The lifeblood of any project is its profitability. And calculating project profitability doesn’t have to be complicated.

Here’s how to easily calculate profitability in five steps:

1. Determine the project’s total revenue

This part is usually the easiest. Your project revenue is simply the amount your client will pay you.

So, if your company charges them $20,000 for an ad campaign, that’s your project revenue.

Scoro, an end-to-end project management tool, makes it easy to monitor your project revenue.

Here’s how:

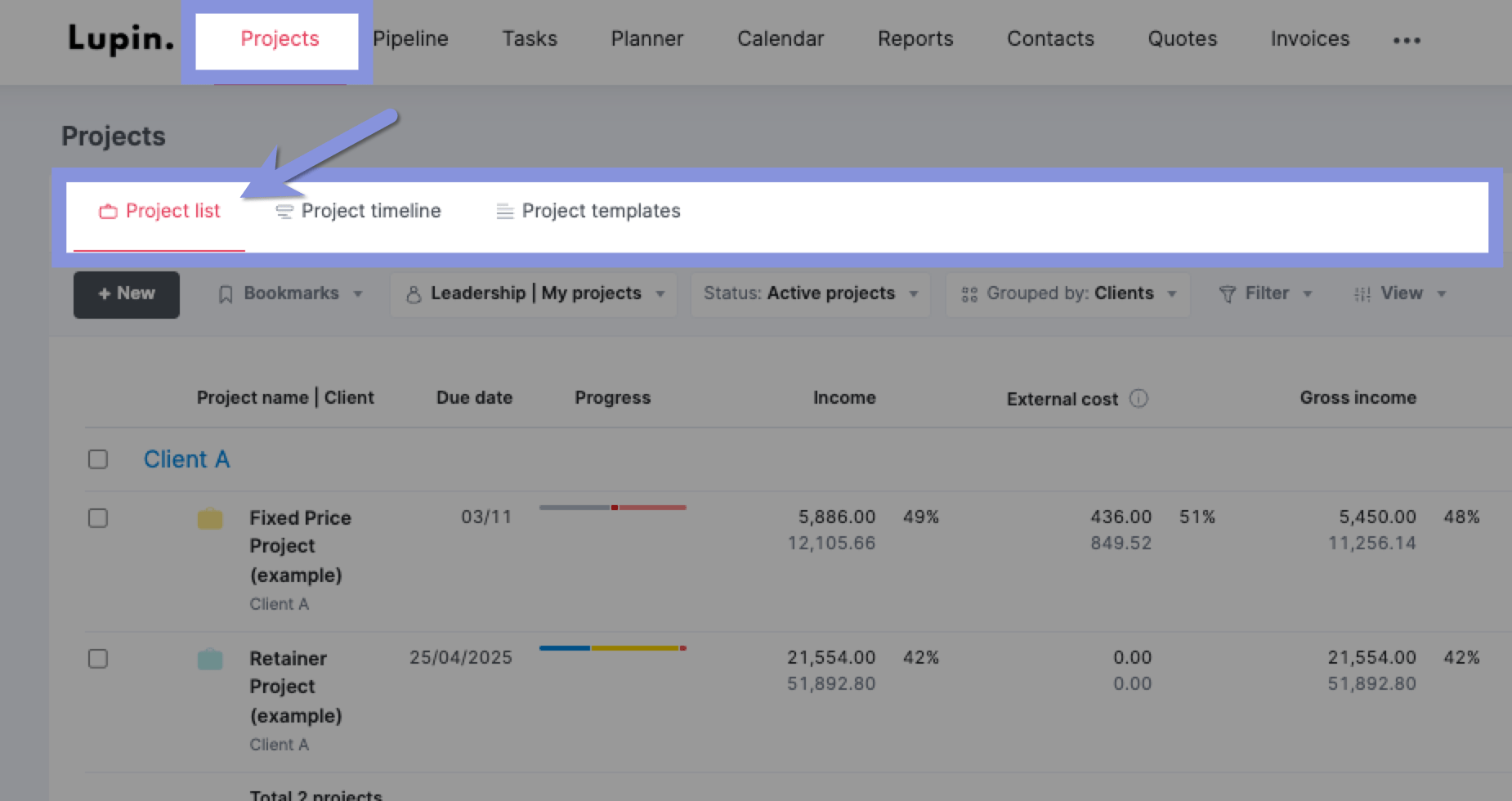

Go to the “Projects” module and click the “Project list” tab.

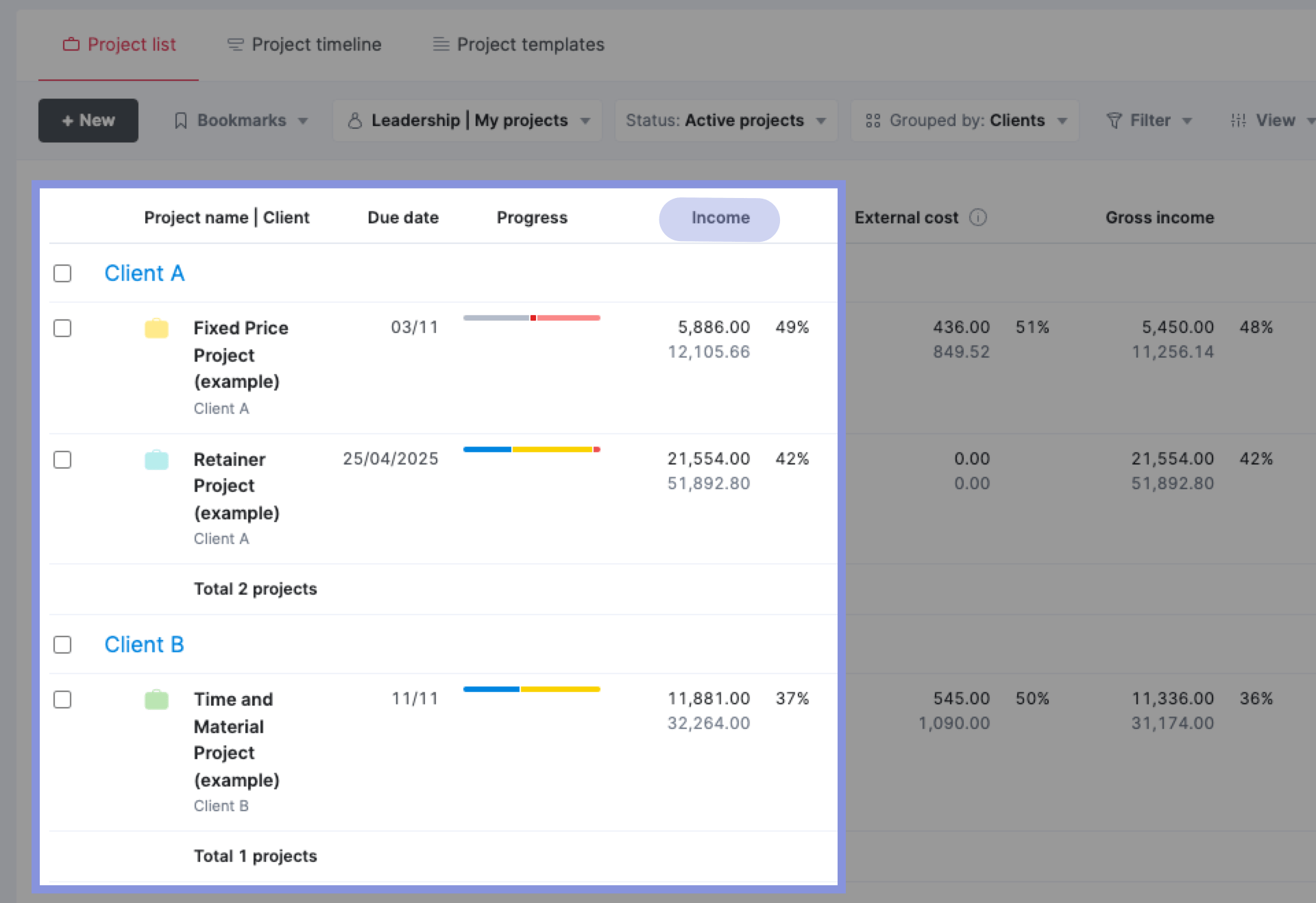

Then, look at the “Income” column. It’ll show your estimated revenue (in gray) and actual revenue (in bold) based on invoices and client payments.

2. Add up direct project costs

Now that you know your revenue, it’s time to tackle the other side of the profitability equation: costs.

Start by calculating all the direct costs your company will incur to deliver the project.

These are the expenses directly tied to delivering the project, including:

Labor costs

Multiply each team member’s estimated hours by their hourly rate to calculate their individual labor cost.

First, list all employees and contractors assigned to the project. Then, identify their hourly labor rate.

For full-time employees, add up their:

- Annual salary

- Training costs

- Equipment costs

Then, divide by 2,080 (40 hours a week x 52 weeks) to get their hourly labor rate.

Working with contractors? Multiply their hourly rate by the number of hours they’ll be working. Add this to the total labor cost for employees.

Repeat for each employee. Then, add up the costs to get your total labor cost.

Here’s what it looks like in practice:

List all employees and contractors assigned to the project:

- Employee A (Project Manager)

- Employee B (Designer)

- Contractor C (Developer)

Determine each employee’s hourly labor rate:

- Employee A: ($80,000 salary + $2,000 training + $1,500 equipment) / 2,080 = $40.14/hour

- Employee B: ($60,000 salary + $1,500 training + $2,000 equipment) / 2,080 = $30.53/hour

Use the contractor’s hourly rate:

- Contractor C: $100/hour

Multiply each person’s hourly rate by their projected hours on the project:

- Employee A: $40.14/hour x 200 hours = $8,028

- Employee B: $30.53/hour x 150 hours = $4,579.50

- Contractor C: $100/hour x 100 hours = $10,000

Then, add up all the individual labor costs.

Which gives you something that looks like this:

| Team member | Hourly rate | Estimated hours | Total cost |

|---|---|---|---|

| Employee A (Project Manager) | $40.14 | 200 | $8,028 |

| Employee B (Designer) | $30.53 | 150 | $4,579.50 |

| Contractor C (Developer) | $100 | 100 | $10,000 |

| Total labor cost | $22,607.50 |

Expenses

Expenses are usually one-off purchases your team members make to complete a project, such as client lunches or business travel.

Estimate your expenses before a project begins by:

- Analyzing past projects of similar scope and size to identify typical costs

- Identifying anticipated expenses with team members and clients

- Creating a detailed budget for each expense category (e.g., travel, meals, supplies)

Here’s an example:

Travel: Two team members meeting with a client at their main office

- Flights: $800

- Hotel (Two nights): $600

- Ground transportation: $200

- Total travel expenses: $1,600

Client lunches: Four lunches during project kickoff and review meetings

- Average cost per lunch: $100

- Total client lunch expenses: $400

Software licenses: Two new design software licenses needed

- Cost per license: $250

- Total software expenses: $500

After adding these estimated expenses, the total would be $2,500 ($1,600 + $400 + $500).

Bills

Now, figure out how much you’ll spend paying external suppliers.

Say you’re working on a website redesign project that requires these external resources:

- Outsourced copywriting: $2,000 for 10 pages of content

- Freelance developers: $4,000 at $200/hour

In this example, the total bills would be:

- $2,000 + $4,00 = $6,000

Now, let’s add up the labor costs, expenses, and bills to get the total projected direct costs for the project:

- Labor costs: $22,607.50

- Expenses: $2,500

- Bills: $6,000

Total projected direct costs = $22,607.50 + $2,500 + $6,000 = $31,107.50

Congrats—you made it through a lot of math!

If you’d rather skip the calculations, Scoro automatically calculates labor costs, bills, and expenses in one place.

Here’s how:

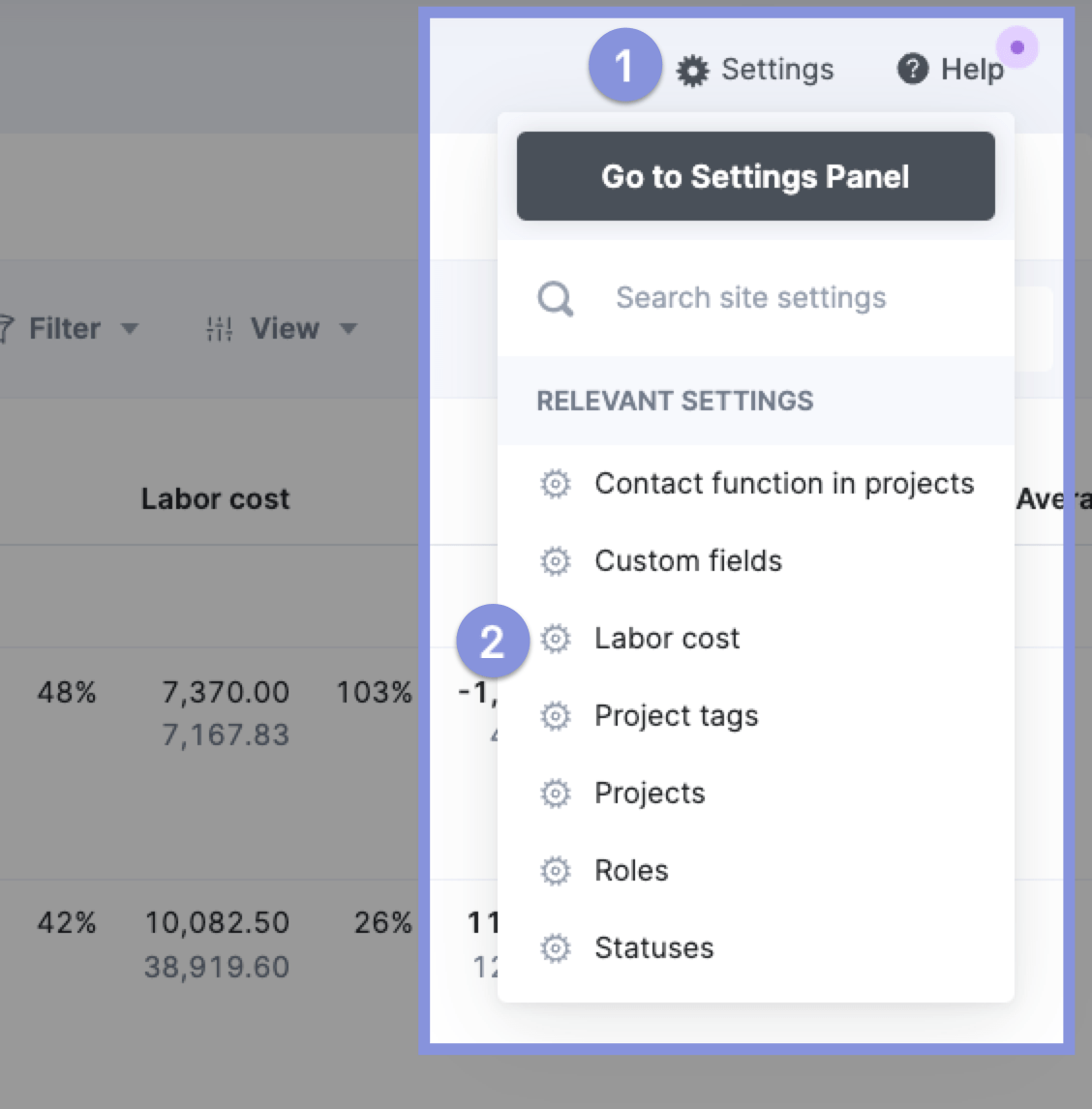

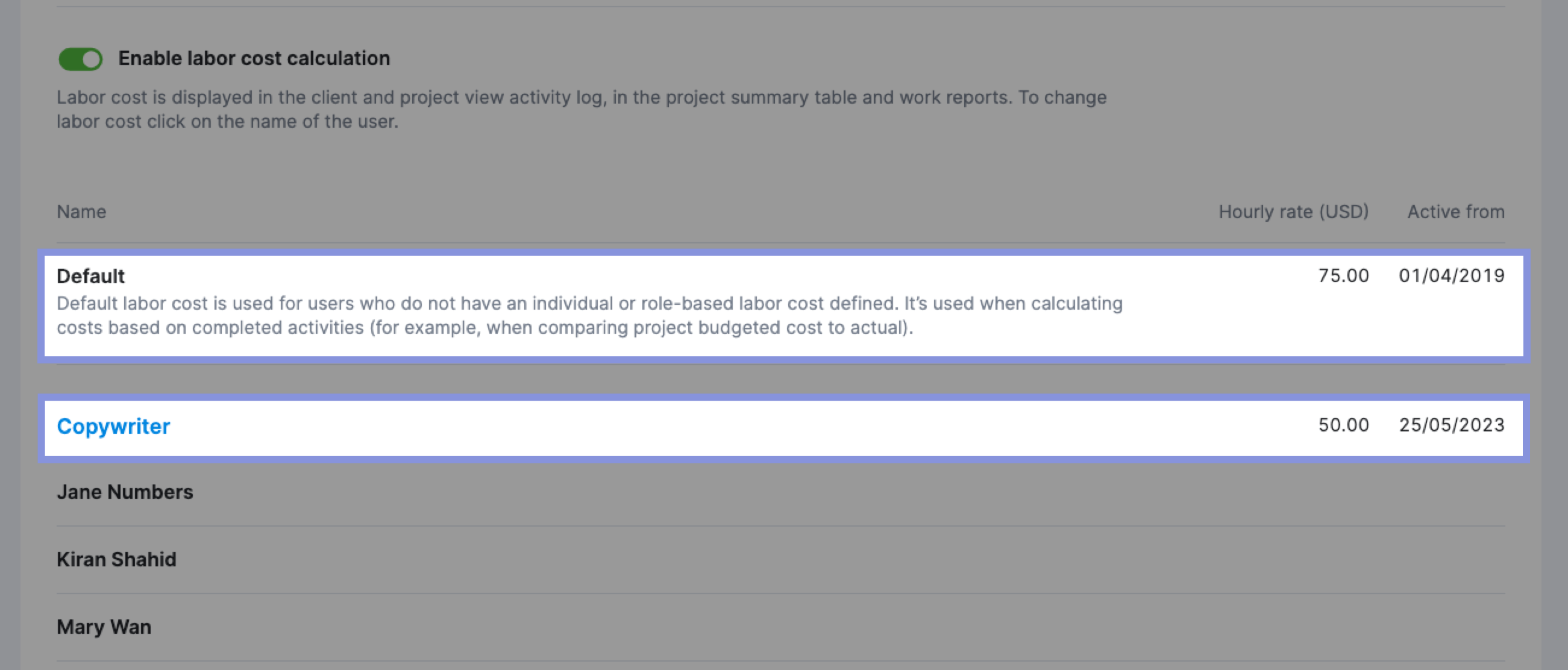

First, click “Settings” in the top right-hand corner and then “Labor cost.“

You can either set a default labor rate for users without a defined role within your team or for specific roles.

You can also set a specific labor rate for each user by clicking on their name. In the “Active from” field, you can set a specific date when the rate becomes active.

Next, you want to ensure that expenses correspond to the right project. Misallocating or overlooking expenses can skew financial data.

The result? Misinformed decisions about which projects to pursue or pass up.

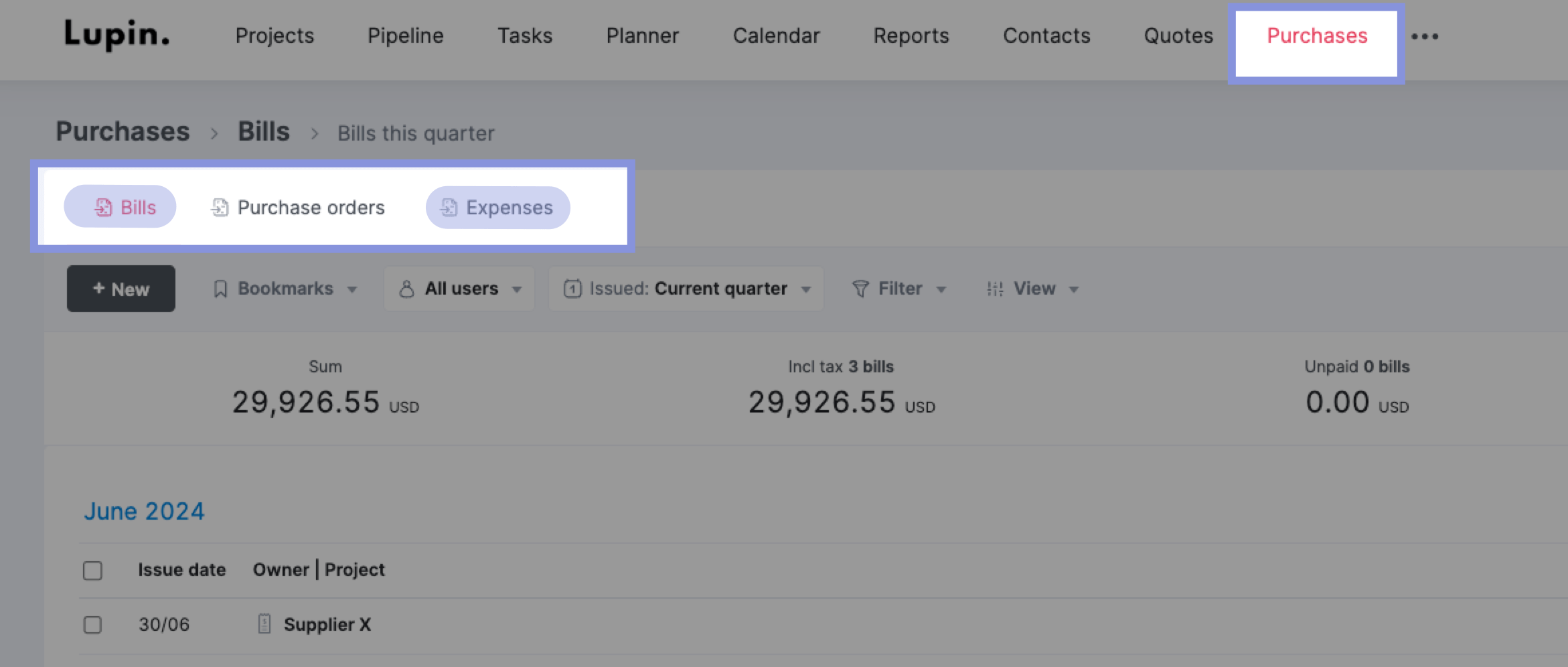

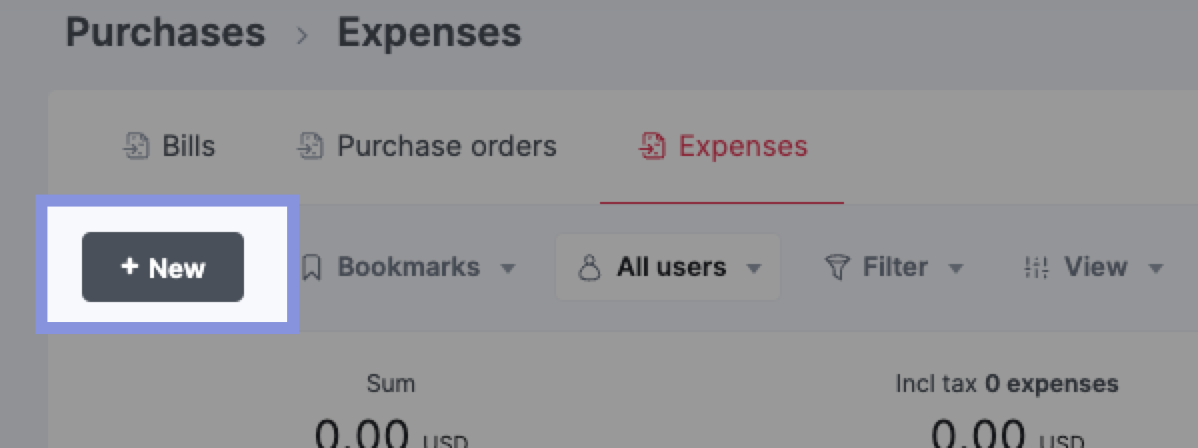

In Scoro, click on the “Purchases” module and then select either “Bills” or “Expenses” to log an external cost.

Click “+ New.”

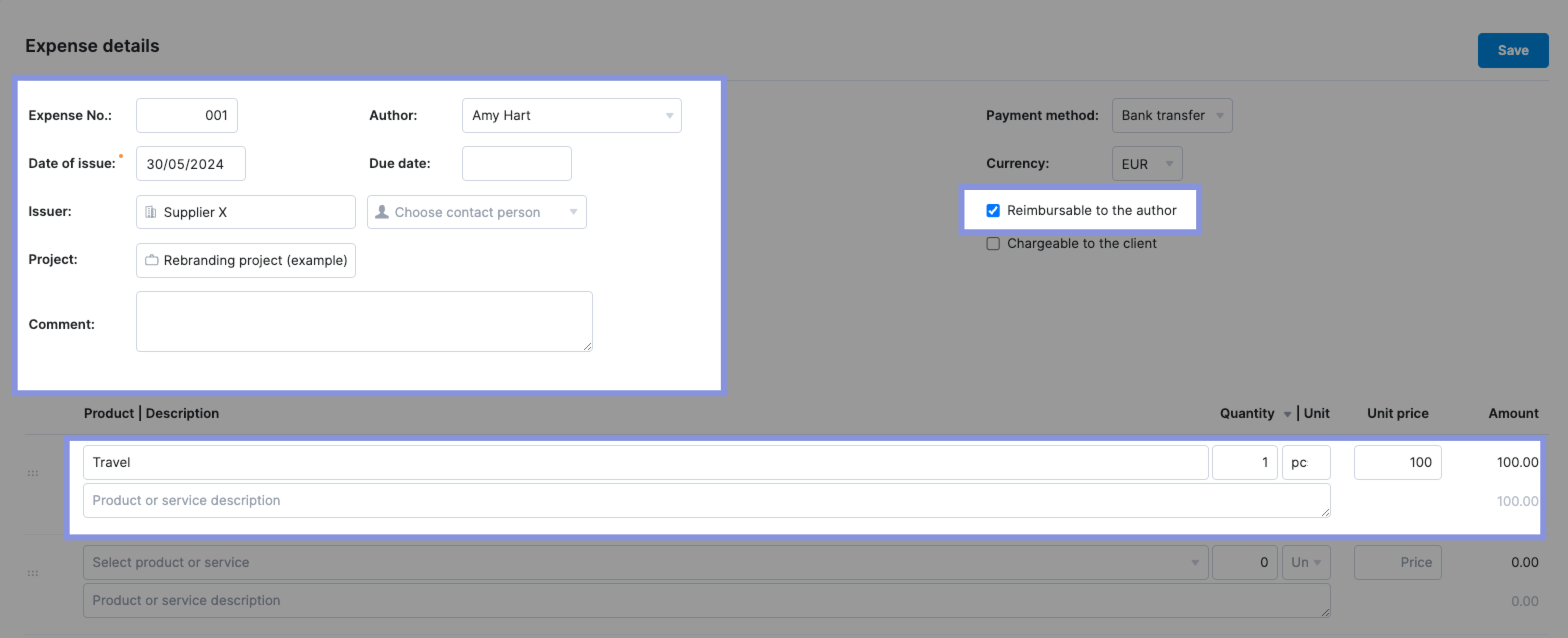

Next, fill in the relevant details for the expense. If any team member initially covered the expense with personal funds, mark it as reimbursable.

Top Tip

If your business uses Expensify, you can sync your data with Scoro to avoid duplicate work and save time. Scoro integrates with Expensify to automatically link expenses to the relevant project.

Lastly, Scoro can also help you track all supplier bills (invoices you receive from your suppliers) using the “Purchases” tab.

If you’ve already estimated the supplier fee when estimating the cost of your project, you can use the data on your quote to automatically generate a bill.

Head to “Quotes” and scroll down. Select “Use data on quote to…” and then select “Create bill.”

Scoro will then use the details from the quote to populate fields in the “Bill” window.

Top Tip

Scoro also integrates with accounting software like Quickbooks and Xero to automatically import real-time invoices.

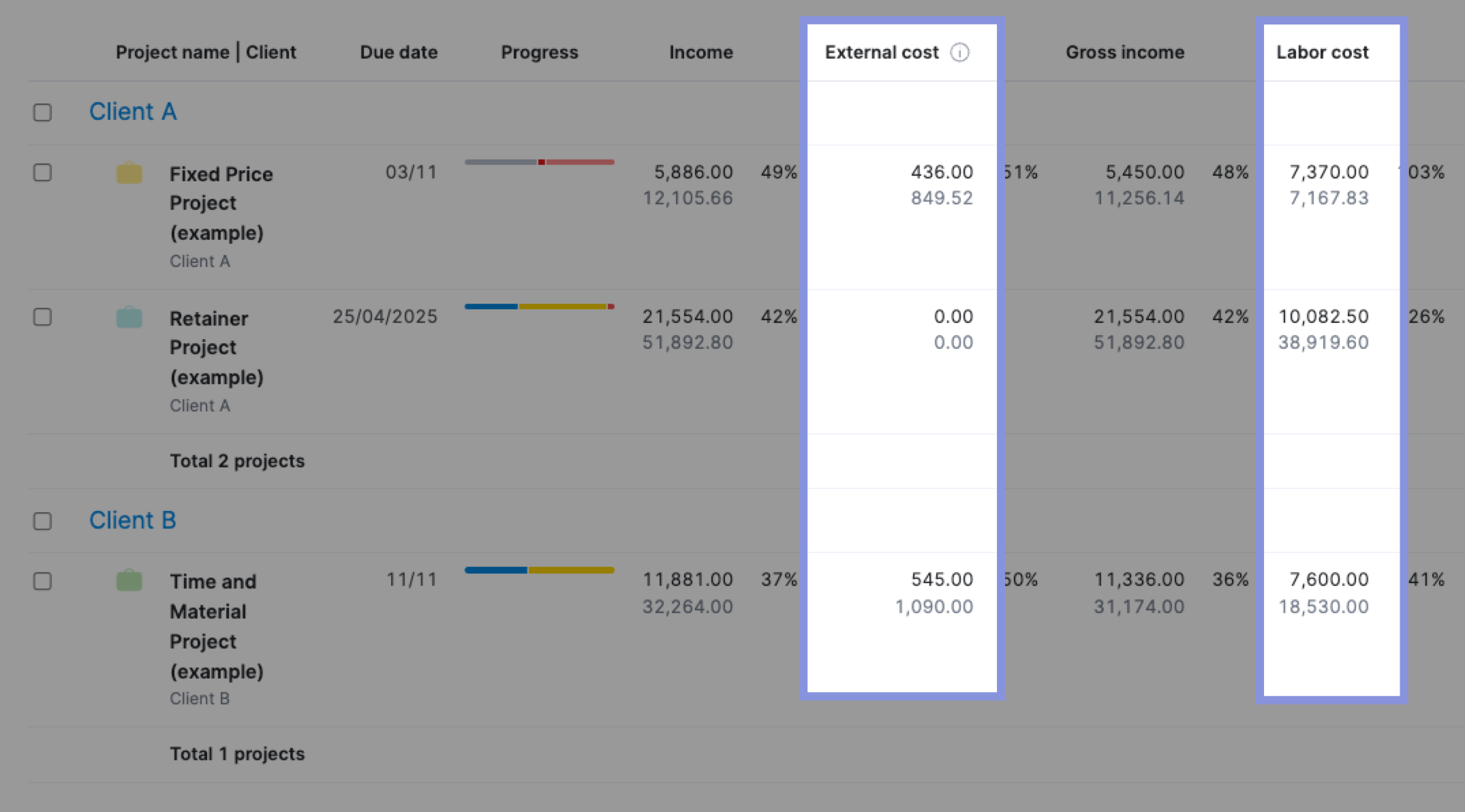

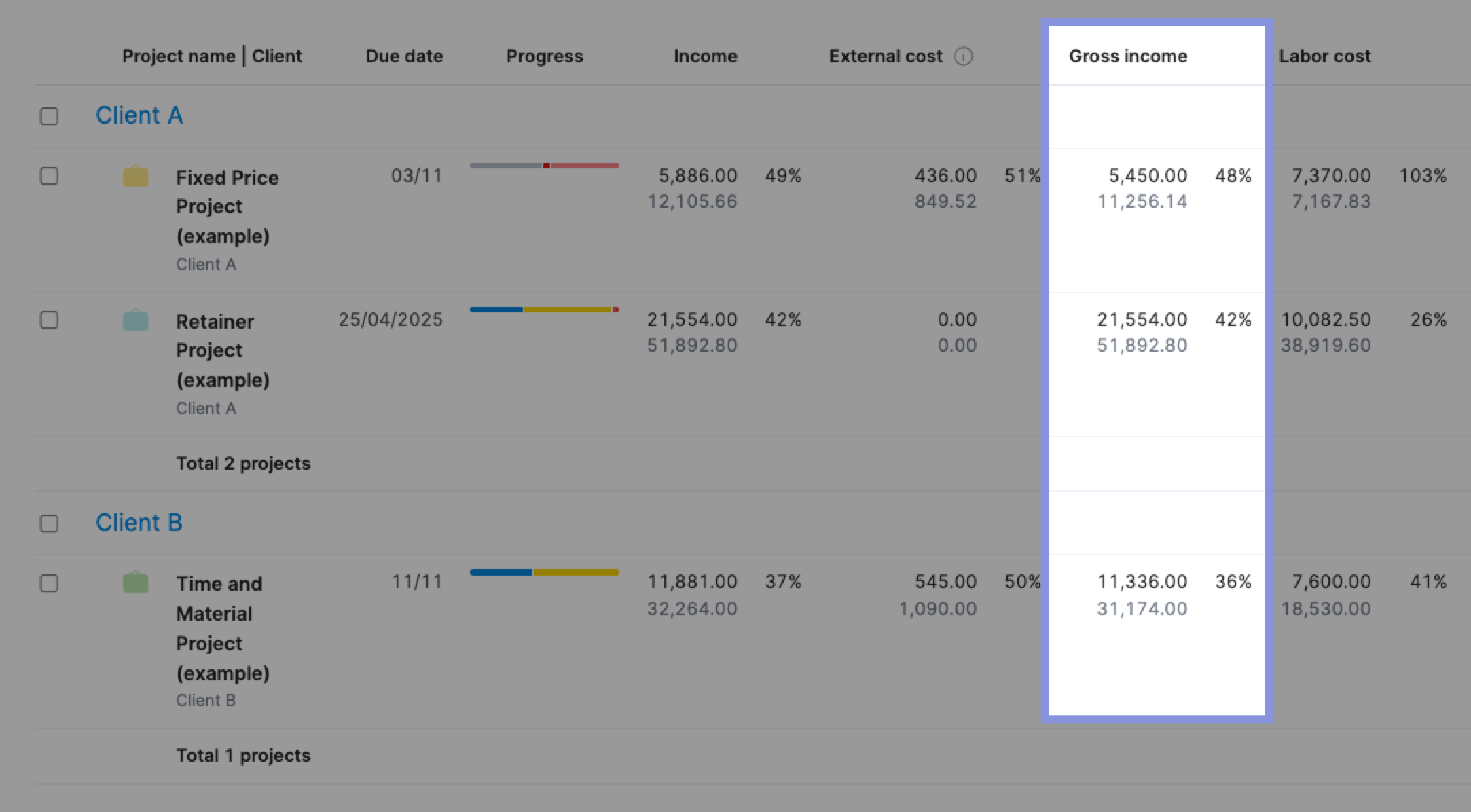

Scoro’s “Project list” view displays labor costs, expenses, and bills together.

To access it, click “View” > “Data columns” and select “Labor cost” and “External costs.“

Note: “External costs” in Scoro include both bills and expenses for each project.

You will then see each project’s total external costs (bills and expenses) and labor costs.

Further Reading: Project Cost Estimation: A Guide to Quoting Profitable Projects

3. Calculate your gross profit

Now, subtract your external costs (bills and expenses) from your project revenue to calculate the gross project profit.

Gross profit reveals the raw profitability of your project, independent of labor costs and other operational expenses. It’s the revenue remaining after covering the direct costs of delivering the project – expenses and bills.

Simple formula:

Gross Profit = Total Revenue – (Expenses + Bills)

Suppose your project generates $50,000 in revenue, with $2,500 in expenses and $6,000 in bills. The external costs in this scenario are $8,500 (expenses + bills).

Your gross profit would be $41,500 ($50,000 – $8,500).

Not including labor costs gives you a clearer picture of your project’s fundamental profitability and whether it generates enough revenue to cover its labor costs.

If gross profit is low or negative, your pricing might be too low or your expenses too high for the scope of work.

In Scoro, you can add the “Gross Income” column to your “Project list” view to see the gross profit for each project.

4. Calculate your project profit

After calculating gross profit, factor in labor costs and determine your project’s net profit. This metric reveals the actual profit your business earns after all costs, including labor, have been accounted for.

The project profit formula:

Project Profit = Gross Profit – Labor Costs

Let’s revisit our previous example:

- Total Revenue: $50,000

- Expenses: $2,500

- Bills: $6,000

- Labor Costs: $20,000

First, calculate Gross Profit: $50,000 – ($2,500 + $6,000) = $41,500

Then, calculate Project Profit: $41,500 – $20,000 = $21,500.

Project profit is the ultimate measure of your project’s financial success. It tells you the exact amount of money your business has earned after all expenses have been paid.

This information is crucial for:

- Assessing overall profitability: Understand how much each project contributes to your bottom line after accounting for all costs.

- Evaluating project performance: Compare the profitability of different projects to identify which ones are most successful.

- Making informed decisions: Use project profit data to guide future project selection, resource allocation, and pricing strategies.

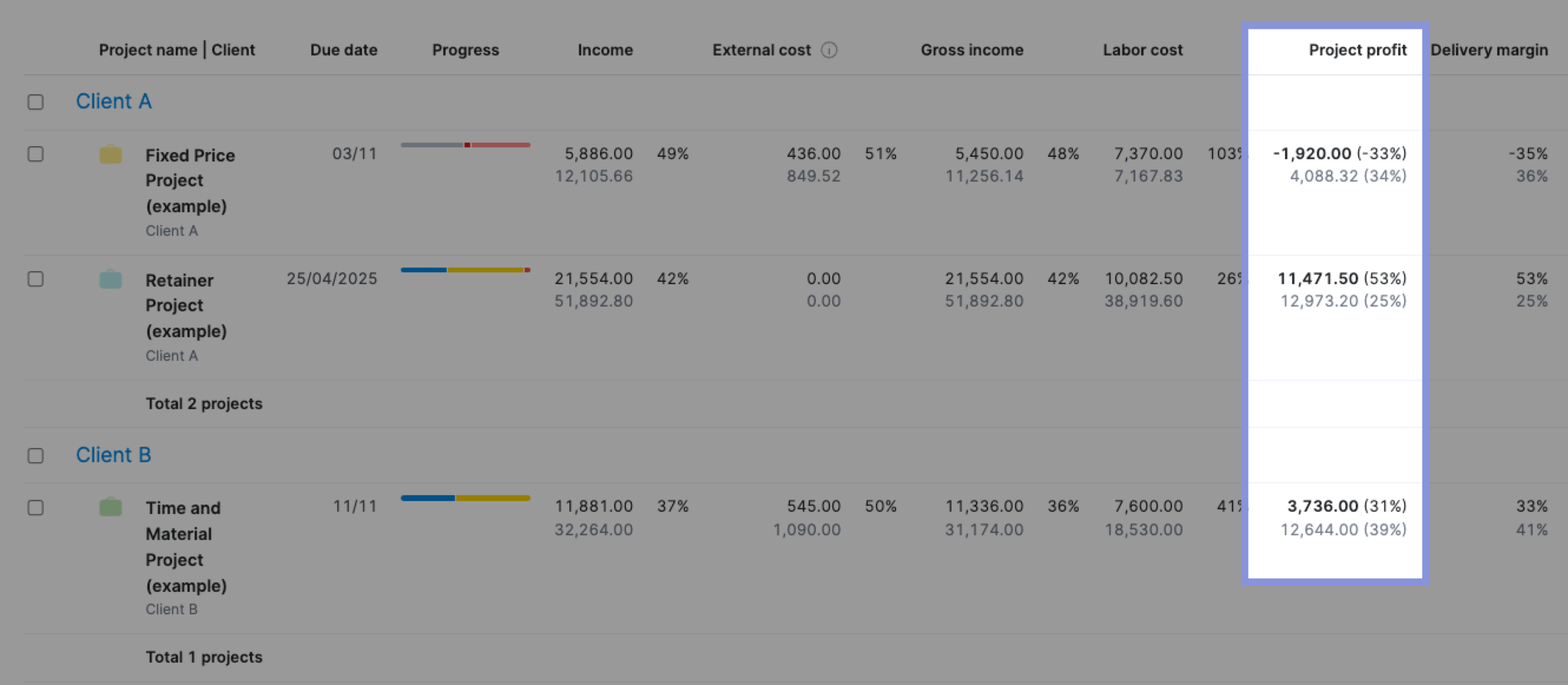

Enabling the “Project profit” column in the “Project list” view in Scoro instantly shows the profit for each project.

5. Calculate your delivery margin

Your delivery margin (also known as profit margin) reveals the percentage of revenue that’s pure profit after accounting for labor and external costs.

It’s calculated as:

Delivery Margin = (Project Profit / Total Revenue) * 100%

Delivery margin allows you to:

- Compare apples to apples: Accurately compare the profitability of different projects, regardless of size or budget.

- Make smarter decisions: Identify the most profitable project types and clients to focus your efforts.

- Optimize pricing: Set prices that consistently achieve your target profit margins.

- Spot red flags: A low delivery margin could indicate budget overruns, scope creep, or inefficient resource allocation.

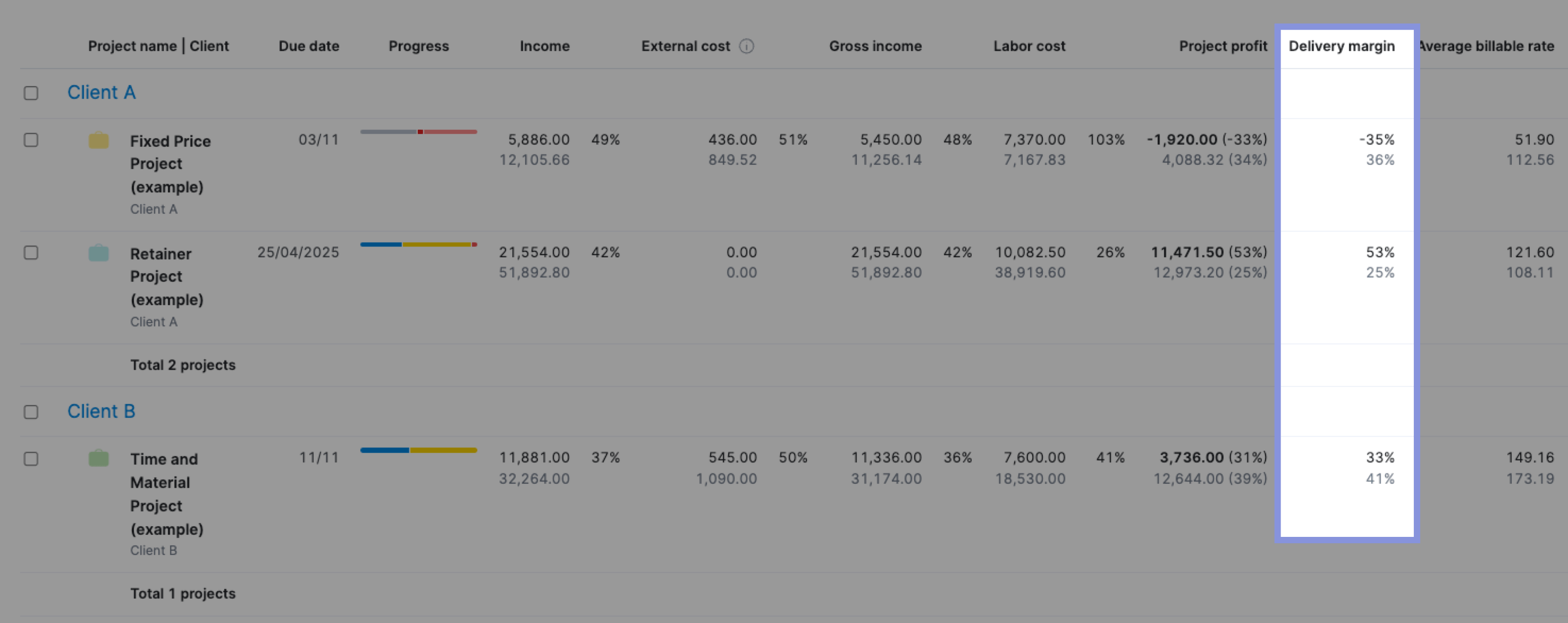

You can use Scoro to calculate delivery margins for all your projects automatically. Go to your “Project list” view. Ensure the “Delivery margin” option is enabled from the “Data columns” drop-down menu.

Now, you can see your estimated delivery margin in gray alongside your actual delivery margin, displayed in bold.

But what’s a good delivery margin?

Every company is different; Parakeeto Founder and CEO Marcel Petitpas recommends aiming for a delivery margin of:

- 60-70% per project: This ensures your projects generate enough profit to cover other business expenses not included above (like overhead) or due to inefficiency in your processes.

- At least 50% overall: This is a good target for your agency’s overall quarterly or annual profit margin after accounting for all expenses, including overhead.

Further Reading: Calculating Agency Margins: A Beginner’s Guide

Top Tip

Delivery margin shows project profitability, but your bottom line is net profit after ALL expenses. Integrate Scoro with your accounting software (Quickbooks, Xero, Sage Intacct) to track all project costs and get the full financial picture.

Boost project profitability with Scoro

If you’re consistently hitting your delivery margin goals, congratulations! Keep up the great work, and continue monitoring your projects to maintain this level of profitability.

But if your profit margins aren’t meeting your targets, don’t panic!

Scoro’s powerful reporting and filtering capabilities can help you pinpoint the root causes. The “Project list” view allows you to analyze project profitability by client, project manager, project type, and more to identify areas for improvement.