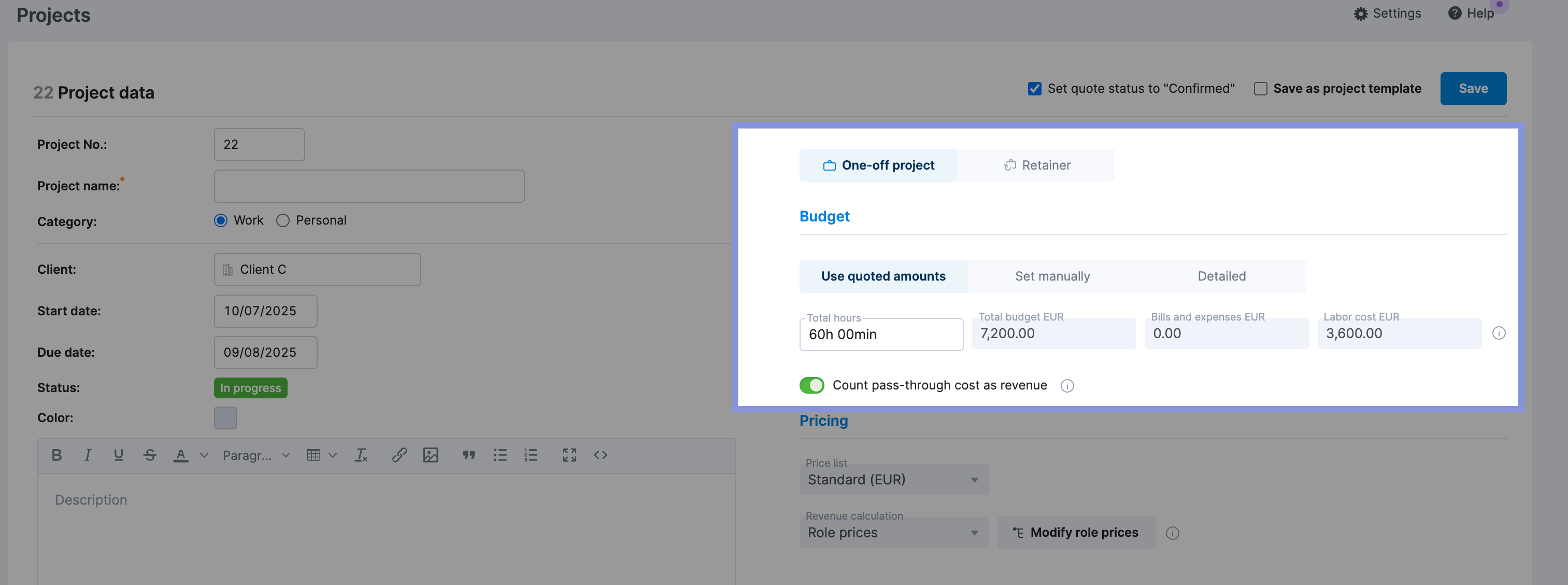

Scoro lets you create any of these budget types directly from your quote.

Go to your approved quote, then click “Create Project.”

The basics will already be pre-filled for you based on the quote. From here, add or adjust relevant project details.

Your budgeted amounts for each phase or deliverable based on the quote are then imported into the “Project” view.

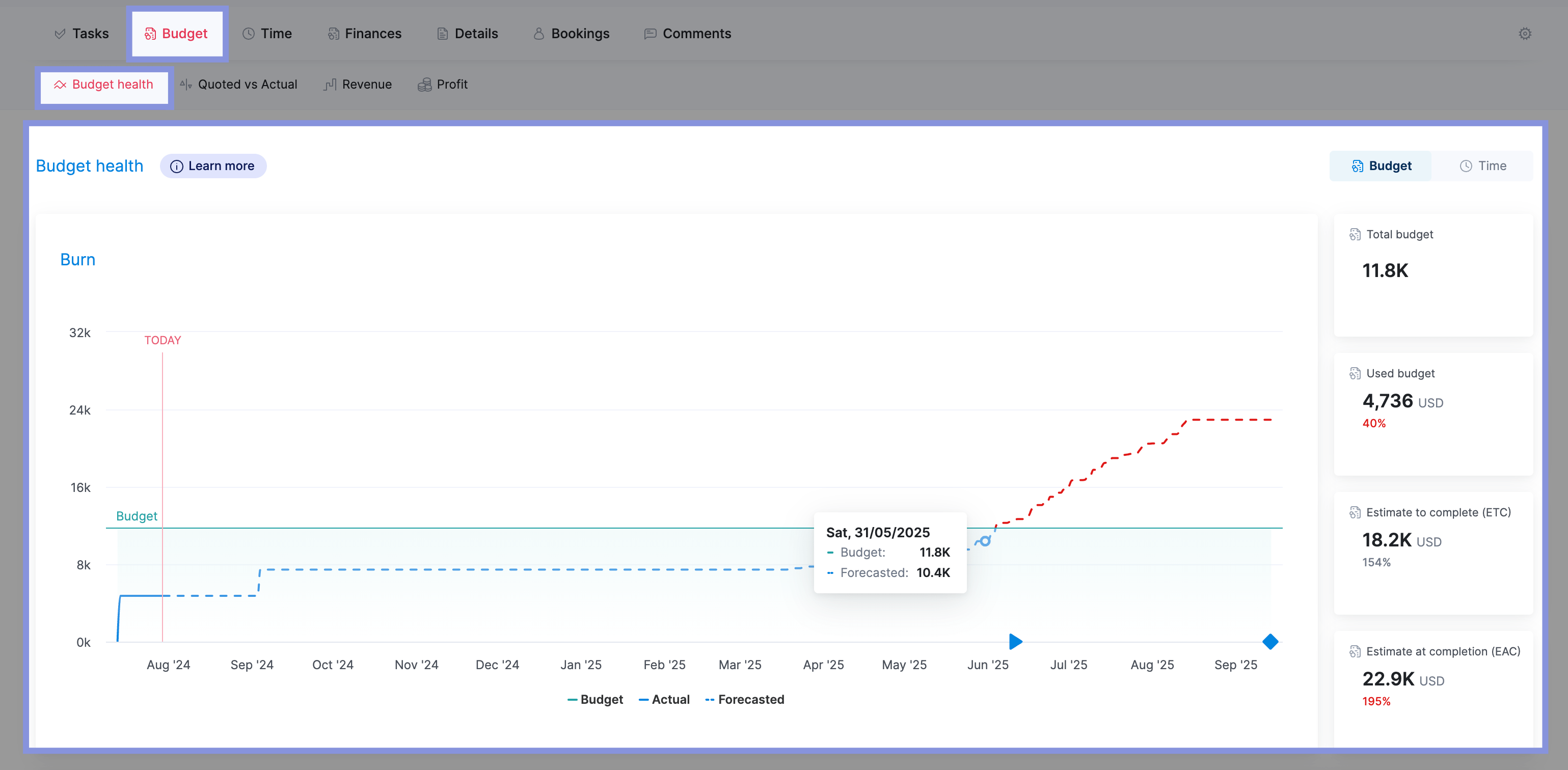

Go to the “Budget” tab, then click “Budget health” to see the “Burn” chart.

It shows the planned budget versus the actual and forecasted spending of a project over time. The report also estimates the total cost at the project’s completion.

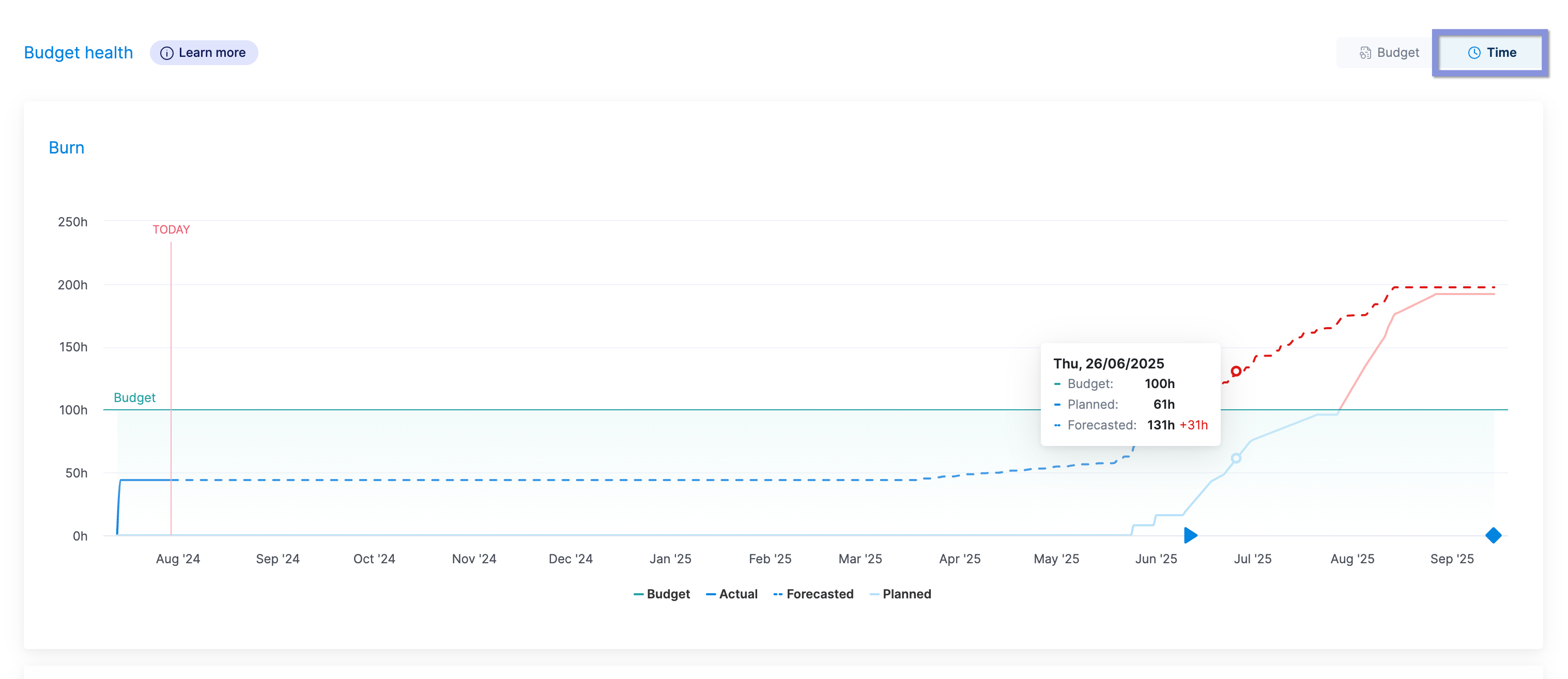

If you click on the “Time” tab, you’ll see a burn-up chart showing the cumulative hours of work planned, the cumulative hours of work completed, and a forecast of the total work hours to be completed over time.

This allows you to track the project’s progress against the planned schedule and see if it’s likely to be completed on time.

Either way, you can track your project’s progress and budget in real-time. If you see that you’re forecasted to go over budget, you can adjust the project’s scope and price with the client or re-assign work to another team member to reduce costs or time.

4. Decide how you’ll monitor project costs as the project progresses

Whether using a fixed fee, time and materials, or a retainer budget, you’ll get the most value from tracking costs throughout the project.

If you create a budget but don’t monitor your real-time spending, it’s hard to tell if you’re overspending or still in the green. Thus, you could easily jeopardize your profit margins without realizing it.

Focus on an approach that lets you easily and accurately:

- Track your actual costs, including internal (labor costs) and external costs (bills and expenses)

- Track time spent on each phase of the project

- Categorize costs by project phase or task

- Measure project costs against budgeted expenses

While tracking costs manually is possible, it’s a huge drain on your time (and brain power).

First, you must collect receipts or expenses from your finance team or finance software (like Quickbooks or Expensify). Then, you have to sort out which expenses are related to your project and categorize them by project phase. Finally, you add up all the costs. And you repeat this process weekly or monthly.

Scoro simplifies things, letting your team track time and expenses automatically and quickly tag them to specific projects, clients, and tasks.

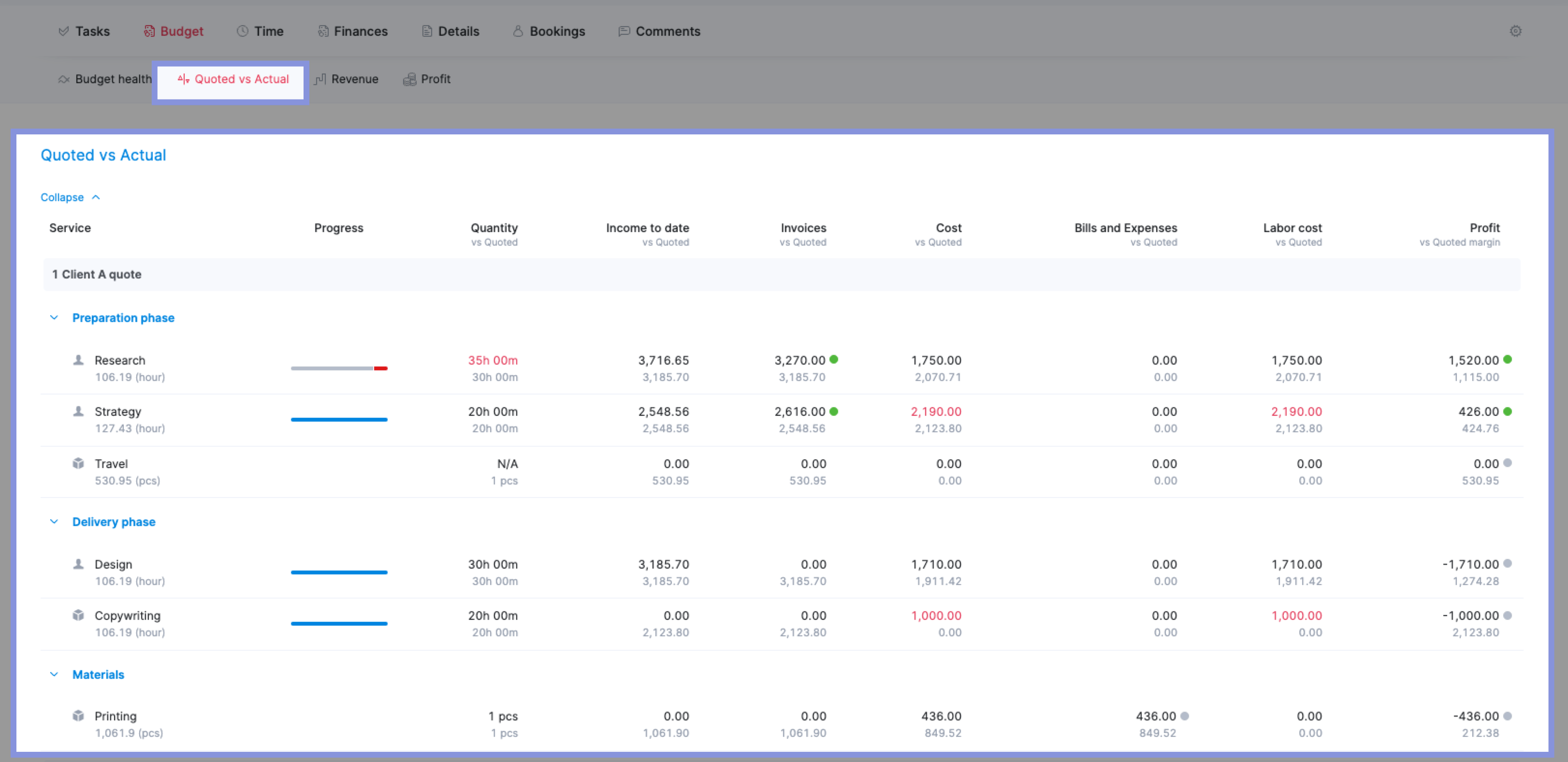

Then, our software takes that data and automatically compares your estimated costs with your actual ones in the “Quoted vs. Actual” table.

Go to the “Project” view, then click the “Budget” tab. There, you’ll find the “Quoted vs Actual” table.

The Quoted number (black text) comes from your initial budget. The actual number (gray text) displays Scoro’s automatic cost calculations for your time and cost entries.

The “Progress” column shows how far along in the phase or deliverable you are.

The blue fill indicates how much work is complete, the yellow shows how much work remains, and the gray shows the remaining time given your estimates. Hover over the progress bar to see each category’s exact hours or percentages.

This way, you get a clear view of project spending compared to your initial budget and planned timeline and can quickly identify any potential issues and where they’re coming from.

For example, you’ll want to investigate if your quoted costs for the Ideation phase are $4,000 but your actual costs are $3,800.

Look at the Progress bar to see how much time you have left for this phase. If the Progress bar is only 50% complete, but you’ve already spent 95% of the budget on that project phase, you’ll know that you’re at risk of running over budget.

From there, you can reassign work to another team member, adjust the project’s scope, or adjust the budget for each deliverable to better match the actual time spent.

Project financial management best practices

Now that you know how to build a project financial management plan, these best practices will help you strengthen your cost estimates and improve profitability:

1. Regularly review and monitor project costs

Tracking your project costs is only helpful when you review them regularly.

For most projects, we recommend reviewing your project costs weekly. However, if you’re working on a project with a longer timescale and less happening week-to-week, monthly may be enough.

The key is to review your costs regularly enough to be able to make changes before you begin overspending. This way, there’s still time to adjust your tactic or scope to keep projects profitable.

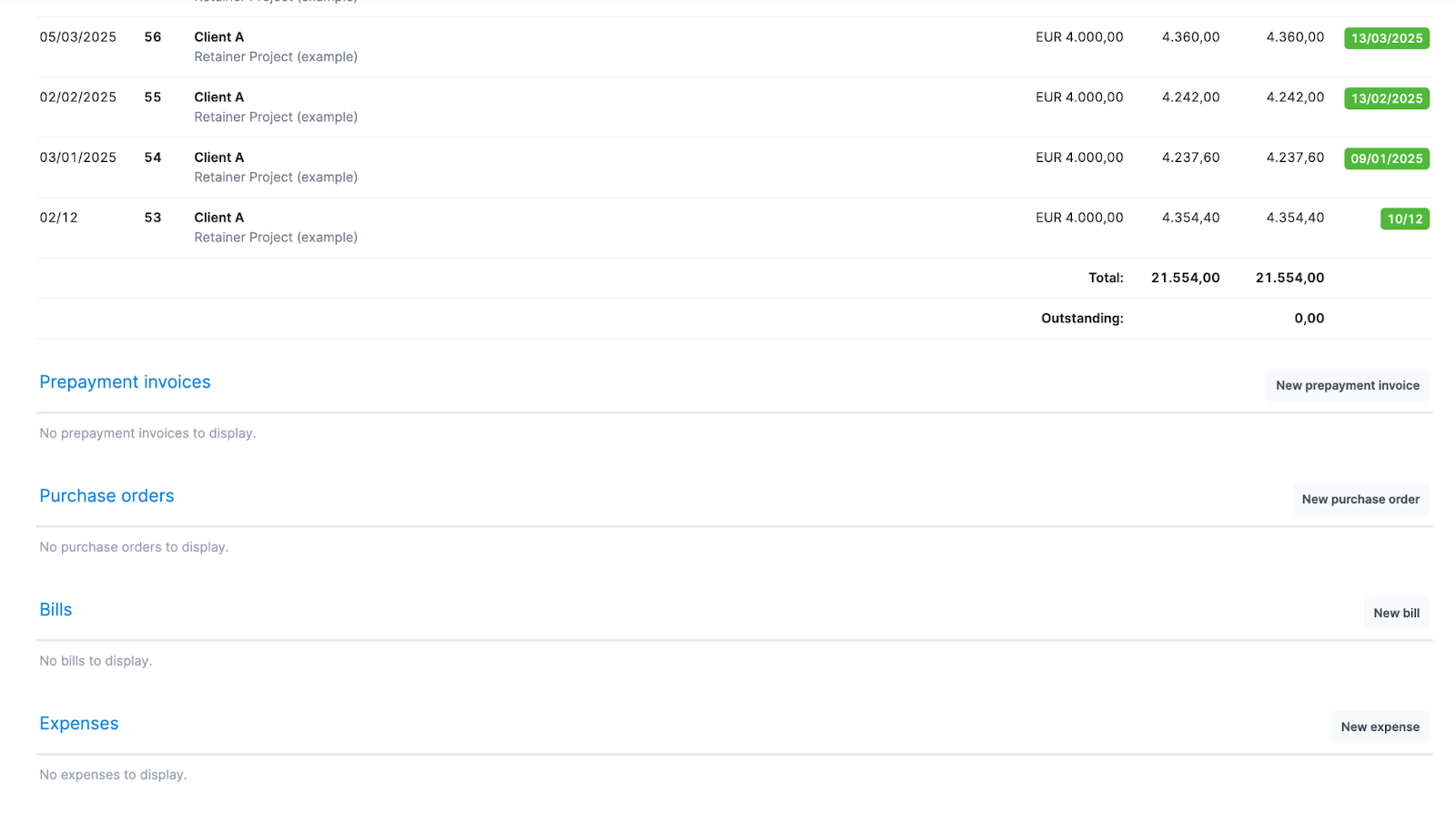

Remember to review external project costs, such as supplier bills and expenses. If you’re using Scoro, monitor them directly from the Project view under the “Finances” tab.

Scroll down to see invoices and quoted amounts. Then, click “New bill” or “New expense” to track external costs.

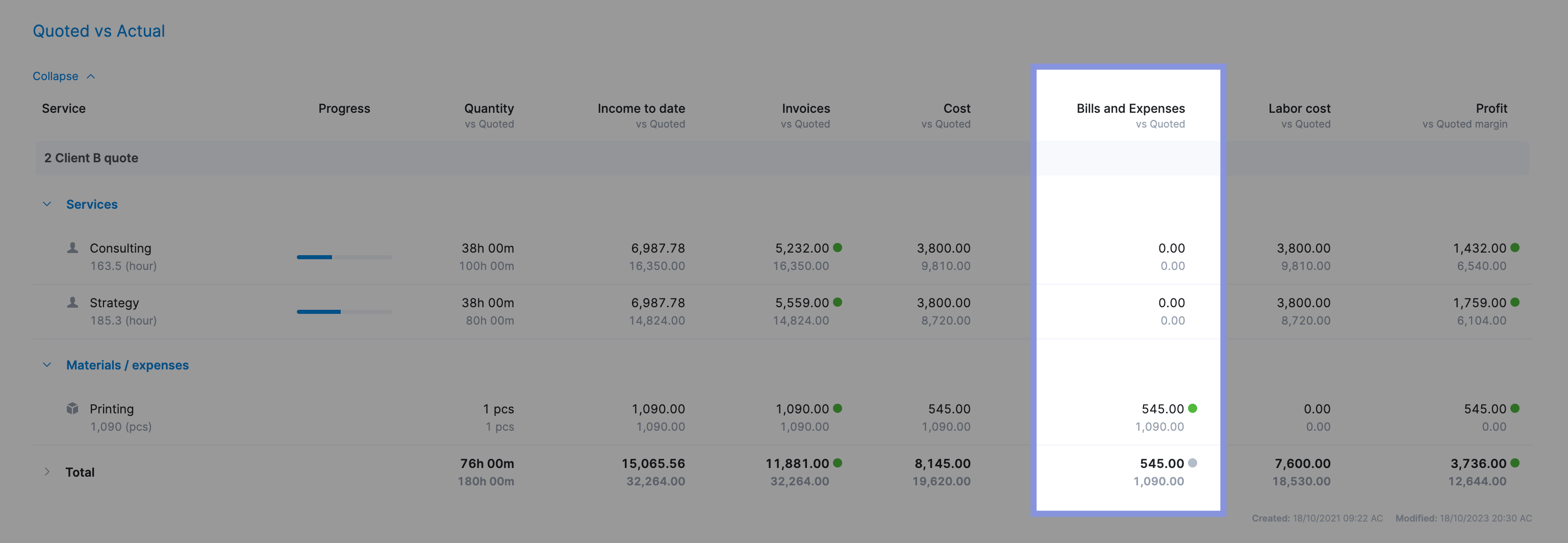

Then, you can also see them reflected in the “Quoted vs. Actual” table under the “Bills and Expenses” column.

2. Analyze completed projects to learn where you went wrong (and right)

Once a project is complete, a postmortem review can help you understand its biggest wins (and mistakes). Apply these practical insights to future projects to strengthen your profits and workflows.

Head back to the “Quoted vs. Actuals” table to look at:

- How much time you scoped for each phase vs. how much time was actually spent on each one

- How much you spent on external costs and how that impacted your final costs

- Which team members were the most and least expensive

- What your overall profit margins were for each phase

For example, if the “Ideation” phase was profitable (e.g. $750 in profit) but the “Delivery” phase was not (e.g., $600 over-budget), you could consider adjustments to future projects like:

- Scoping more time for the delivery phase

- Allocating more of the budget to the delivery phase vs. the ideation phase

- Outsourcing more of the delivery phase work to lower internal labor costs

- Using a different team member for delivery tasks to lower costs or speed up delivery

3. Use historical data when creating cost estimates

If you frequently track and review your completed projects, you’ll accumulate a wealth of historical data to use for future project planning.

For example, let’s say you’re scoping and creating a cost estimate for a website redesign project.

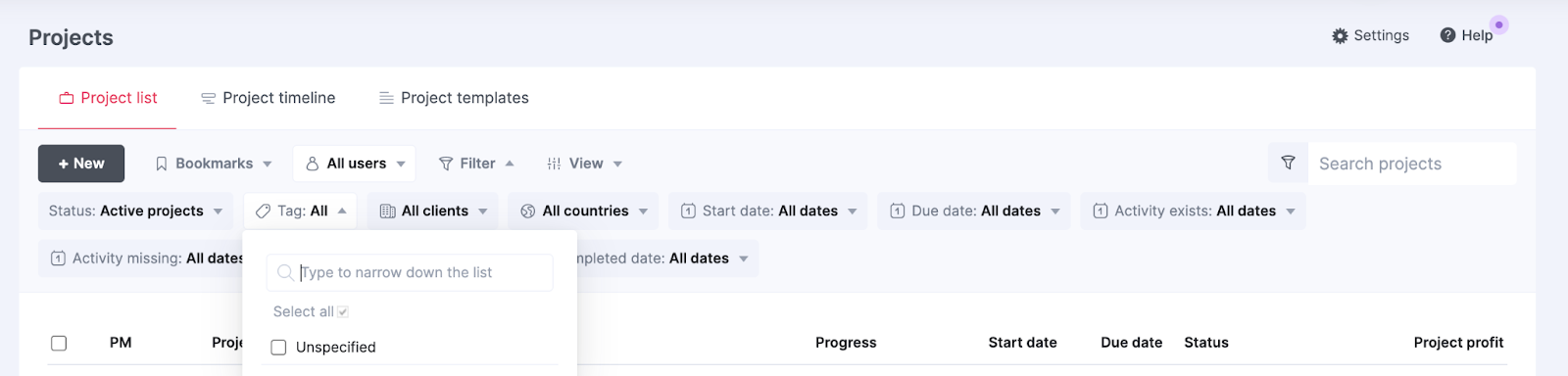

In Scoro, go to the “Projects list” view and use the “Tag” filter or the search bar to find other website or rebranding projects from the past.

Then, click on any of those projects to get historical data on:

- How long each phase of the project took

- Who worked on different deliverables

- What your costs for each phase were

- How profitable the project was overall

This will allow you to create more accurate cost estimates for future projects by using real, tracked data instead of best-guess estimates. Making it easier to quote and deliver profitable projects.

4. Add a contingency fund to your project

A contingency fund reduces the risk of going over budget. It serves as a “buffer” that factors in potential scope creep, delays, or other issues that can impact project finances.

It doesn’t prevent these things from happening. But it minimizes their effect if they do happen because you have a safety net of additional funding built in from the start.

In general, a contingency fund of 20% of your project budget is a good starting place.

You can build this into each phase of your project estimate and budget, or write it in as a separate line item.

For example, if you estimate that the “Ideation” phase of your project will take 50 hours, you might put in 60 hours for it on your estimate as a 20% contingency.

You can estimate each phase of your project and then use a separate “Contingency Fund” line item to add 20% of the entire estimate.

If you use a separate line item, it can help signal to the client that changes in scope may incur additional costs and make the client more aware of changing the scope.

5. Add project and account management fees to your quote

Budget 15% to 25% of your total project time for project and account management, including:

- Client meetings

- Admin work

- Planning and scheduling project work

- Analyzing project data

- Monitoring project performance and execution

This work takes up a significant part of the project, yet it’s often underestimated and overlooked in estimates.

The result?

Your project goes over budget without you even realizing it.

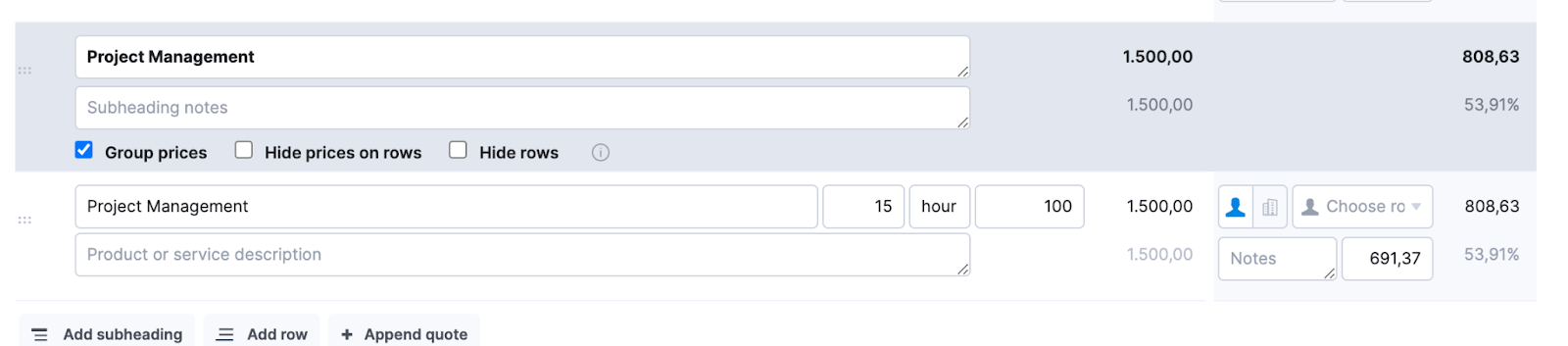

To avoid this, add an additional line item to your quotes that accounts for “Project Management.” If you’ve budgeted 100 hours for the total project, your project management line should budget 15-25 hours.

Then, assign the project management row to your project manager role, or even the specific PM who will be managing the project. Scoro will automatically calculate their labor rate based on the estimated hours, and add this total cost to your scope and budget.

This transparency also helps clients know where their budget is going and emphasizes the time and effort you’ll put into the partnership.

Streamline project financial management with Scoro

Mastering project financial management, from creating accurate estimates to monitoring costs, is key to maintaining profit margins and keeping clients happy.

And Scoro makes it simple to monitor costs across all your projects. Keep an eye on individual ones with our Quoted vs. Actuals table. And use the Project List view to see what’s happening across the board.

This way, you can identify big-picture financial trends and problems that need to be addressed. And use it as a frame of reference to monitor your cost management progress.

See how one consulting agency used Scoro’s project budgets to track costs, avoid overservicing and improve profit margins.

Then, try it out for yourself — sign up for our 14-day free trial and streamline your project financial management.