Revenue recognition is when you record income as you deliver products and services, not when you receive payment for them.

Let’s walk through the basics and how to make this accounting strategy sustainable in your agency or consultancy.

Why revenue recognition matters

Revenue recognition gives agencies and consultancies a more accurate picture of profitability than simply tracking cash flow or relying on profit and loss statements.

Why?

Because recognizing revenue as it’s earned helps you avoid artificial revenue spikes—ones that make you think you’ve got more money in the bank than you actually do.

Here’s an example:

Say your agency books a year-long project in January. And you invoice for the full project ($100,000) upfront.

Recognizing the revenue immediately (i.e., in January) would be misleading, making you think your agency received that income.

So, thinking that you have an extra $100,000 in the bank, you could easily end up spending money that you don’t actually have in hand yet. Like hiring new employees or purchasing new software.

This can lead to cash flow issues that jeopardize your business’ financial health.

But recognizing the revenue as you complete the work shows your true monthly income. So you can accurately predict your revenue and cash flow. And make smart financial decisions.

For instance, you can make sure you have enough money coming in before you decide to hire new employees or sign new freelance contracts. So you get the right coverage without compromising your financial stability.

Revenue recognition also gives you a more precise view of how much client work you’ve booked each month.

Which helps you with resource planning and making the most of your team’s billable utilization, further supporting your agency’s bottom line.

Top Tip

Watch “What is ‘rev rec’ & which metrics matter?” with Richard Brett.

Rich will take a deep dive of agency finances, starting with revenue recognition – recording revenue when it’s earned, not when payment is received – and explain why this is so important.

Types of revenue recognition

Let’s look at the three main revenue recognition methods for professional services:

1. Time and Material (T&M) method

The T&M method is the most common revenue recognition approach, recognizing income based on the billable hours your team has worked.

With T&M, you invoice after your team performs the work and logs their time.

Say your in-house designer worked 25 hours on a project at an hourly rate of $150. The recognized revenue for those 25 hours would be $3,750 (25 hours x $150).

By reflecting this real-time revenue from your projects, the T&M method helps you avoid any misleading income spikes.

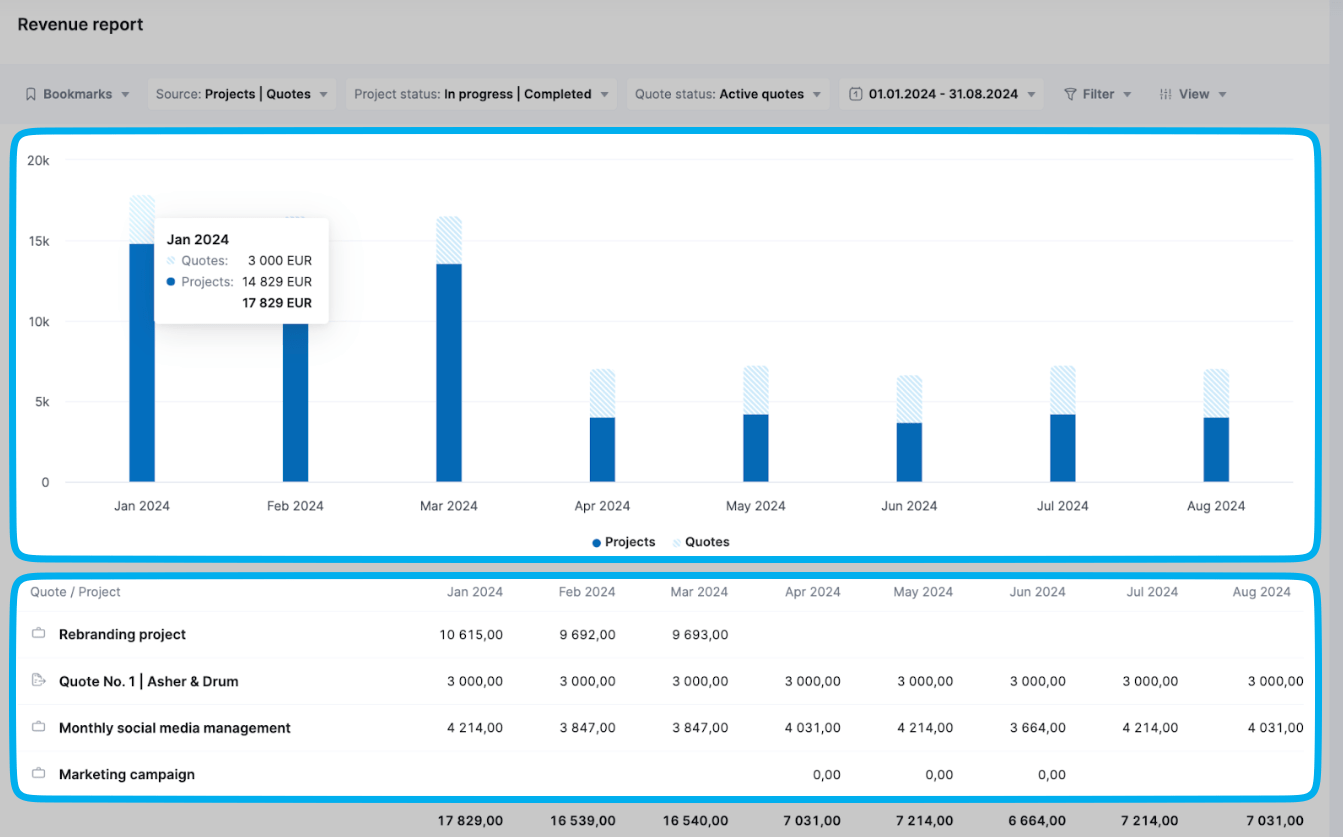

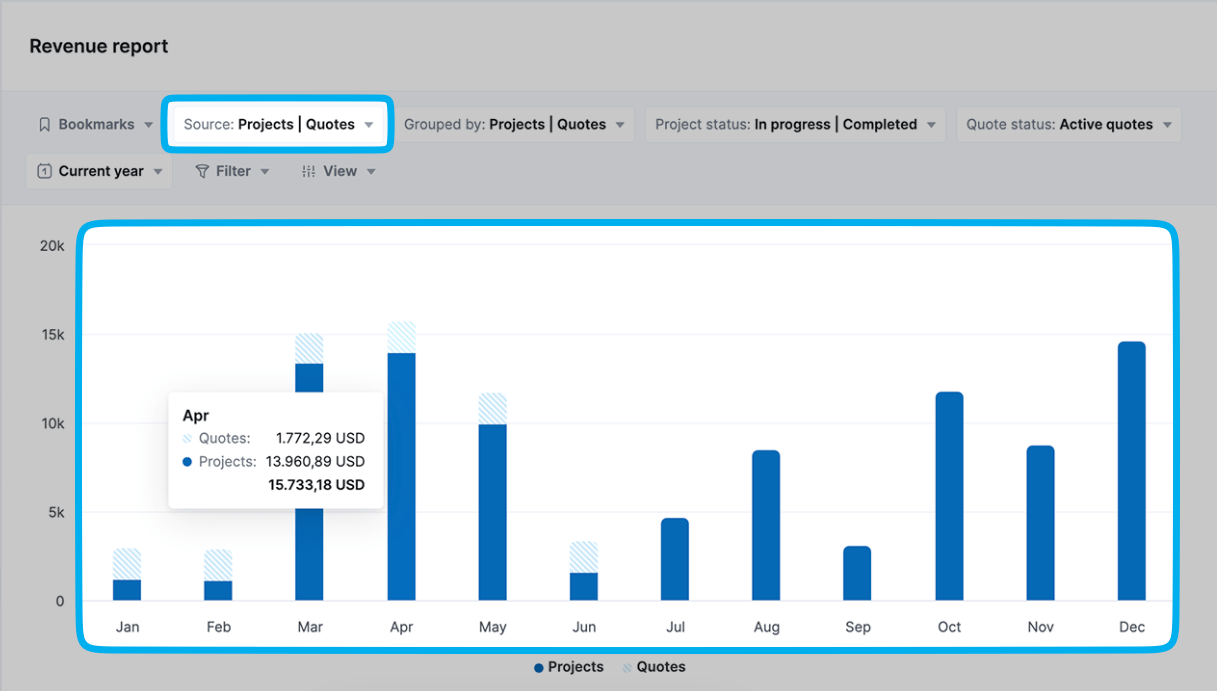

Scoro’s Revenue report makes it easy to implement the T&M method.

Using the report, you can see your current and expected earnings for each month, factoring in revenue from both booked projects (solid blue bars) and quoted work (striped blue bars). And below the chart, you’ll see revenue breakdowns for each individual project.

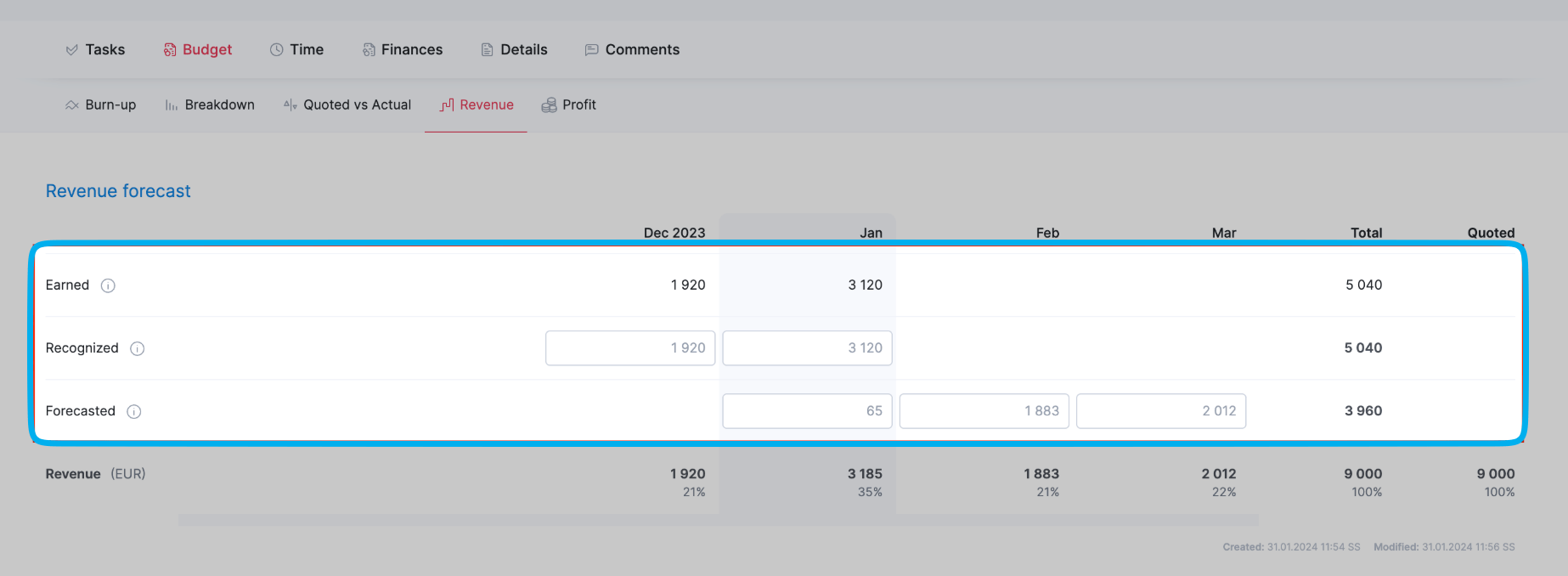

Click on any project to open a month-by-month analysis of its:

- Earned revenue: Automatically calculated based on labor rates and logged hours

- Recognized revenue: Automatically calculated based on earned revenue (and can be manually adjusted as needed)

- Forecasted revenue: Automatically calculated based on your initial revenue estimate

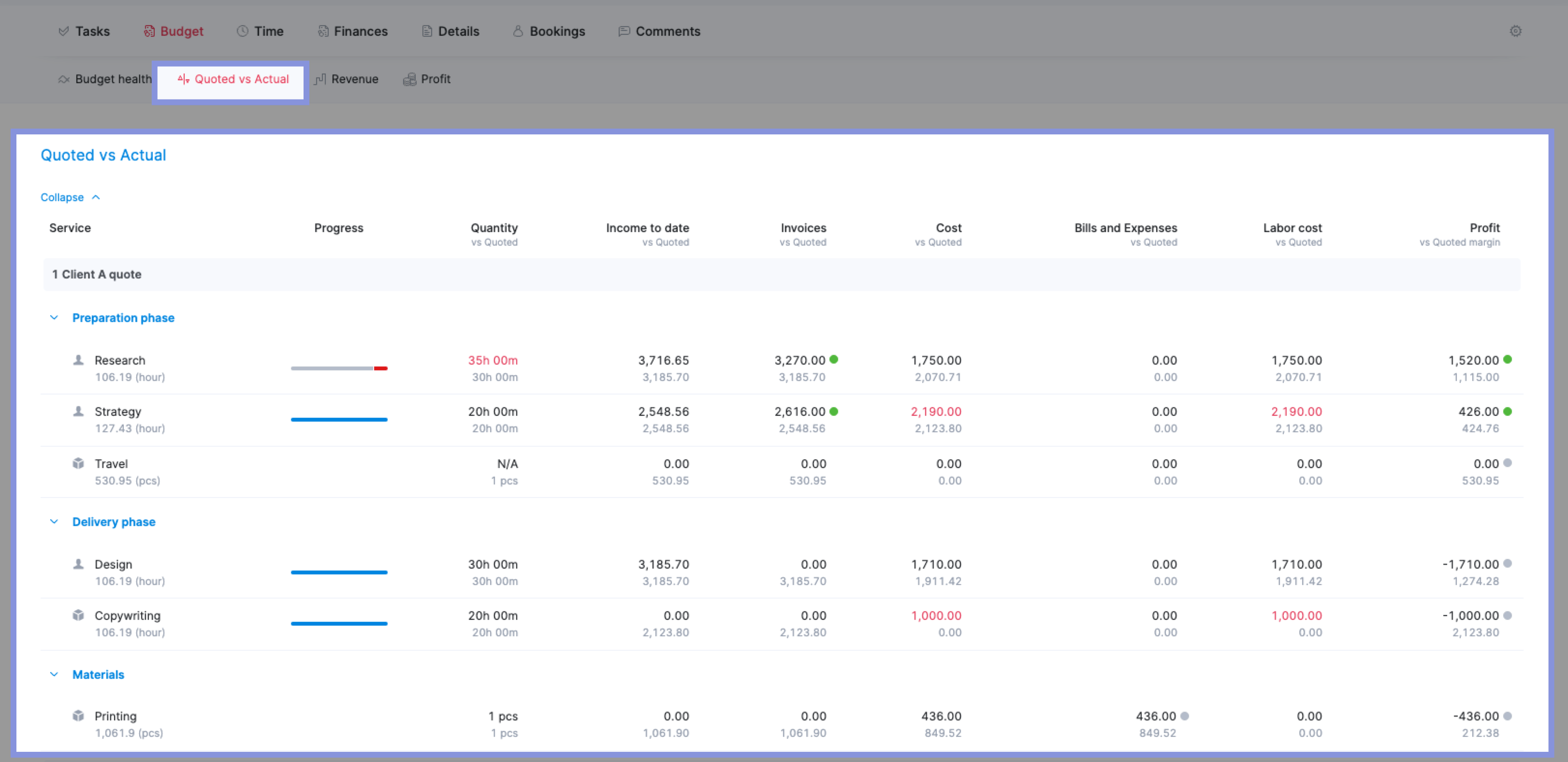

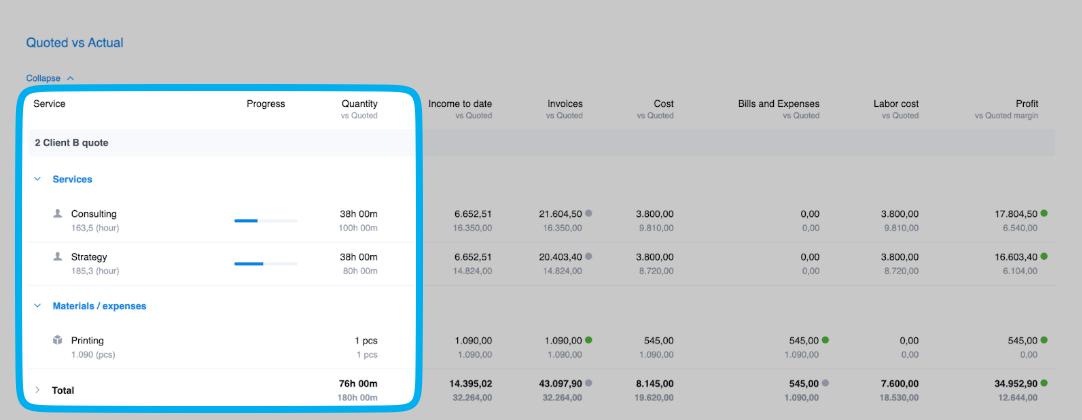

If you spot significant differences between a project’s forecasted and recognized revenue, click “Budget” > “Quoted vs Actual.”

Here, you can see the project’s quoted and actual hours, income, costs, and profit. Compare the numbers so you can figure out why your forecasted and recognized revenue don’t align.

For example, you might find that revenue for a project is 25% lower than predicted. Your team hasn’t been able to complete their deliverable yet because they’ve been spending more time than anticipated on calls with the client.

To address this issue, you can revisit the project scope or set firmer boundaries with the client. You can also implement real-time tracking to monitor logged hours and avoid a bigger over-servicing problem, which drives up time logged without creating more billable work.

2. Percentage of completion (progress-based) method

The percentage of completion method ties revenue to the project’s actual progress. It’s a good fit for fixed-price projects, aligning income with the percentage of work completed.

Say you budget 100 hours for a project. Once your team completes 75 hours, you would recognize 75% of the project revenue.

A key part of sustainable business growth is understanding when your team actually completes work. This method gives you those insights, preventing you from recognizing revenue too early and ending up with a skewed view of profitability.

You can define project completion a few different ways:

- Your own assessment: Determine project progress based on unique deliverables

- Hours worked vs. budgeted: Compare the percentage of actual hours worked to the total budgeted hours

- Cost incurred vs. budgeted cost: Recognize revenue in proportion to incurred costs (Note: This method is rare for agencies and more common in organizations with higher upfront costs)

With a clear link between progress and revenue, the percentage of completion approach gives you an accurate view of profitability for each project. And since it allows flexibility in how you choose to measure progress, it still works well across different project types.

Check the “Progress” and “Quantity” columns in Scoro’s “Quoted vs Actual” table to track what your team has completed compared to what you anticipated:

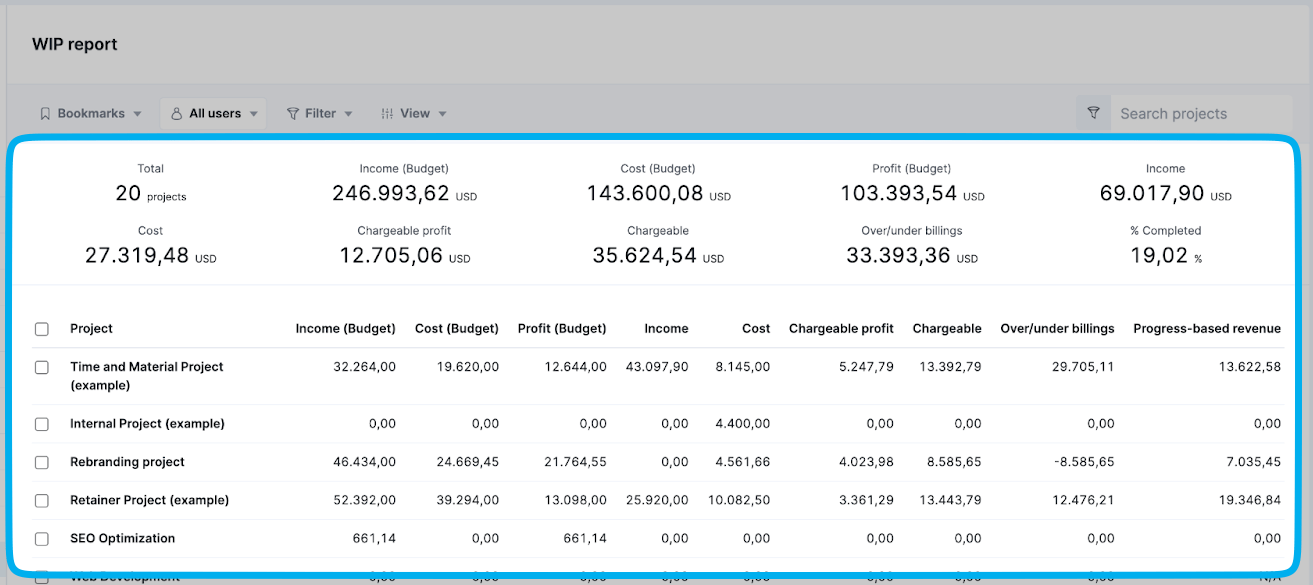

And review the “Progress-based revenue” and “Chargeable profit” columns in Scoro’s WIP report. It calculates revenue based on your project progress and planned income, helping you see what you should’ve earned based on how much work has been completed.

Since this report reflects in-progress work, you can manage your finances and project profitability before it’s too late to recoup potential losses.

Like reassigning resources to reduce labor costs or talking with the client about charging for work outside of the scope.

3. Milestone-based recognition

This method recognizes revenue when you hit major project milestones. It’s ideal for projects with well-defined deliverables and phases.

Say you book a four-phase project. And each phase is worth $25,000. You would recognize $25,000 in revenue when each phase is completed.

The milestone approach helps you plan exactly when it’s time to recognize revenue—and how much you’ll be recording. And it helps clients understand what they’re paying for during each phase of the project.

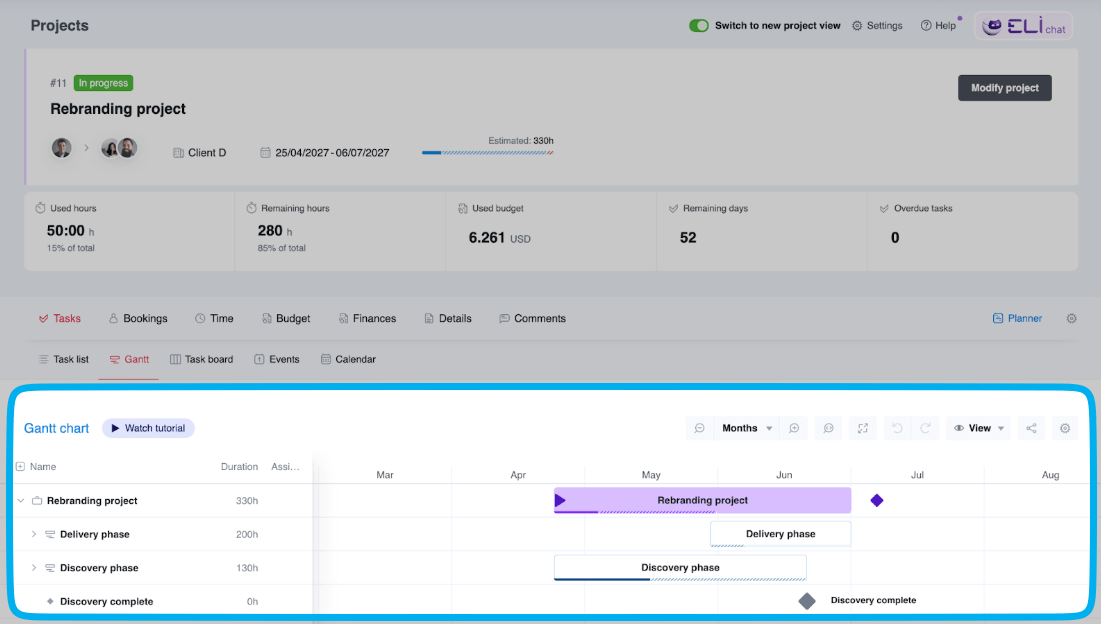

Scoro automatically converts sub-headings on your quotes into phases and milestones, which you can then see and adjust in the “Gantt” view:

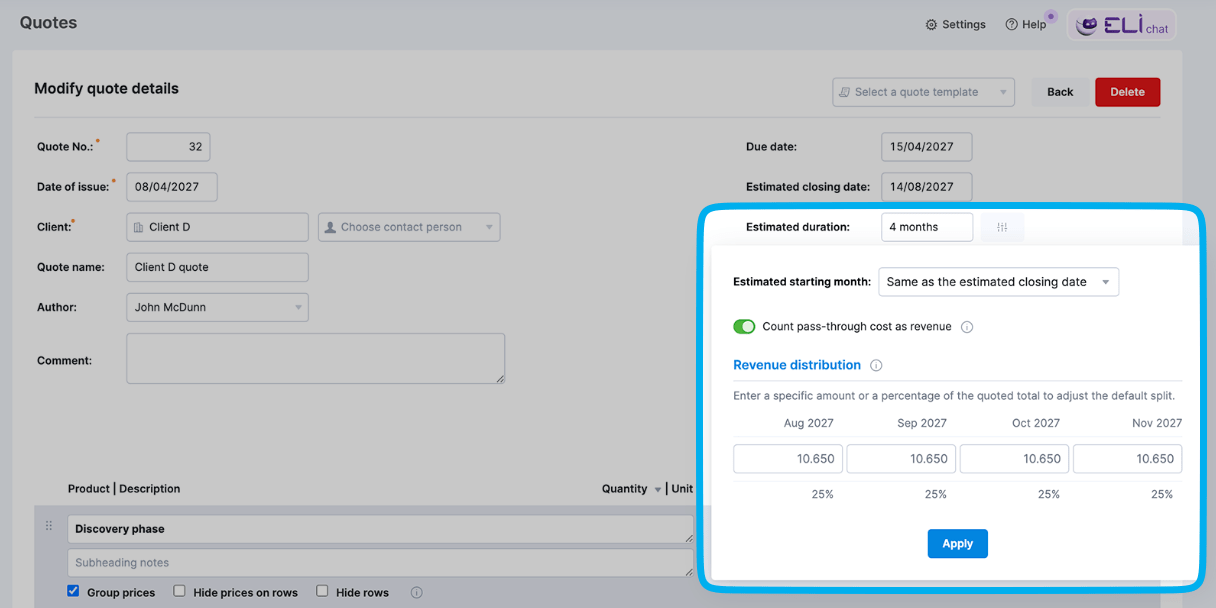

Then, you can track milestone-based revenue using the “Quotes” tab. Just open a quote and click the “Modify quote” button. Then, click the graph icon to the right of the “Estimated duration” field.

You’ll see a pop-up box with an automatic revenue breakdown, distributing the planned income equally across your project timeline. Click each box to adjust the projected revenue targets as needed. Then, click “Apply.”

How to make revenue recognition sustainable

When done right, revenue recognition for professional services helps you avoid sudden revenue spikes or drops, helping you make stronger long-term plans for hiring, scheduling, and other business needs.

Follow these best practices to make this approach work for your agency or consultancy:

Track true performance, not invoices

Long-term revenue recognition focuses on tracking actual project progress, not the amount invoiced. This way, you don’t end up with revenue in one month and costs in another. And can get a more accurate view of your company’s financial health.

Say your agency books a six-month project in January. And you invoice $100,000 for the entire project upfront.

But by the end of February, you’ve only completed 25% of the work. That means you should recognize $25,000.

This approach aligns revenue with the work your team has actually done. And prevents you from inaccurately inflating your January earnings.

Use Scoro’s “Revenue report” and select “Projects | Quotes” in the “Source” field. This way, you can see both earned and projected revenue in one spot. Which helps you with better revenue forecasting, resource forecasting, and project budgeting.

Watch for overservicing and scope creep

Track your team’s hours using automated software like Scoro. Then, compare those hours against your project budgets. This helps prevent costly over-servicing.

If you don’t routinely compare these two areas, you can unintentionally blow through your budget—killing your margins in the process.

Say you book a project that has a $20,000 budget and includes 150 hours of design work. But when you reach the 75% milestone, your design team has already worked 150 hours, including requested tasks that weren’t outlined in the original contract.

Your designers still need to complete the final 25% of the project. But if you can’t adjust the budget this late in the game or bill the client for additional time, your profitability takes a hit.

Revenue recognition makes it easier to catch scope creep and overservicing earlier on. This way, you can communicate with the client about billing for the additional work and setting expectations moving forward to keep things on track and protect your margins.

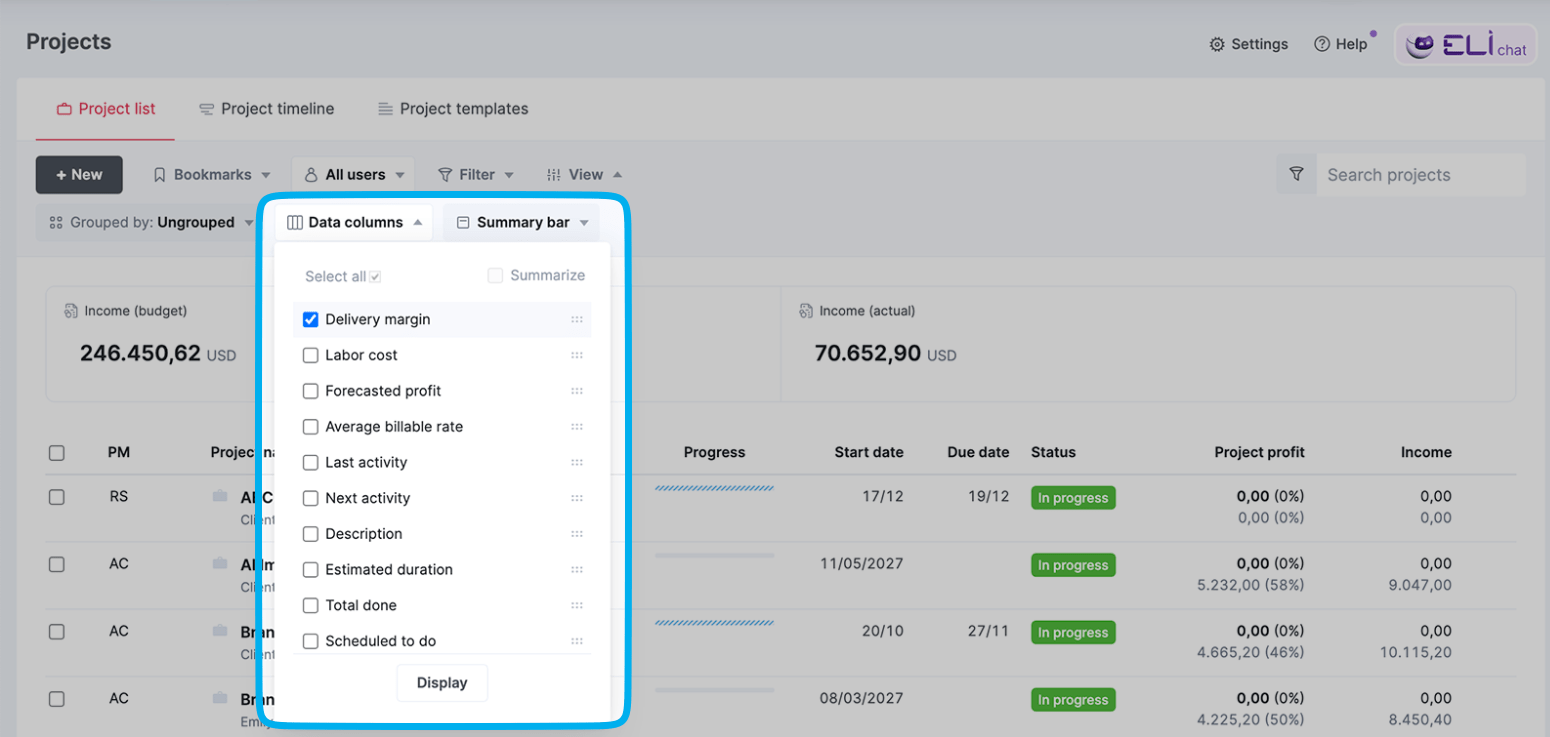

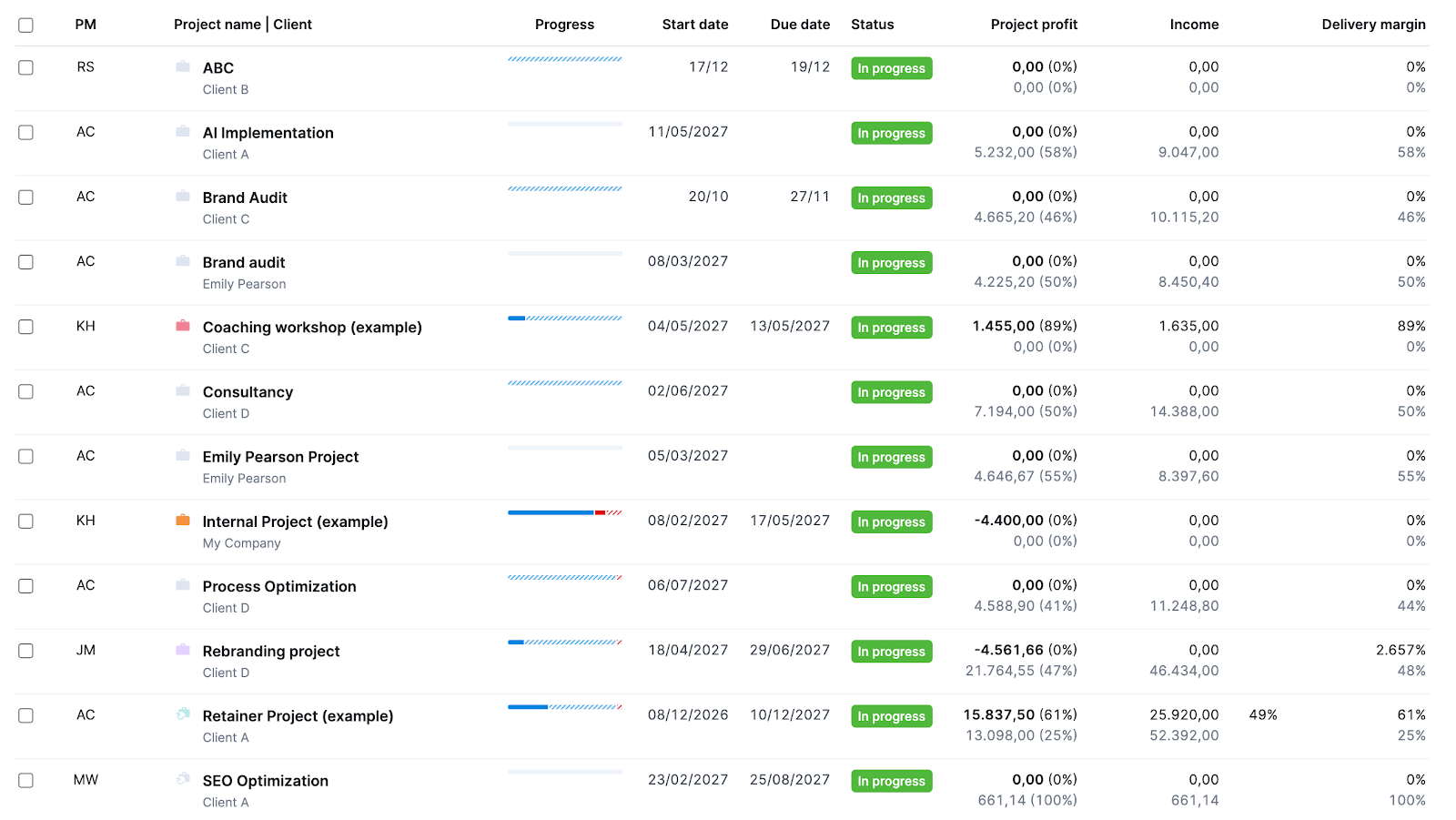

Use Scoro’s “Project list” view to track delivery margins across all projects.

Click “View” > “Data columns.” Then, select “Delivery margin” and click the “Display” button.

Then, look for projects with delivery margins below your agency’s average or goal (the higher the better, but a general benchmark is 40% to 70%).

If you spot projects with a delivery margin below 40%, revisit the budget and scope. And discuss adjustments with your client.

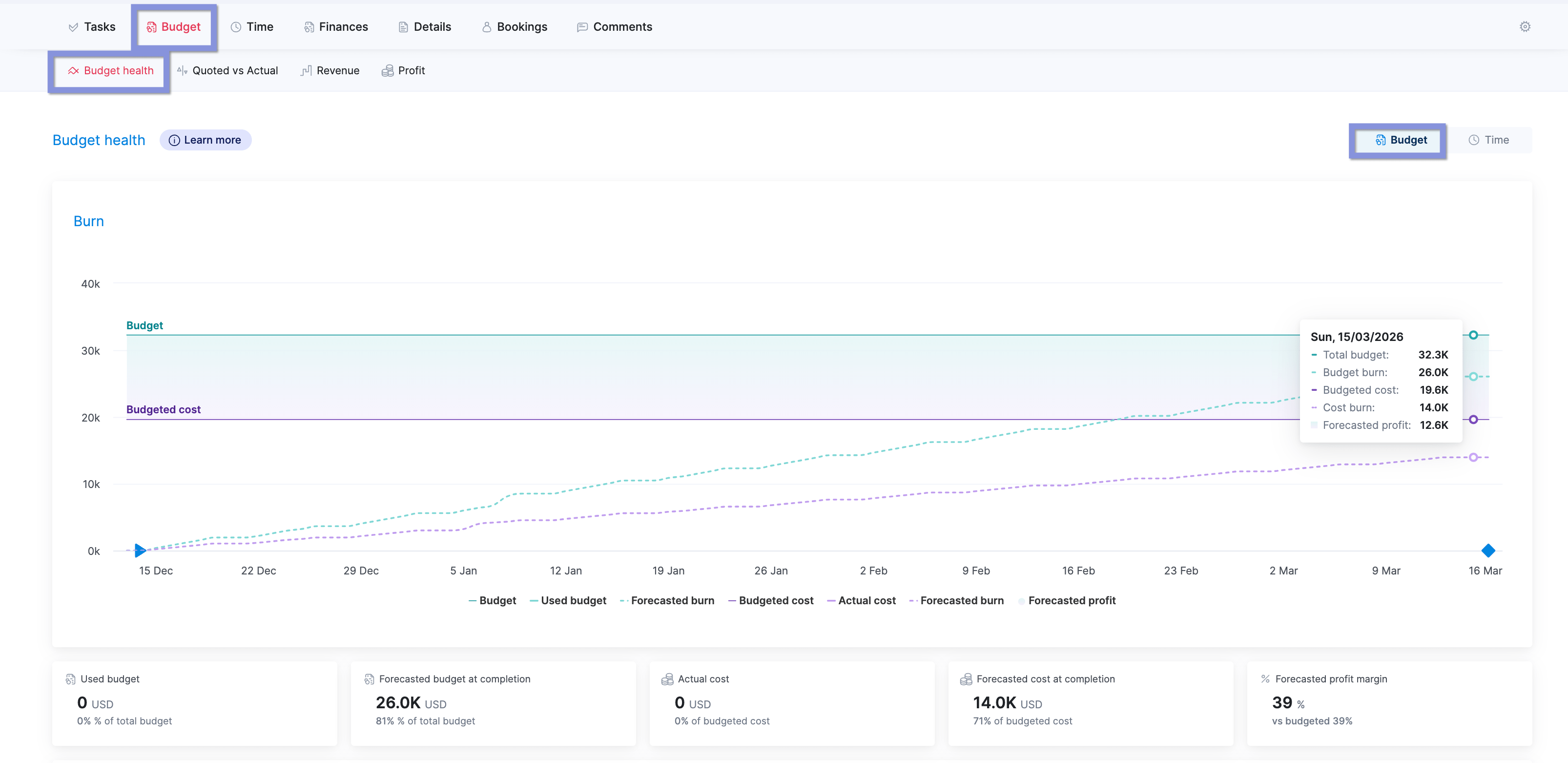

You can also check Scoro’s “Budget health” chart for more detailed tracking within each project:

This chart shows your:

- Used budget: Light blue line

- Forecasted budget: Dotted light blue line

- Actual cost: Purple line

- Forecasted cost: Dotted purple line

Use it to spot excessive costs and budget issues early so you can avoid overservicing.

Focus on billable work to drive revenue

Prioritizing billable work is key for profitability.

But underutilized team members and too much non-billable time mean missed opportunities to bring in income.

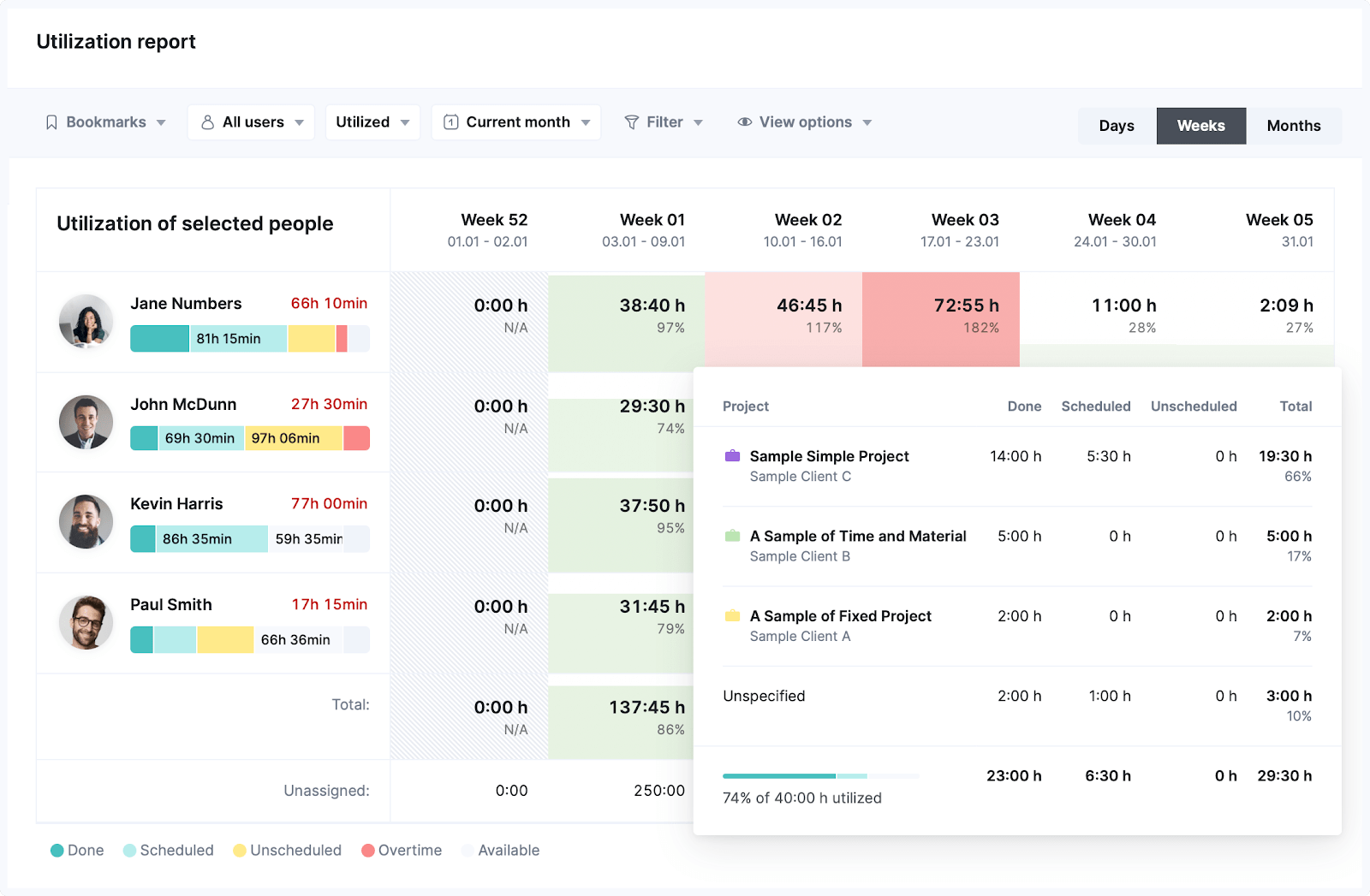

Make the most of your team’s available hours with Scoro’s utilization reports.

Here, you can quickly review utilization rates across projects, roles, and individual team members. And figure out who can take on more billable work without burning out (i.e., going above 80% to 85% utilization).

Dive deeper into how team members are spending their time with the “Billable vs. non-billable time” report. You might not realize how much time (and money) you’re losing as meetings, emails, and other admin tasks add up—but this report will show you.

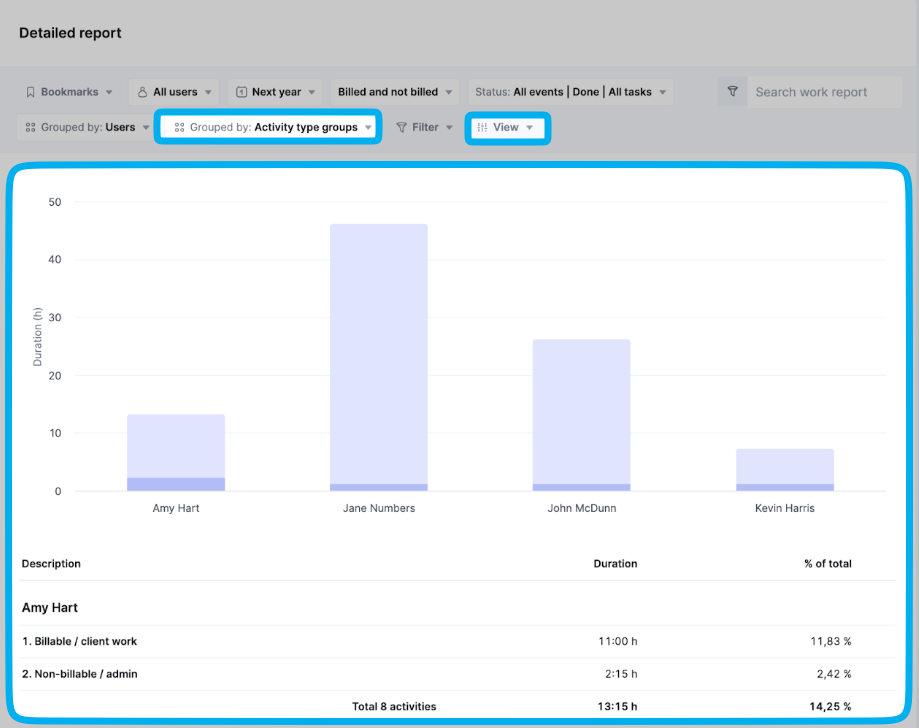

Group by “Users” > “Activity type groups” and enable the “% of total” view.

Now, you can see the percentage of billable and non-billable time for each team member.

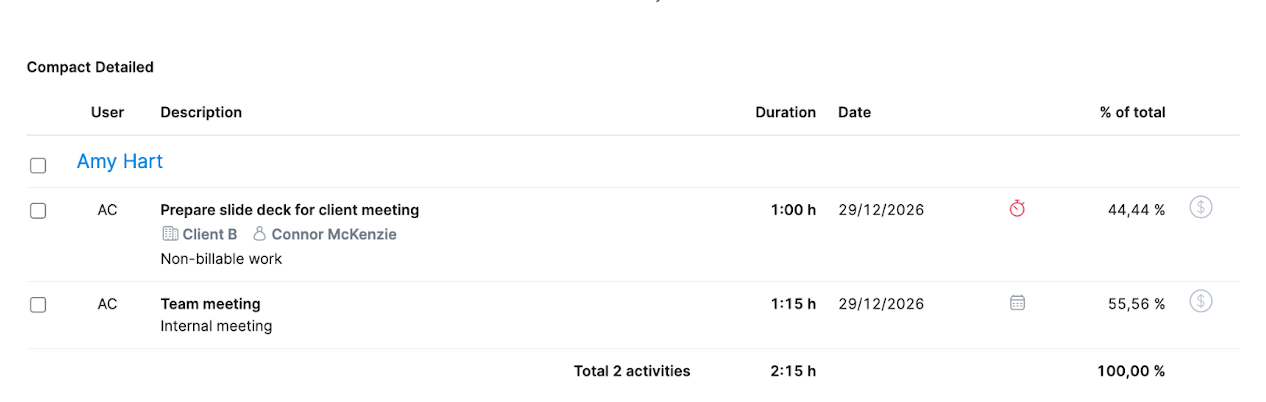

Click “Non-billable / admin” under a team member’s name to review the non-billable work logged. Below, in Amy’s case, she spent a little over two hours on “preparing a slide deck for a client meeting” and the “client meeting.”

Take a closer look at the team members who have higher non-billable percentages. And figure out the “whys.”

Were they stuck in lots of client meetings? Did they accidentally categorize billable work as non-billable? Was there scope creep (like extra revisions) that drained their time?

Use your findings to reduce admin tasks, charge for your team’s time and work appropriately, and create more detailed quotes to reduce overservicing.

Further reading: Billable Utilization 101: Your Ultimate Guide

Simplify revenue recognition with Scoro

When you recognize revenue as your agency earns it, you’ll have an easier time keeping revenue forecasts accurate, maximizing billable hours, and avoiding overservicing.

For example, take creative agency Yellow Cherry. The company struggled with delayed invoicing and had no way to record non-billable time. Which led to late payments and an inefficient use of their team’s availability.

But after adopting Scoro and leveraging its streamlined invoicing, time tracking, and utilization reports, the business boosted its cash flow by over 66%. And has been able to make more informed staffing and hiring decisions.

See how Scoro can simplify revenue recognition and boost your agency’s billable utilization with a free 14-day trial.